Robo advisors use automated algorithms to manage investment portfolios with low fees and 24/7 accessibility, appealing to tech-savvy investors seeking efficient, data-driven advice. Family offices offer personalized wealth management, tax planning, and estate services tailored for ultra-high-net-worth families, emphasizing a holistic approach overseen by dedicated financial professionals. Discover more about how each option can fit your unique financial goals and preferences.

Why it is important

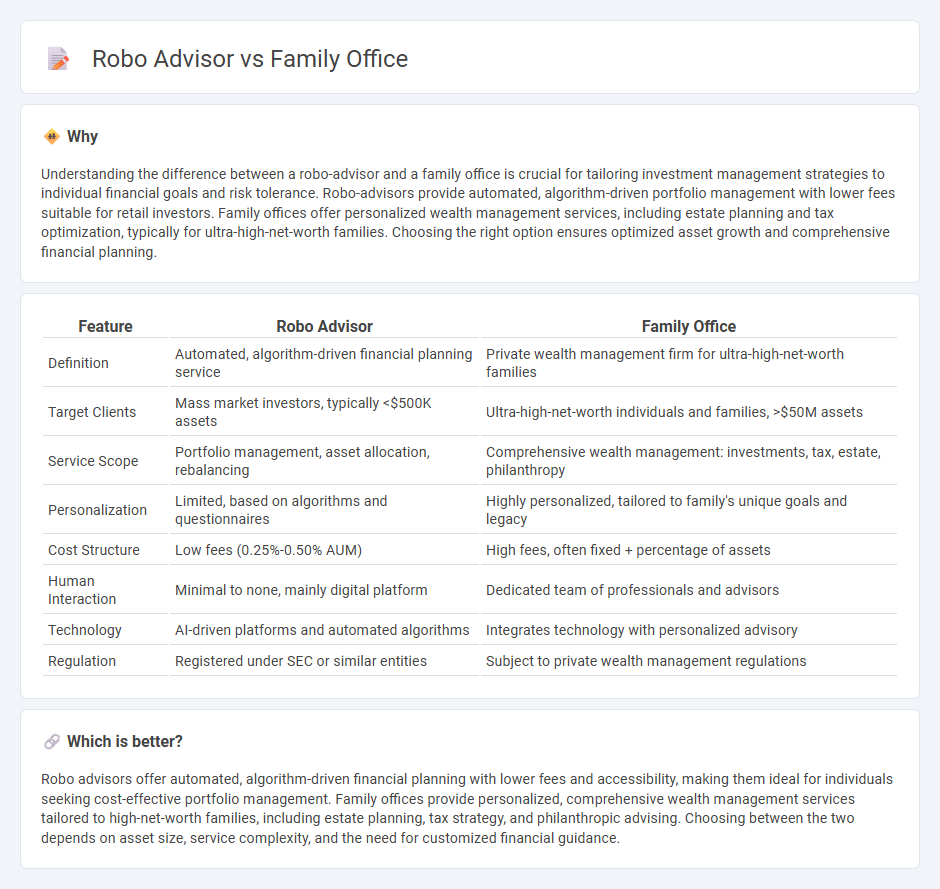

Understanding the difference between a robo-advisor and a family office is crucial for tailoring investment management strategies to individual financial goals and risk tolerance. Robo-advisors provide automated, algorithm-driven portfolio management with lower fees suitable for retail investors. Family offices offer personalized wealth management services, including estate planning and tax optimization, typically for ultra-high-net-worth families. Choosing the right option ensures optimized asset growth and comprehensive financial planning.

Comparison Table

| Feature | Robo Advisor | Family Office |

|---|---|---|

| Definition | Automated, algorithm-driven financial planning service | Private wealth management firm for ultra-high-net-worth families |

| Target Clients | Mass market investors, typically <$500K assets | Ultra-high-net-worth individuals and families, >$50M assets |

| Service Scope | Portfolio management, asset allocation, rebalancing | Comprehensive wealth management: investments, tax, estate, philanthropy |

| Personalization | Limited, based on algorithms and questionnaires | Highly personalized, tailored to family's unique goals and legacy |

| Cost Structure | Low fees (0.25%-0.50% AUM) | High fees, often fixed + percentage of assets |

| Human Interaction | Minimal to none, mainly digital platform | Dedicated team of professionals and advisors |

| Technology | AI-driven platforms and automated algorithms | Integrates technology with personalized advisory |

| Regulation | Registered under SEC or similar entities | Subject to private wealth management regulations |

Which is better?

Robo advisors offer automated, algorithm-driven financial planning with lower fees and accessibility, making them ideal for individuals seeking cost-effective portfolio management. Family offices provide personalized, comprehensive wealth management services tailored to high-net-worth families, including estate planning, tax strategy, and philanthropic advising. Choosing between the two depends on asset size, service complexity, and the need for customized financial guidance.

Connection

Robo advisors streamline investment management by leveraging algorithms to provide personalized financial advice, increasingly integrating with family offices to enhance asset allocation and portfolio diversification. Family offices adopt robo advisor technology to automate routine tasks, reduce operational costs, and gain real-time insights into complex wealth structures. This integration enables tailored strategies that align with multi-generational wealth preservation and growth objectives within family office ecosystems.

Key Terms

Wealth Management

Family offices deliver personalized wealth management services, catering to high-net-worth individuals and families with tailored investment strategies, estate planning, tax optimization, and philanthropy management. Robo advisors use algorithm-driven platforms to provide automated, low-cost portfolio management primarily targeting mass-market investors with standardized investment options. Explore deeper insights to understand which approach best aligns with your wealth management goals.

Personalized Service

Family offices offer highly personalized wealth management tailored to the unique financial, legal, and lifestyle needs of ultra-high-net-worth families, providing bespoke investment strategies and comprehensive estate planning. Robo advisors utilize algorithm-driven platforms to deliver automated, cost-effective portfolio management primarily based on risk tolerance and financial goals, lacking the nuanced human touch of family offices. Explore further to understand which wealth management approach best aligns with your personalized service expectations.

Automated Investing

Family office services provide personalized wealth management with a dedicated team catering to complex financial needs, while robo advisors leverage algorithms to offer automated investing with lower fees and broader accessibility. Automated investing through robo advisors uses data-driven portfolio rebalancing and tax optimization techniques to enhance returns efficiently. Explore the advantages and limitations of both to determine the best fit for your investment strategy.

Source and External Links

What is a Family Office? - Ocorian - A family office is a private wealth management entity providing a comprehensive suite of personalized services to high-net-worth families, including investment management, lifestyle support, and succession planning to preserve and grow family wealth across generations.

Family office - Wikipedia - A family office is a privately held company managing investment, wealth, and a range of ancillary services--such as property management, legal affairs, and philanthropy--for a single wealthy family, typically with at least $50-100 million in investable assets.

What Does a Family Office Do - SmartAsset - Family offices act as one-stop financial shops for ultra-high-net-worth individuals, offering tailored wealth and asset management, and are generally only accessible to those with $30 million or more in investable assets.

dowidth.com

dowidth.com