Instant settlement enables real-time transfer of funds between banks, enhancing transaction efficiency and liquidity management. Delayed settlement processes transactions in batches at scheduled intervals, potentially increasing risk exposure and delaying fund availability. Explore the advantages and implications of each settlement method to optimize your banking operations.

Why it is important

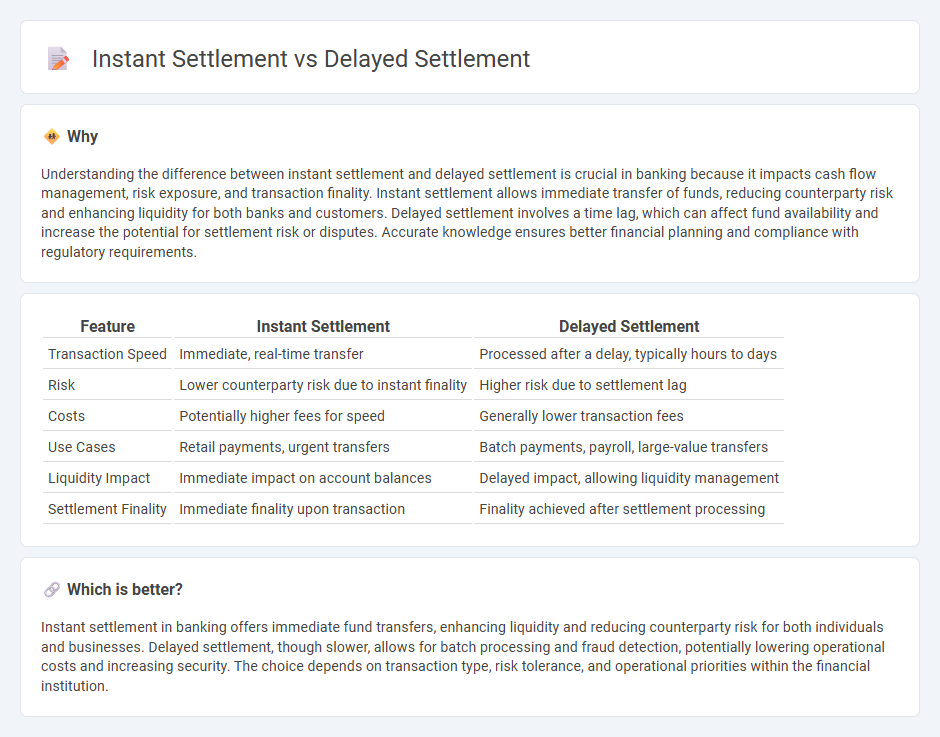

Understanding the difference between instant settlement and delayed settlement is crucial in banking because it impacts cash flow management, risk exposure, and transaction finality. Instant settlement allows immediate transfer of funds, reducing counterparty risk and enhancing liquidity for both banks and customers. Delayed settlement involves a time lag, which can affect fund availability and increase the potential for settlement risk or disputes. Accurate knowledge ensures better financial planning and compliance with regulatory requirements.

Comparison Table

| Feature | Instant Settlement | Delayed Settlement |

|---|---|---|

| Transaction Speed | Immediate, real-time transfer | Processed after a delay, typically hours to days |

| Risk | Lower counterparty risk due to instant finality | Higher risk due to settlement lag |

| Costs | Potentially higher fees for speed | Generally lower transaction fees |

| Use Cases | Retail payments, urgent transfers | Batch payments, payroll, large-value transfers |

| Liquidity Impact | Immediate impact on account balances | Delayed impact, allowing liquidity management |

| Settlement Finality | Immediate finality upon transaction | Finality achieved after settlement processing |

Which is better?

Instant settlement in banking offers immediate fund transfers, enhancing liquidity and reducing counterparty risk for both individuals and businesses. Delayed settlement, though slower, allows for batch processing and fraud detection, potentially lowering operational costs and increasing security. The choice depends on transaction type, risk tolerance, and operational priorities within the financial institution.

Connection

Instant settlement enables immediate transfer of funds and securities between parties, enhancing liquidity and reducing counterparty risk in banking transactions. Delayed settlement, often spanning days, involves a time gap that allows for verification, clearing, and reconciliation processes, which can increase operational risk and capital requirements. Both settlement types impact bank liquidity management and transaction efficiency, influencing risk exposure and regulatory compliance.

Key Terms

Clearing

Delayed settlement involves a time gap between trade execution and final clearing, increasing counterparty risk and requiring robust risk management frameworks. Instant settlement accelerates clearing by finalizing transactions in real time, enhancing liquidity and reducing systemic risk across financial markets. Discover how instant clearing reshapes market efficiency and risk mitigation strategies.

Real-Time Gross Settlement (RTGS)

Real-Time Gross Settlement (RTGS) systems process fund transfers instantly and individually, ensuring immediate settlement of payments without delay. Delayed settlement methods aggregate transactions, settling them at specific intervals which may increase the risk of liquidity constraints. Explore the mechanics and benefits of RTGS to understand how it enhances financial transaction efficiency and security.

Settlement Risk

Delayed settlement increases settlement risk by exposing parties to potential default, market fluctuations, and liquidity constraints during the waiting period. Instant settlement mitigates these risks by ensuring the immediate transfer of assets and funds, reducing counterparty exposure and enhancing transaction security. Explore the advantages and mechanisms of instant versus delayed settlement to optimize risk management in financial transactions.

Source and External Links

Settlement Delayed? Here's What You Should Know - GM Law - A delayed settlement in property conveyance can occur due to financing, legal, or property issues, potentially leading to financial penalties or contract cancellations depending on the responsible party and local laws.

Delayed Settlement? Here's What To Do - NerdWallet Australia - Settlement delays often result from lender issues, disputes over settlement statements, or failure to clear mortgage obligations, requiring coordination between parties to resolve and proceed.

What is a settlement delay? - Checkout.com - In payment processing, a settlement delay is the waiting period before funds from a transaction become available to the recipient, which can vary by payment method and affect cash flow.

dowidth.com

dowidth.com