Alternative credit data includes non-traditional financial information such as utility payments, rental history, and mobile phone bills that provide a broader view of a consumer's creditworthiness compared to conventional bank statements. Bank statements primarily reflect transactional history, balances, and income deposits, often missing comprehensive insights into consistent payment behaviors outside traditional banking. Discover how leveraging alternative credit data can enhance risk assessment and financial inclusion beyond standard bank statements.

Why it is important

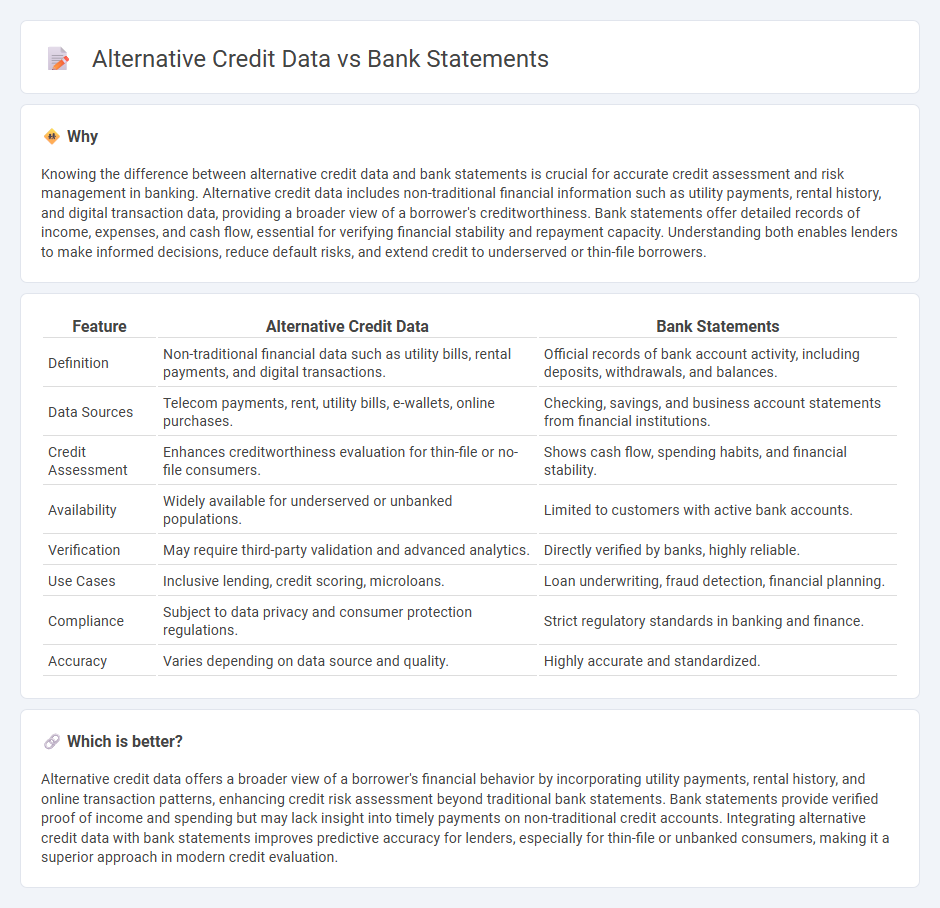

Knowing the difference between alternative credit data and bank statements is crucial for accurate credit assessment and risk management in banking. Alternative credit data includes non-traditional financial information such as utility payments, rental history, and digital transaction data, providing a broader view of a borrower's creditworthiness. Bank statements offer detailed records of income, expenses, and cash flow, essential for verifying financial stability and repayment capacity. Understanding both enables lenders to make informed decisions, reduce default risks, and extend credit to underserved or thin-file borrowers.

Comparison Table

| Feature | Alternative Credit Data | Bank Statements |

|---|---|---|

| Definition | Non-traditional financial data such as utility bills, rental payments, and digital transactions. | Official records of bank account activity, including deposits, withdrawals, and balances. |

| Data Sources | Telecom payments, rent, utility bills, e-wallets, online purchases. | Checking, savings, and business account statements from financial institutions. |

| Credit Assessment | Enhances creditworthiness evaluation for thin-file or no-file consumers. | Shows cash flow, spending habits, and financial stability. |

| Availability | Widely available for underserved or unbanked populations. | Limited to customers with active bank accounts. |

| Verification | May require third-party validation and advanced analytics. | Directly verified by banks, highly reliable. |

| Use Cases | Inclusive lending, credit scoring, microloans. | Loan underwriting, fraud detection, financial planning. |

| Compliance | Subject to data privacy and consumer protection regulations. | Strict regulatory standards in banking and finance. |

| Accuracy | Varies depending on data source and quality. | Highly accurate and standardized. |

Which is better?

Alternative credit data offers a broader view of a borrower's financial behavior by incorporating utility payments, rental history, and online transaction patterns, enhancing credit risk assessment beyond traditional bank statements. Bank statements provide verified proof of income and spending but may lack insight into timely payments on non-traditional credit accounts. Integrating alternative credit data with bank statements improves predictive accuracy for lenders, especially for thin-file or unbanked consumers, making it a superior approach in modern credit evaluation.

Connection

Alternative credit data, such as utility payments and rental history, enhances the evaluation of creditworthiness beyond traditional credit scores. Bank statements provide transactional insights that verify income stability and spending patterns, offering a real-time financial overview. Combining these data sources allows lenders to make more accurate risk assessments and extend credit to underserved or thin-file borrowers.

Key Terms

Transaction History

Transaction history in bank statements provides detailed records of deposits, withdrawals, and balances, offering a clear view of an individual's financial behavior over time. Alternative credit data includes transaction patterns from rent payments, utility bills, and mobile phone payments, expanding credit assessment beyond traditional bank activity. Explore how integrating both sources enhances credit scoring accuracy for a comprehensive financial profile.

Non-traditional Payment Records

Bank statements provide detailed insights into an individual's financial transactions and account balances, reflecting traditional banking activities. Alternative credit data, particularly non-traditional payment records such as utility bills, rent payments, and telecom expenses, offer a broader perspective on creditworthiness for those lacking extensive banking history. Explore how these non-traditional data points can enhance credit assessments and expand financial inclusion.

Creditworthiness Evaluation

Bank statements provide detailed financial transaction records reflecting income stability and spending patterns, offering traditional insights into an individual's creditworthiness. Alternative credit data, such as utility payments, rental history, and digital financial activity, supplement traditional evaluations by capturing broader financial behavior, especially for thin-file or credit-invisible consumers. Explore further to understand how integrating these data sources enhances credit decision accuracy and inclusivity.

Source and External Links

Bank statement - Wikipedia - A bank statement is an official summary of financial transactions over a specific period for each bank account held by an individual or business, used to monitor cash flow, detect fraud, and perform reconciliations.

What Is a Bank Statement and Why Is It Still Important? | PNC Insights - A bank statement includes sections such as account summary, balance summary, transaction summary, interest summary, and detailed activity to provide a full account overview for a set period.

An Essential Guide to Understanding Your Bank Statement - Square - Bank statements summarize account transactions typically monthly, helping businesses track expenses, detect errors, and identify unauthorized activity or fraud.

dowidth.com

dowidth.com