Predictive analytics in banking uses historical data and machine learning models to forecast customer behaviors, credit risks, and market trends, enhancing decision-making and personalized services. Transaction anomaly detection focuses on identifying unusual patterns in real-time financial transactions to prevent fraud and security breaches, ensuring regulatory compliance and safeguarding assets. Explore the differences and applications of these technologies to optimize banking operations and risk management.

Why it is important

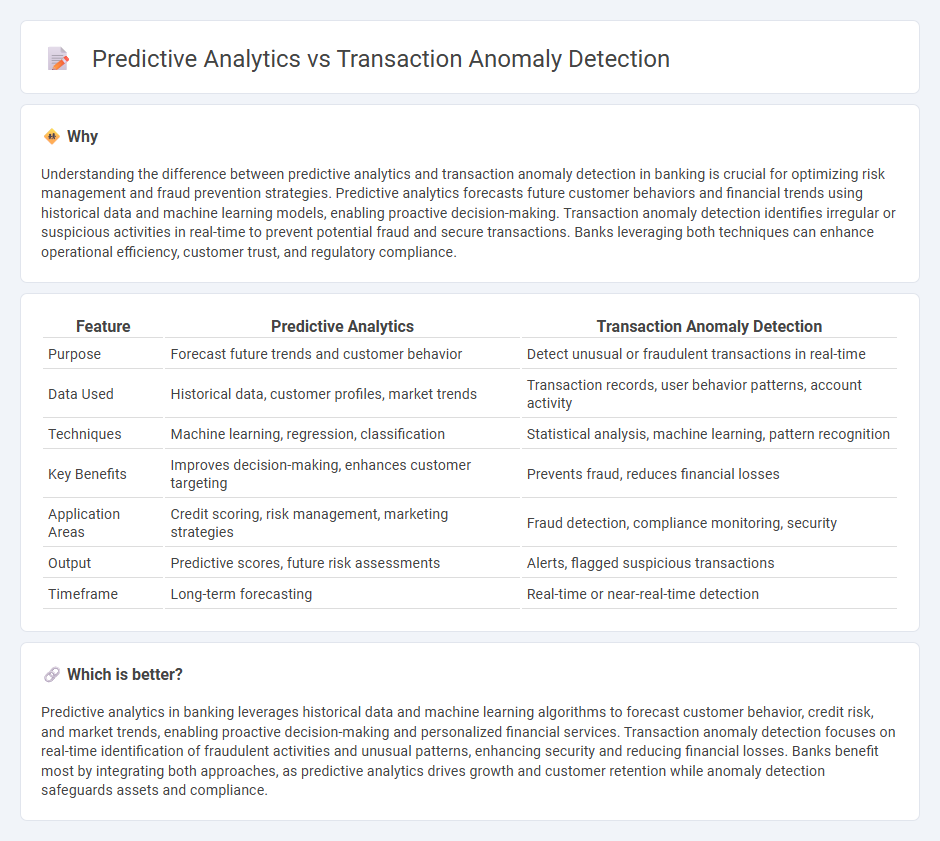

Understanding the difference between predictive analytics and transaction anomaly detection in banking is crucial for optimizing risk management and fraud prevention strategies. Predictive analytics forecasts future customer behaviors and financial trends using historical data and machine learning models, enabling proactive decision-making. Transaction anomaly detection identifies irregular or suspicious activities in real-time to prevent potential fraud and secure transactions. Banks leveraging both techniques can enhance operational efficiency, customer trust, and regulatory compliance.

Comparison Table

| Feature | Predictive Analytics | Transaction Anomaly Detection |

|---|---|---|

| Purpose | Forecast future trends and customer behavior | Detect unusual or fraudulent transactions in real-time |

| Data Used | Historical data, customer profiles, market trends | Transaction records, user behavior patterns, account activity |

| Techniques | Machine learning, regression, classification | Statistical analysis, machine learning, pattern recognition |

| Key Benefits | Improves decision-making, enhances customer targeting | Prevents fraud, reduces financial losses |

| Application Areas | Credit scoring, risk management, marketing strategies | Fraud detection, compliance monitoring, security |

| Output | Predictive scores, future risk assessments | Alerts, flagged suspicious transactions |

| Timeframe | Long-term forecasting | Real-time or near-real-time detection |

Which is better?

Predictive analytics in banking leverages historical data and machine learning algorithms to forecast customer behavior, credit risk, and market trends, enabling proactive decision-making and personalized financial services. Transaction anomaly detection focuses on real-time identification of fraudulent activities and unusual patterns, enhancing security and reducing financial losses. Banks benefit most by integrating both approaches, as predictive analytics drives growth and customer retention while anomaly detection safeguards assets and compliance.

Connection

Predictive analytics in banking leverages transaction anomaly detection to identify unusual patterns indicating potential fraud or financial risks. By analyzing historical transaction data, banks can forecast suspicious activities and prevent security breaches proactively. This integration enhances real-time decision-making and strengthens risk management frameworks.

Key Terms

**Transaction Anomaly Detection:**

Transaction Anomaly Detection leverages machine learning algorithms and real-time data analysis to identify unusual patterns and potentially fraudulent transactions, enhancing security and reducing financial losses. This technology is critical in sectors like banking and e-commerce where timely detection of irregular activities prevents significant risks. Explore how transaction anomaly detection can safeguard your business by diving deeper into its methodologies and applications.

Outlier Detection

Transaction anomaly detection specializes in identifying irregular or suspicious transactions by analyzing patterns that deviate from normal behavior, often using machine learning and statistical methods to flag outliers quickly. Predictive analytics leverages historical transaction data to forecast future trends and customer behaviors but may not specifically highlight unexpected anomalies as transaction anomaly detection does. Explore the differences in methodologies and applications to optimize your outlier detection strategy effectively.

Fraudulent Activities

Transaction anomaly detection specializes in identifying unusual patterns in financial data that may signal fraudulent activities, leveraging real-time monitoring and machine learning algorithms. Predictive analytics uses historical transaction data to forecast potential fraud risks and guide proactive decision-making. Explore how combining both approaches enhances fraud prevention effectiveness.

Source and External Links

Complete Guide to Data Anomaly Detection in Financial Transactions - Anomaly detection in transaction data involves identifying deviations from normal patterns to detect fraud, errors, and irregularities using AI and machine learning algorithms, which enhance financial accuracy and fraud prevention by analyzing historical transactional data.

A Machine Learning Framework for Anomaly Detection in Payment Systems - This paper presents a layered machine learning approach combining supervised and unsupervised algorithms to detect anomalous transactions in high-value payment systems in real time, improving detection efficiency and helping prevent systemic financial risks.

A Guide to Building a Financial Transaction Anomaly Detector - Employing unsupervised machine learning models for anomaly detection in financial transactions helps identify fraudulent activities by isolating data points generated by atypical processes compared to the majority of normal transaction data.

dowidth.com

dowidth.com