Neo banking revolutionizes traditional finance by offering fully digital banking services without physical branches, focusing on user-friendly mobile apps and streamlined customer experiences. Open banking enables secure data sharing between banks and third-party providers through APIs, fostering innovation and personalized financial products. Discover how both trends are transforming the banking landscape and what they mean for the future of financial services.

Why it is important

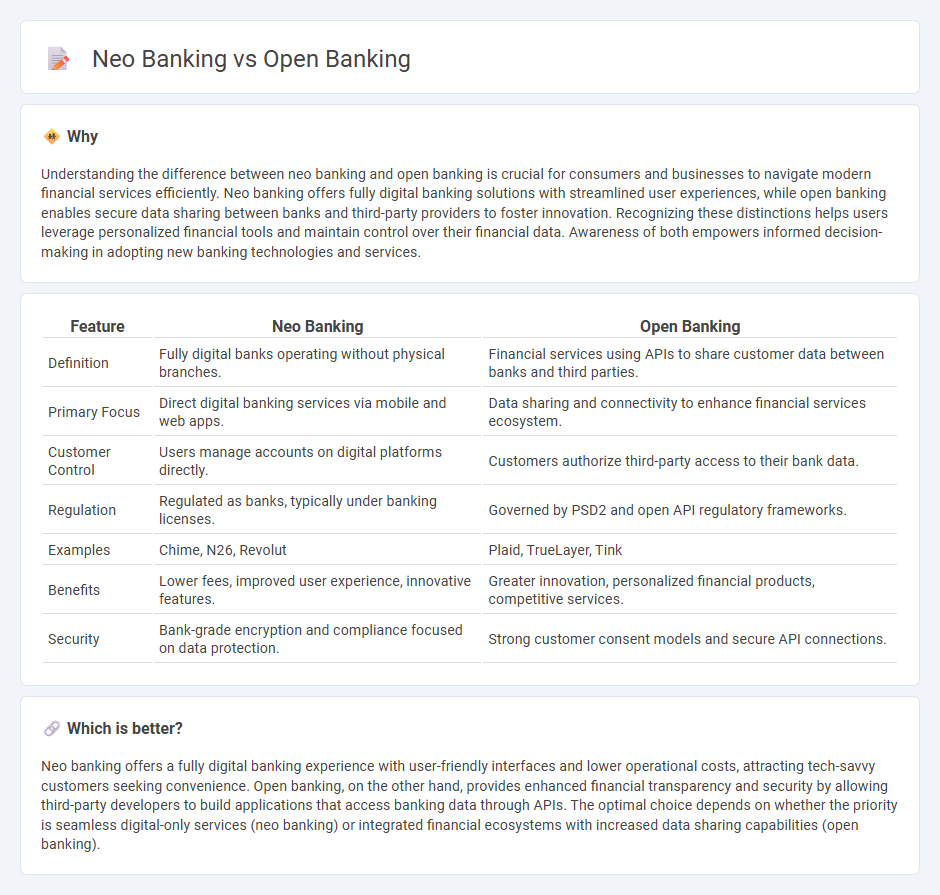

Understanding the difference between neo banking and open banking is crucial for consumers and businesses to navigate modern financial services efficiently. Neo banking offers fully digital banking solutions with streamlined user experiences, while open banking enables secure data sharing between banks and third-party providers to foster innovation. Recognizing these distinctions helps users leverage personalized financial tools and maintain control over their financial data. Awareness of both empowers informed decision-making in adopting new banking technologies and services.

Comparison Table

| Feature | Neo Banking | Open Banking |

|---|---|---|

| Definition | Fully digital banks operating without physical branches. | Financial services using APIs to share customer data between banks and third parties. |

| Primary Focus | Direct digital banking services via mobile and web apps. | Data sharing and connectivity to enhance financial services ecosystem. |

| Customer Control | Users manage accounts on digital platforms directly. | Customers authorize third-party access to their bank data. |

| Regulation | Regulated as banks, typically under banking licenses. | Governed by PSD2 and open API regulatory frameworks. |

| Examples | Chime, N26, Revolut | Plaid, TrueLayer, Tink |

| Benefits | Lower fees, improved user experience, innovative features. | Greater innovation, personalized financial products, competitive services. |

| Security | Bank-grade encryption and compliance focused on data protection. | Strong customer consent models and secure API connections. |

Which is better?

Neo banking offers a fully digital banking experience with user-friendly interfaces and lower operational costs, attracting tech-savvy customers seeking convenience. Open banking, on the other hand, provides enhanced financial transparency and security by allowing third-party developers to build applications that access banking data through APIs. The optimal choice depends on whether the priority is seamless digital-only services (neo banking) or integrated financial ecosystems with increased data sharing capabilities (open banking).

Connection

Neo banking leverages open banking APIs to provide innovative, customer-centric digital financial services without traditional branch networks. Open banking facilitates secure data sharing between banks and third-party providers, enabling neo banks to offer personalized products like real-time payments, budgeting tools, and lending options. The integration of open banking standards drives neo banking growth by enhancing transparency, interoperability, and user experience in the financial ecosystem.

Key Terms

API Integration

Open banking leverages API integration to enable seamless data sharing between traditional banks and third-party providers, fostering innovation and personalized financial services. Neo banks depend heavily on API-driven platforms to offer streamlined, fully digital banking experiences without physical branches, emphasizing rapid response and customization. Explore further to understand how API integration transforms financial ecosystems in open and neo banking.

Digital-Only Platform

Open banking leverages APIs to enable third-party developers to build applications and services around financial institutions, fostering greater financial transparency and innovation. Neo banking refers to digital-only banks that operate without physical branches, offering streamlined, tech-driven banking experiences solely through mobile apps or websites. Explore the detailed differences and benefits of open banking and neo banking digital platforms to understand how they reshape modern finance.

Third-Party Fintech Collaboration

Third-party fintech collaboration plays a crucial role in both open banking and neo banking by enabling seamless integration of innovative financial services through APIs. Open banking leverages regulated data sharing frameworks to facilitate secure access to consumer banking data for authorized fintech providers, whereas neo banks operate as fully digital banks often partnering with fintech firms to enhance customer experience and product offerings. Explore how these collaborative models are transforming financial services by driving innovation, competition, and personalized banking solutions.

Source and External Links

Open banking - Open banking allows customers to securely share their financial information electronically with other banks or authorized financial organizations.

What is open banking? A guide to the future of finance - Open banking is a system enabling consumers to share banking and financial data securely with third-party providers through APIs, improving transparency, access, and innovation in the financial industry.

What is open banking? Your essential guide - Mastercard - Open banking empowers individuals and businesses to control and share their financial data securely, unlocking innovative financial experiences and broadening access to services.

dowidth.com

dowidth.com