Account aggregation consolidates financial data from multiple sources into a unified view, enhancing user convenience and financial management. Fraud detection employs advanced algorithms and machine learning to identify suspicious activities and prevent unauthorized transactions, safeguarding customer assets. Explore how integrating account aggregation and fraud detection can revolutionize secure banking experiences.

Why it is important

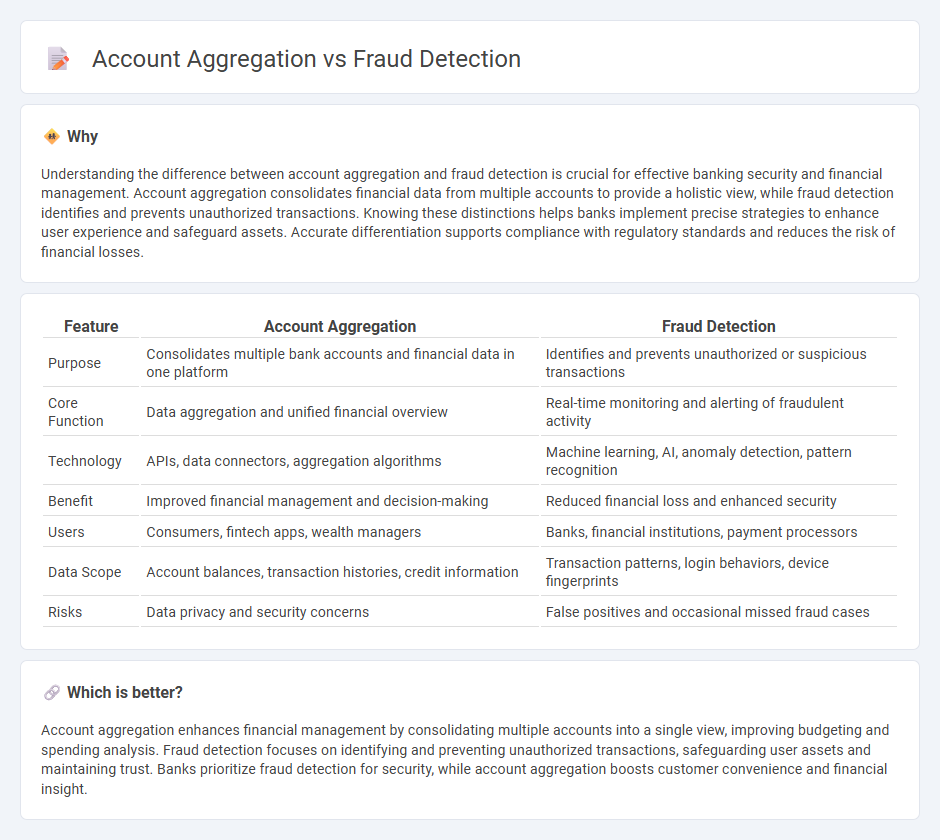

Understanding the difference between account aggregation and fraud detection is crucial for effective banking security and financial management. Account aggregation consolidates financial data from multiple accounts to provide a holistic view, while fraud detection identifies and prevents unauthorized transactions. Knowing these distinctions helps banks implement precise strategies to enhance user experience and safeguard assets. Accurate differentiation supports compliance with regulatory standards and reduces the risk of financial losses.

Comparison Table

| Feature | Account Aggregation | Fraud Detection |

|---|---|---|

| Purpose | Consolidates multiple bank accounts and financial data in one platform | Identifies and prevents unauthorized or suspicious transactions |

| Core Function | Data aggregation and unified financial overview | Real-time monitoring and alerting of fraudulent activity |

| Technology | APIs, data connectors, aggregation algorithms | Machine learning, AI, anomaly detection, pattern recognition |

| Benefit | Improved financial management and decision-making | Reduced financial loss and enhanced security |

| Users | Consumers, fintech apps, wealth managers | Banks, financial institutions, payment processors |

| Data Scope | Account balances, transaction histories, credit information | Transaction patterns, login behaviors, device fingerprints |

| Risks | Data privacy and security concerns | False positives and occasional missed fraud cases |

Which is better?

Account aggregation enhances financial management by consolidating multiple accounts into a single view, improving budgeting and spending analysis. Fraud detection focuses on identifying and preventing unauthorized transactions, safeguarding user assets and maintaining trust. Banks prioritize fraud detection for security, while account aggregation boosts customer convenience and financial insight.

Connection

Account aggregation consolidates financial data from multiple sources, enabling comprehensive monitoring of transactions and balances. This unified view enhances fraud detection systems by identifying unusual patterns and discrepancies across accounts more accurately. Integrating account aggregation with fraud detection improves real-time risk assessment and reduces false positives in banking security.

Key Terms

Fraud Detection:

Fraud detection utilizes advanced machine learning algorithms and real-time analytics to identify suspicious activities and prevent unauthorized transactions, safeguarding financial institutions and customers. It relies on pattern recognition, anomaly detection, and behavioral biometrics to reduce financial losses and enhance security measures. Explore how cutting-edge fraud detection technologies can protect your assets and ensure transactional integrity.

Transaction Monitoring

Fraud detection in transaction monitoring involves real-time analysis of transaction patterns to identify suspicious activities and prevent financial losses. Account aggregation consolidates data from multiple accounts to provide a comprehensive view, enhancing the accuracy of anomaly detection. Discover how combining fraud detection and account aggregation elevates transaction monitoring effectiveness.

Anomaly Detection

Fraud detection leverages anomaly detection techniques to identify unusual patterns or transactions that deviate from normal behavior, minimizing financial losses and enhancing security. Account aggregation uses similar algorithms to consolidate data securely, focusing on accurate data integration rather than detecting fraud. Explore the latest advancements in anomaly detection to improve fraud prevention and account aggregation efficiency.

Source and External Links

What is fraud detection and why is it needed? - Fraud detection is the process of identifying fraudulent activities through analyzing customer behavior and data patterns using AI and machine learning to prevent financial losses and reputational damage, involving stages like data warehousing and association rule creation.

How Fraud Detection Works: Common Software and Tools | F5 - Fraud detection systems use AI and machine learning to monitor transactions, user behaviors, and aggregate data across sources to identify suspicious patterns and anomalies indicative of fraud, such as unusual transaction amounts or failed login attempts.

Fraud detection: An overview - Thomson Reuters Legal Solutions - Fraud detection systematically identifies suspicious financial activities by analyzing data for anomalies and patterns over time, acting as a key component of fraud risk management to respond to threats by uncovering fraudulent behavior including sophisticated schemes.

dowidth.com

dowidth.com