Personal financial management tools empower individuals to track expenses, create budgets, and set savings goals for better money control. Treasury management systems serve businesses by optimizing cash flow, managing liquidity, and mitigating financial risks through advanced analytics and automation. Explore how choosing the right financial tool can enhance your personal or corporate financial strategy.

Why it is important

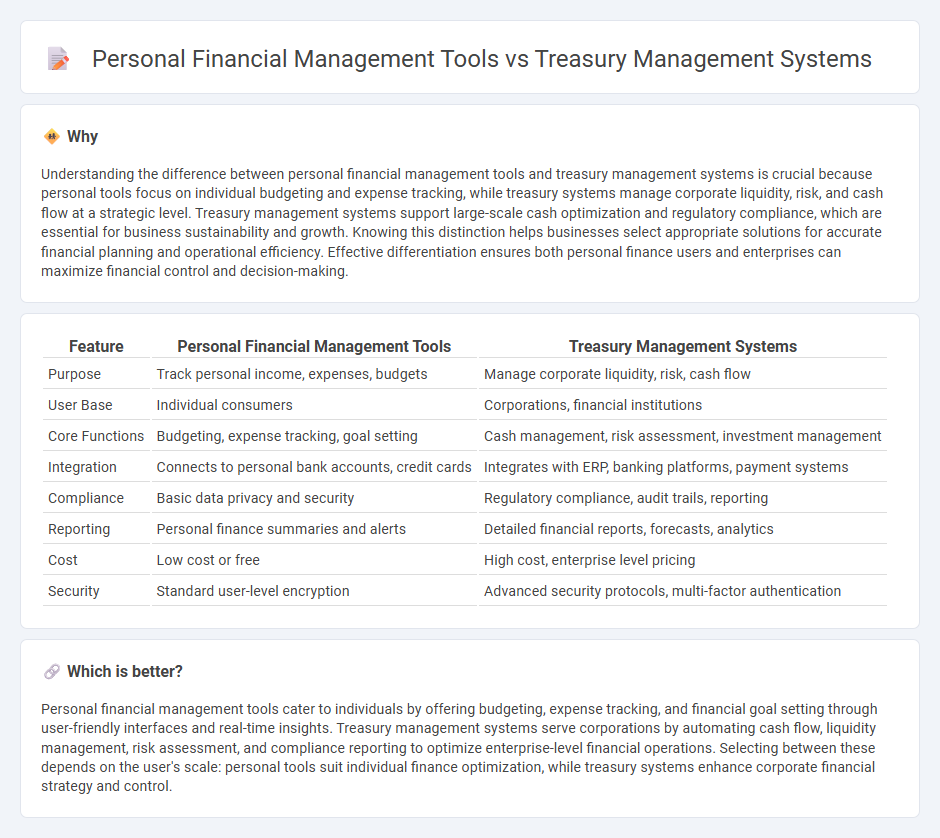

Understanding the difference between personal financial management tools and treasury management systems is crucial because personal tools focus on individual budgeting and expense tracking, while treasury systems manage corporate liquidity, risk, and cash flow at a strategic level. Treasury management systems support large-scale cash optimization and regulatory compliance, which are essential for business sustainability and growth. Knowing this distinction helps businesses select appropriate solutions for accurate financial planning and operational efficiency. Effective differentiation ensures both personal finance users and enterprises can maximize financial control and decision-making.

Comparison Table

| Feature | Personal Financial Management Tools | Treasury Management Systems |

|---|---|---|

| Purpose | Track personal income, expenses, budgets | Manage corporate liquidity, risk, cash flow |

| User Base | Individual consumers | Corporations, financial institutions |

| Core Functions | Budgeting, expense tracking, goal setting | Cash management, risk assessment, investment management |

| Integration | Connects to personal bank accounts, credit cards | Integrates with ERP, banking platforms, payment systems |

| Compliance | Basic data privacy and security | Regulatory compliance, audit trails, reporting |

| Reporting | Personal finance summaries and alerts | Detailed financial reports, forecasts, analytics |

| Cost | Low cost or free | High cost, enterprise level pricing |

| Security | Standard user-level encryption | Advanced security protocols, multi-factor authentication |

Which is better?

Personal financial management tools cater to individuals by offering budgeting, expense tracking, and financial goal setting through user-friendly interfaces and real-time insights. Treasury management systems serve corporations by automating cash flow, liquidity management, risk assessment, and compliance reporting to optimize enterprise-level financial operations. Selecting between these depends on the user's scale: personal tools suit individual finance optimization, while treasury systems enhance corporate financial strategy and control.

Connection

Personal financial management tools and treasury management systems are connected through their shared goal of optimizing cash flow, liquidity, and overall financial health for individuals and organizations. These systems utilize data integration, real-time analytics, and automated reporting to provide accurate insights into financial positions, enabling informed decision-making. This connection enhances budgeting, forecasting, and risk management by synchronizing personal and corporate financial information effectively.

Key Terms

Liquidity Management

Treasury management systems (TMS) provide advanced liquidity management by offering real-time cash positioning, automated cash forecasting, and centralized control over multiple bank accounts, ideal for corporate finance teams managing large cash flows. Personal financial management (PFM) tools primarily focus on individual cash flow tracking and budgeting without sophisticated liquidity forecasting or multi-account synchronization features found in TMS. Explore detailed comparisons to identify which system aligns best with your liquidity management needs.

Cash Flow Forecasting

Treasury management systems (TMS) provide advanced cash flow forecasting capabilities tailored for corporate finance, integrating real-time data from multiple accounts and transactions to optimize liquidity and manage risk. Personal financial management (PFM) tools offer simplified cash flow projections based on individual income and expenses, primarily focusing on budgeting and expense tracking. Explore how these solutions differ in accuracy, scale, and functionality to choose the best fit for your cash flow forecasting needs.

Investment Portfolio Tracking

Treasury management systems offer comprehensive investment portfolio tracking tailored for corporate liquidity, risk management, and asset allocation optimization, supporting real-time analytics and compliance monitoring. Personal financial management tools provide individual investors with simplified portfolio overviews, transaction categorization, and goal-based investing insights, focusing on ease of use and integration with personal banking data. Explore detailed comparisons to find the best solution suited to your investment tracking needs.

Source and External Links

What is a Treasury Management System? - DebtBook - A Treasury Management System (TMS) is a software solution that centralizes and automates key treasury functions like cash management, liquidity tracking, and financial risk management.

Best Treasury Management Systems Reviews 2025 - Gartner - A Treasury Management System (TMS) is specialized software that helps organizations manage financial activities, including cash flow, payments, and investments, by centralizing and automating processes.

What Is a Treasury Management System? - A Treasury Management System (TMS) oversees a range of financial activities on a global scale, providing functionalities such as cash management, payments, and risk management.

dowidth.com

dowidth.com