Invisible payments streamline transactions by eliminating the need for physical cards or cash, leveraging technologies like NFC and mobile wallets to enable seamless, fast purchases. Biometric authentication payments enhance security and user convenience by using fingerprints, facial recognition, or voice verification to authorize transactions. Explore the future of secure and effortless banking experiences by learning more about these innovative payment solutions.

Why it is important

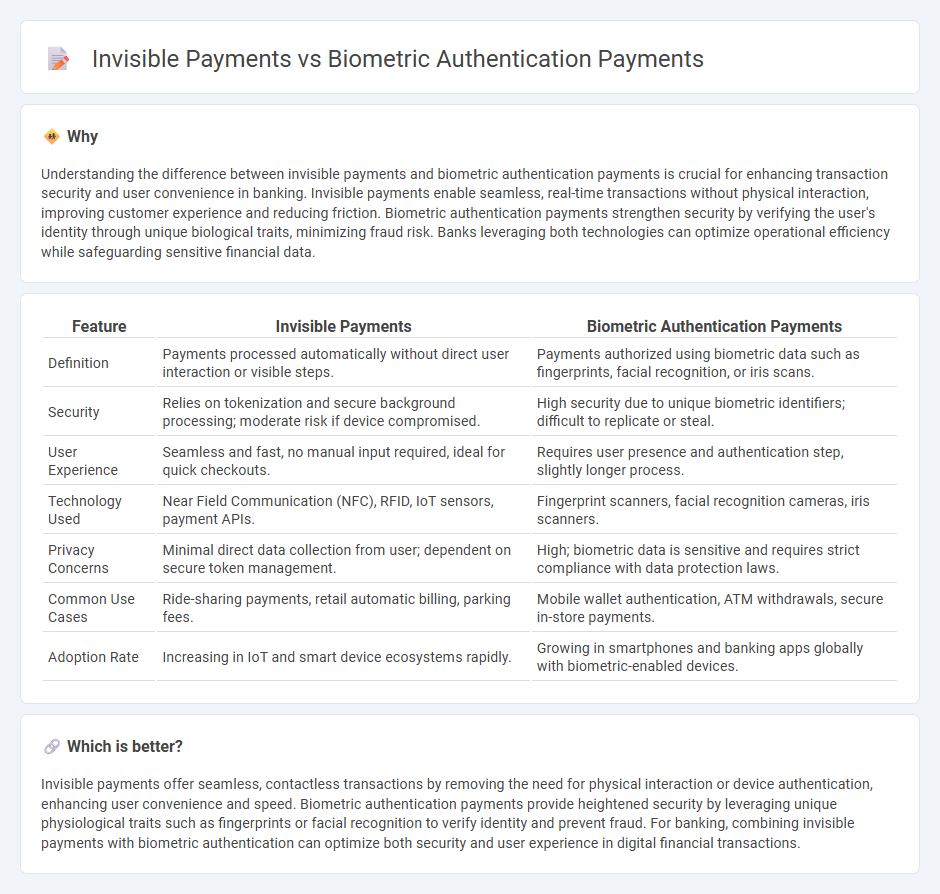

Understanding the difference between invisible payments and biometric authentication payments is crucial for enhancing transaction security and user convenience in banking. Invisible payments enable seamless, real-time transactions without physical interaction, improving customer experience and reducing friction. Biometric authentication payments strengthen security by verifying the user's identity through unique biological traits, minimizing fraud risk. Banks leveraging both technologies can optimize operational efficiency while safeguarding sensitive financial data.

Comparison Table

| Feature | Invisible Payments | Biometric Authentication Payments |

|---|---|---|

| Definition | Payments processed automatically without direct user interaction or visible steps. | Payments authorized using biometric data such as fingerprints, facial recognition, or iris scans. |

| Security | Relies on tokenization and secure background processing; moderate risk if device compromised. | High security due to unique biometric identifiers; difficult to replicate or steal. |

| User Experience | Seamless and fast, no manual input required, ideal for quick checkouts. | Requires user presence and authentication step, slightly longer process. |

| Technology Used | Near Field Communication (NFC), RFID, IoT sensors, payment APIs. | Fingerprint scanners, facial recognition cameras, iris scanners. |

| Privacy Concerns | Minimal direct data collection from user; dependent on secure token management. | High; biometric data is sensitive and requires strict compliance with data protection laws. |

| Common Use Cases | Ride-sharing payments, retail automatic billing, parking fees. | Mobile wallet authentication, ATM withdrawals, secure in-store payments. |

| Adoption Rate | Increasing in IoT and smart device ecosystems rapidly. | Growing in smartphones and banking apps globally with biometric-enabled devices. |

Which is better?

Invisible payments offer seamless, contactless transactions by removing the need for physical interaction or device authentication, enhancing user convenience and speed. Biometric authentication payments provide heightened security by leveraging unique physiological traits such as fingerprints or facial recognition to verify identity and prevent fraud. For banking, combining invisible payments with biometric authentication can optimize both security and user experience in digital financial transactions.

Connection

Invisible payments leverage biometric authentication to enhance security and user convenience by enabling transactions without the need for physical cards or cash. Biometric methods, such as fingerprint scans or facial recognition, provide seamless verification, reducing fraud risks and accelerating the checkout process. This integration of invisible payments and biometric authentication drives the evolution of contactless banking experiences and digital wallets.

Key Terms

Identity Verification

Biometric authentication payments utilize unique biological traits such as fingerprints or facial recognition to securely verify a user's identity, significantly reducing fraud and enhancing transaction confidence. Invisible payments rely on seamless, background processing that minimizes user interaction, often integrating biometric data to support identity verification behind the scenes. Explore how advancements in biometric technology continue to shape the future of invisible payment systems and secure identity verification.

Seamless Transactions

Biometric authentication payments leverage unique biological traits such as fingerprints and facial recognition to offer secure and convenient user verification, significantly reducing fraud and checkout time. Invisible payments, often powered by IoT and AI technologies, enable seamless transactions without requiring active customer interaction, enhancing user experience in retail and IoT ecosystems. Explore how integrating these payment methods can revolutionize seamless transactions for your business.

Security Protocols

Biometric authentication payments utilize unique biological traits such as fingerprints or facial recognition to establish secure identity verification, significantly reducing the risk of fraud through multi-factor security protocols. Invisible payments leverage background processes like tokenization and data encryption to authorize transactions without interrupting user interaction, enhancing convenience while maintaining strong security measures. Explore how these distinct security protocols safeguard your financial transactions and elevate payment experiences.

Source and External Links

Biometric Payments: What Are They and How Are They Shaping the Future of Commerce? - Biometric payments use unique biological characteristics like fingerprints, facial recognition, or voice to authenticate and authorize transactions, typically involving registration, authentication, and authorization stages which can be done via smartphone hardware or dedicated payment terminals.

What are biometric payments? - Biometric payment systems authenticate users based on physical traits such as eyes, face, or voice, following a process of registration, payment initiation, and biometric verification--with data usually stored securely on the device rather than on external servers.

What are biometric payments? A quick guide for businesses - Biometric payments verify identity using biological features before processing transactions, with common applications in retail, banking, digital wallets, healthcare, and government services, and popular methods including fingerprint and facial recognition.

dowidth.com

dowidth.com