Predictive analytics in banking leverages data mining, machine learning, and statistical models to forecast future customer behaviors and financial trends. Portfolio management focuses on optimizing asset allocation and risk management to maximize returns based on client investment goals. Discover how integrating predictive analytics enhances portfolio management strategies for better banking outcomes.

Why it is important

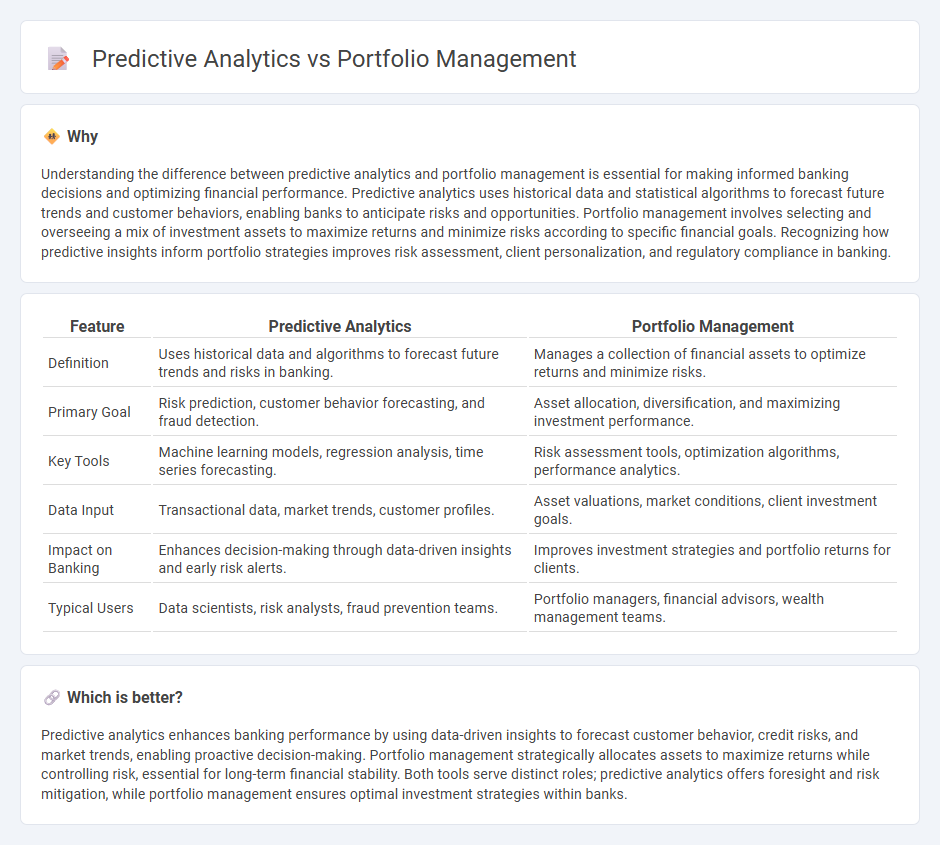

Understanding the difference between predictive analytics and portfolio management is essential for making informed banking decisions and optimizing financial performance. Predictive analytics uses historical data and statistical algorithms to forecast future trends and customer behaviors, enabling banks to anticipate risks and opportunities. Portfolio management involves selecting and overseeing a mix of investment assets to maximize returns and minimize risks according to specific financial goals. Recognizing how predictive insights inform portfolio strategies improves risk assessment, client personalization, and regulatory compliance in banking.

Comparison Table

| Feature | Predictive Analytics | Portfolio Management |

|---|---|---|

| Definition | Uses historical data and algorithms to forecast future trends and risks in banking. | Manages a collection of financial assets to optimize returns and minimize risks. |

| Primary Goal | Risk prediction, customer behavior forecasting, and fraud detection. | Asset allocation, diversification, and maximizing investment performance. |

| Key Tools | Machine learning models, regression analysis, time series forecasting. | Risk assessment tools, optimization algorithms, performance analytics. |

| Data Input | Transactional data, market trends, customer profiles. | Asset valuations, market conditions, client investment goals. |

| Impact on Banking | Enhances decision-making through data-driven insights and early risk alerts. | Improves investment strategies and portfolio returns for clients. |

| Typical Users | Data scientists, risk analysts, fraud prevention teams. | Portfolio managers, financial advisors, wealth management teams. |

Which is better?

Predictive analytics enhances banking performance by using data-driven insights to forecast customer behavior, credit risks, and market trends, enabling proactive decision-making. Portfolio management strategically allocates assets to maximize returns while controlling risk, essential for long-term financial stability. Both tools serve distinct roles; predictive analytics offers foresight and risk mitigation, while portfolio management ensures optimal investment strategies within banks.

Connection

Predictive analytics enhances portfolio management by utilizing historical data and machine learning algorithms to forecast asset performance and market trends. This connection enables banks to optimize investment strategies, minimize risks, and improve decision-making accuracy. Integrating predictive analytics within portfolio management drives better allocation of capital and maximizes returns.

Key Terms

**Portfolio Management:**

Portfolio management involves selecting, prioritizing, and controlling a collection of investments or projects to meet strategic objectives while balancing risk and return. It encompasses asset allocation, risk assessment, performance monitoring, and ongoing decision-making to optimize the overall value of the portfolio. Explore more about how advanced techniques in portfolio management drive better financial outcomes and strategic alignment.

Asset Allocation

Portfolio management leverages asset allocation strategies to balance risk and return, optimizing investment diversification across asset classes like equities, bonds, and real estate. Predictive analytics applies statistical models and machine learning to forecast market trends and asset performance, enhancing asset allocation decisions with data-driven insights. Explore how integrating predictive analytics can refine portfolio management for superior asset allocation outcomes.

Risk Diversification

Risk diversification in portfolio management involves spreading investments across various asset classes to minimize exposure to any single risk source. Predictive analytics enhances this process by using historical data and machine learning models to forecast potential risks and market trends, enabling more informed diversification decisions. Explore our detailed insights to learn how predictive analytics transforms risk diversification strategies in portfolio management.

Source and External Links

Understanding Portfolio Management & Diversification - Awork - Portfolio management is the process of selecting, monitoring, and adjusting projects or investments to efficiently use resources, set priorities, and reduce risk through diversification, with strategies including active, passive, value-oriented, and growth-oriented management.

An Introduction to Portfolio Management - NYU Stern - Portfolio management involves asset allocation across classes, selecting individual assets, executing portfolio construction while balancing trading costs, and performance evaluation to maximize returns given risk preferences.

Project portfolio management - Wikipedia - Project portfolio management is the centralized approach to managing projects and resources to optimize delivery and achieve organizational goals, incorporating decision-making methods from financial portfolio theories to reduce risk and optimize benefits.

dowidth.com

dowidth.com