Personal financial management tools offer comprehensive budgeting, expense tracking, and goal-setting features that help users gain deep insights into their financial health. Mobile banking apps provide convenient access to transactions, account balances, and real-time notifications, ensuring seamless day-to-day banking. Discover how both solutions can optimize your financial control and convenience.

Why it is important

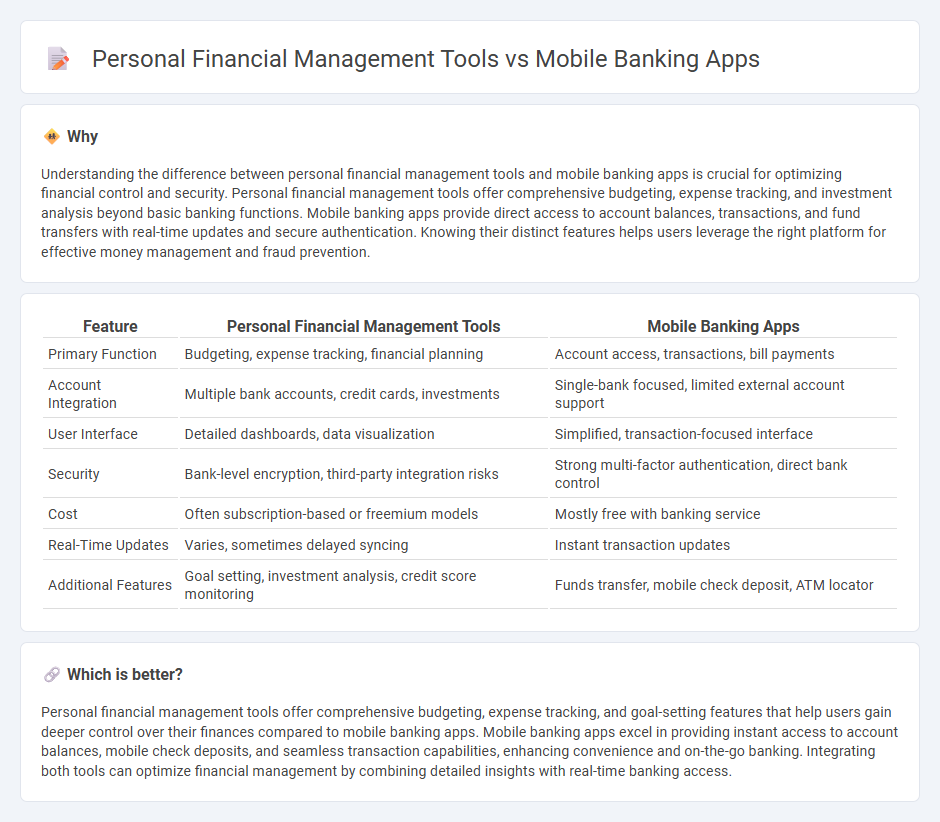

Understanding the difference between personal financial management tools and mobile banking apps is crucial for optimizing financial control and security. Personal financial management tools offer comprehensive budgeting, expense tracking, and investment analysis beyond basic banking functions. Mobile banking apps provide direct access to account balances, transactions, and fund transfers with real-time updates and secure authentication. Knowing their distinct features helps users leverage the right platform for effective money management and fraud prevention.

Comparison Table

| Feature | Personal Financial Management Tools | Mobile Banking Apps |

|---|---|---|

| Primary Function | Budgeting, expense tracking, financial planning | Account access, transactions, bill payments |

| Account Integration | Multiple bank accounts, credit cards, investments | Single-bank focused, limited external account support |

| User Interface | Detailed dashboards, data visualization | Simplified, transaction-focused interface |

| Security | Bank-level encryption, third-party integration risks | Strong multi-factor authentication, direct bank control |

| Cost | Often subscription-based or freemium models | Mostly free with banking service |

| Real-Time Updates | Varies, sometimes delayed syncing | Instant transaction updates |

| Additional Features | Goal setting, investment analysis, credit score monitoring | Funds transfer, mobile check deposit, ATM locator |

Which is better?

Personal financial management tools offer comprehensive budgeting, expense tracking, and goal-setting features that help users gain deeper control over their finances compared to mobile banking apps. Mobile banking apps excel in providing instant access to account balances, mobile check deposits, and seamless transaction capabilities, enhancing convenience and on-the-go banking. Integrating both tools can optimize financial management by combining detailed insights with real-time banking access.

Connection

Personal financial management tools integrate seamlessly with mobile banking apps to provide users real-time access to their account balances, transaction histories, and budgeting features. These tools leverage data from mobile banking apps to offer personalized spending insights, automated expense categorization, and goal tracking. The synergy between these technologies enhances user control over finances and promotes informed decision-making through centralized financial data.

Key Terms

User Authentication

Mobile banking apps employ multi-factor authentication methods such as biometric verification and one-time passwords to safeguard user accounts and ensure secure access. Personal financial management tools also integrate advanced authentication protocols but often emphasize seamless connectivity with multiple bank accounts and financial institutions for comprehensive budget tracking. Explore how these authentication mechanisms enhance security while maintaining user convenience.

Budgeting Features

Mobile banking apps offer basic budgeting features such as expense tracking and bill reminders integrated within the banking ecosystem, providing convenience for users managing accounts and transactions in one place. Personal financial management tools deliver advanced budgeting capabilities, including customizable spending categories, detailed financial reports, and goal-setting functions that promote comprehensive money management. Explore the unique budgeting strengths of each to optimize your financial planning strategy.

Transaction Monitoring

Mobile banking apps provide real-time transaction monitoring with instant alerts for deposits, withdrawals, and suspicious activity, ensuring users stay informed about account status. Personal financial management (PFM) tools offer enhanced categorization and trend analysis of transactions, enabling users to track spending patterns and budget more effectively. Discover how these technologies can enhance your financial control and security.

Source and External Links

Bank of America Mobile Banking - Offers a secure and convenient way to manage U.S.-based checking, savings, credit card, loan, and investment accounts, including features like mobile check deposit, bill pay, money transfers via Zelle, and access to a virtual assistant named Erica.

U.S. Bank Mobile Banking - Provides account management in one place with security features such as alerts on suspicious activity, card locking, access to credit scores, personalized spending insights, and money transfers via Zelle.

Bank of America Mobile Banking on Google Play - A widely used app with over 50 million downloads, enabling users to securely view balances, activate cards, pay bills, deposit checks via photo, and use Erica, the virtual financial assistant, with biometric login for security.

dowidth.com

dowidth.com