Super apps integrate a wide range of financial services including payments, lending, and investments within a single platform, offering unparalleled convenience beyond traditional banking functions. ATM networks remain essential for cash withdrawals and deposit services, providing widespread physical accessibility and real-time transactions. Explore how these banking innovations complement each other and reshape the financial ecosystem.

Why it is important

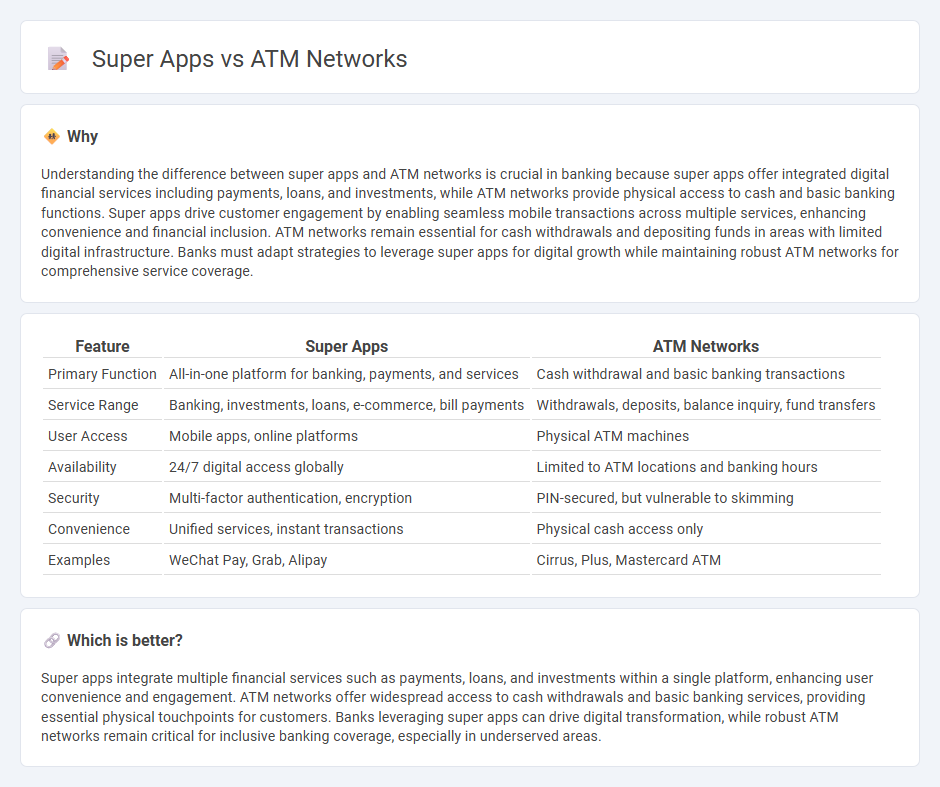

Understanding the difference between super apps and ATM networks is crucial in banking because super apps offer integrated digital financial services including payments, loans, and investments, while ATM networks provide physical access to cash and basic banking functions. Super apps drive customer engagement by enabling seamless mobile transactions across multiple services, enhancing convenience and financial inclusion. ATM networks remain essential for cash withdrawals and depositing funds in areas with limited digital infrastructure. Banks must adapt strategies to leverage super apps for digital growth while maintaining robust ATM networks for comprehensive service coverage.

Comparison Table

| Feature | Super Apps | ATM Networks |

|---|---|---|

| Primary Function | All-in-one platform for banking, payments, and services | Cash withdrawal and basic banking transactions |

| Service Range | Banking, investments, loans, e-commerce, bill payments | Withdrawals, deposits, balance inquiry, fund transfers |

| User Access | Mobile apps, online platforms | Physical ATM machines |

| Availability | 24/7 digital access globally | Limited to ATM locations and banking hours |

| Security | Multi-factor authentication, encryption | PIN-secured, but vulnerable to skimming |

| Convenience | Unified services, instant transactions | Physical cash access only |

| Examples | WeChat Pay, Grab, Alipay | Cirrus, Plus, Mastercard ATM |

Which is better?

Super apps integrate multiple financial services such as payments, loans, and investments within a single platform, enhancing user convenience and engagement. ATM networks offer widespread access to cash withdrawals and basic banking services, providing essential physical touchpoints for customers. Banks leveraging super apps can drive digital transformation, while robust ATM networks remain critical for inclusive banking coverage, especially in underserved areas.

Connection

Super apps integrate multiple banking services, including ATM locators and cash withdrawal features, enhancing customer convenience and transaction efficiency. ATM networks provide the essential infrastructure allowing these apps to offer real-time access to physical cash and banking functionalities. This connectivity supports seamless user experiences, blending digital finance management with widespread ATM accessibility.

Key Terms

Interoperability

ATM networks provide established interoperability through standardized protocols enabling seamless cash withdrawals and deposits across different banks globally. Super apps integrate multiple services, combining payments, messaging, and e-commerce within a single platform, yet face challenges in achieving cross-platform interoperability and universal user access. Explore how advancements in API standards and cross-network collaboration are shaping the future of seamless financial connectivity.

Digital Ecosystem

ATM networks remain crucial for cash access and financial inclusivity, supporting millions of transactions daily worldwide. Super apps integrate diverse services like payments, ride-hailing, messaging, and e-commerce into a unified digital ecosystem, enhancing user convenience and engagement. Explore how these platforms reshape financial interaction and consumer behavior in the evolving digital landscape.

Real-time Transactions

ATM networks process real-time transactions by securely authenticating cardholders and facilitating immediate fund transfers between banks, ensuring quick cash withdrawals and balance inquiries. Super apps integrate multiple services within a single platform, enabling seamless real-time payments, peer-to-peer transfers, and instant merchant transactions through digital wallets and QR codes. Explore how these technologies are transforming financial ecosystems for faster, more convenient transaction experiences.

Source and External Links

Interbank Network - Wikipedia - An interbank network allows ATM cards from one financial institution to be used at ATMs of other network member banks, providing convenience especially for travelers.

NCR Atleos - ATM Network & Allpoint - Allpoint is a large surcharge-free ATM network with over 55,000 locations globally, offering convenient cash access in retail stores like Target and CVS.

PULSE ATM Network - PULSE connects millions of cardholders across the U.S. and North America, providing access to over 400,000 ATMs and competitive interchange rates.

dowidth.com

dowidth.com