Regulatory sandboxes offer a controlled environment for banks and fintechs to test innovative financial products under regulatory supervision, reducing compliance risks. Accelerators provide structured programs that support early-stage startups with mentorship, funding, and market access to scale banking innovations rapidly. Explore our detailed comparison to understand which approach suits your financial innovation goals best.

Why it is important

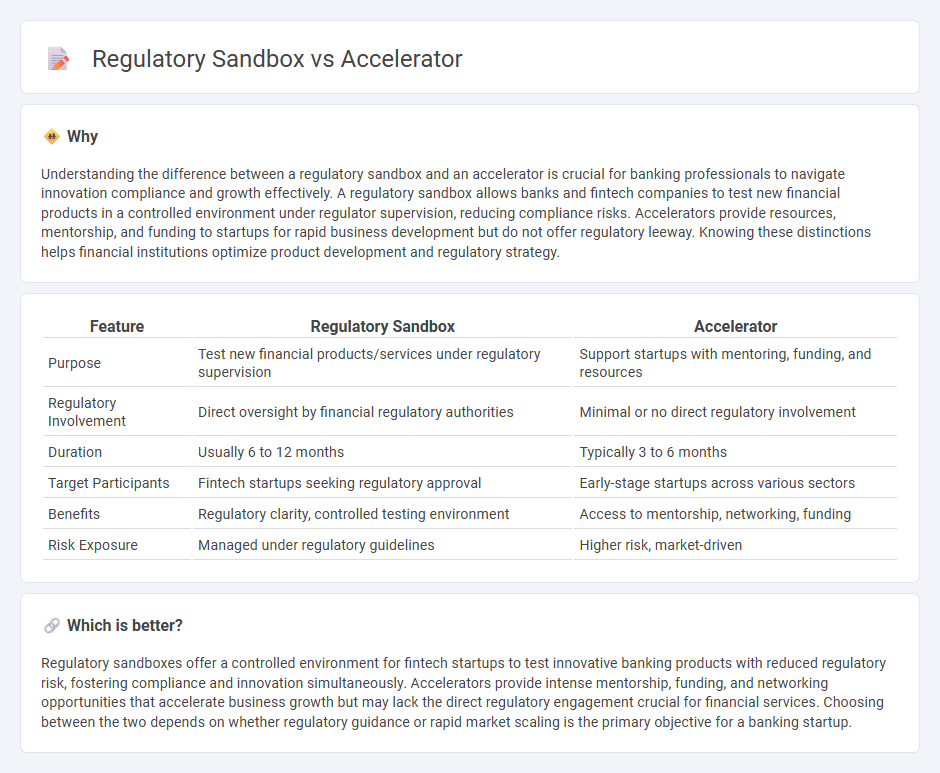

Understanding the difference between a regulatory sandbox and an accelerator is crucial for banking professionals to navigate innovation compliance and growth effectively. A regulatory sandbox allows banks and fintech companies to test new financial products in a controlled environment under regulator supervision, reducing compliance risks. Accelerators provide resources, mentorship, and funding to startups for rapid business development but do not offer regulatory leeway. Knowing these distinctions helps financial institutions optimize product development and regulatory strategy.

Comparison Table

| Feature | Regulatory Sandbox | Accelerator |

|---|---|---|

| Purpose | Test new financial products/services under regulatory supervision | Support startups with mentoring, funding, and resources |

| Regulatory Involvement | Direct oversight by financial regulatory authorities | Minimal or no direct regulatory involvement |

| Duration | Usually 6 to 12 months | Typically 3 to 6 months |

| Target Participants | Fintech startups seeking regulatory approval | Early-stage startups across various sectors |

| Benefits | Regulatory clarity, controlled testing environment | Access to mentorship, networking, funding |

| Risk Exposure | Managed under regulatory guidelines | Higher risk, market-driven |

Which is better?

Regulatory sandboxes offer a controlled environment for fintech startups to test innovative banking products with reduced regulatory risk, fostering compliance and innovation simultaneously. Accelerators provide intense mentorship, funding, and networking opportunities that accelerate business growth but may lack the direct regulatory engagement crucial for financial services. Choosing between the two depends on whether regulatory guidance or rapid market scaling is the primary objective for a banking startup.

Connection

Regulatory sandboxes and accelerators both support innovation in banking by providing controlled environments where financial technology startups can test new products under regulatory supervision. Sandboxes enable banks and fintechs to experiment with innovative solutions while ensuring compliance with evolving banking regulations. Accelerators offer mentorship, resources, and industry connections that complement sandbox trials, accelerating the development and market readiness of compliant banking technologies.

Key Terms

Innovation

An accelerator is a program designed to rapidly scale startups through mentorship, funding, and resources, fostering innovation by compressing growth timelines and market entry. A regulatory sandbox offers a controlled environment for companies to test innovative products or services under regulatory supervision, encouraging experimentation without full compliance risks. Explore the distinct roles of accelerators and regulatory sandboxes in driving innovation and how they complement each other in startup ecosystems.

Compliance

Accelerators streamline compliance processes by providing startups with expert guidance, resources, and networking opportunities to rapidly meet regulatory standards. Regulatory sandboxes offer a controlled environment for companies to test innovative products while ensuring adherence to existing legal frameworks. Explore how each approach addresses compliance challenges and supports successful market entry.

Risk Management

Accelerators emphasize rapid business scaling, providing startups with mentorship, resources, and investor connections while focusing on market risks and growth strategies. Regulatory sandboxes concentrate on risk management related to compliance, allowing fintech firms to test innovative products under regulatory supervision to ensure consumer protection and mitigate legal risks. Discover how these frameworks balance innovation with risk in financial technology.

Source and External Links

How an accelerator works - An accelerator in physics speeds up and increases the energy of a particle beam using electric fields for acceleration and magnetic fields for steering and focusing.

Welcome to the ACCelerator - You Belong Here! - The ACCelerator at Austin Community College provides students with tech resources, tutoring, academic coaching, and support services to enhance their learning experience.

100+ Accelerator - The 100+ Accelerator is a corporate partnership program that funds and pilots sustainable innovations to help entrepreneurs solve global challenges and bring their solutions to market more quickly.

dowidth.com

dowidth.com