Neo banking leverages digital platforms to offer seamless, low-cost financial services without traditional branch networks, appealing to tech-savvy customers. Shadow banking operates outside regulated banking systems, providing credit and liquidity through non-bank entities, often with higher risk profiles. Explore the key differences, benefits, and risks of neo banking versus shadow banking to understand their impact on the financial landscape.

Why it is important

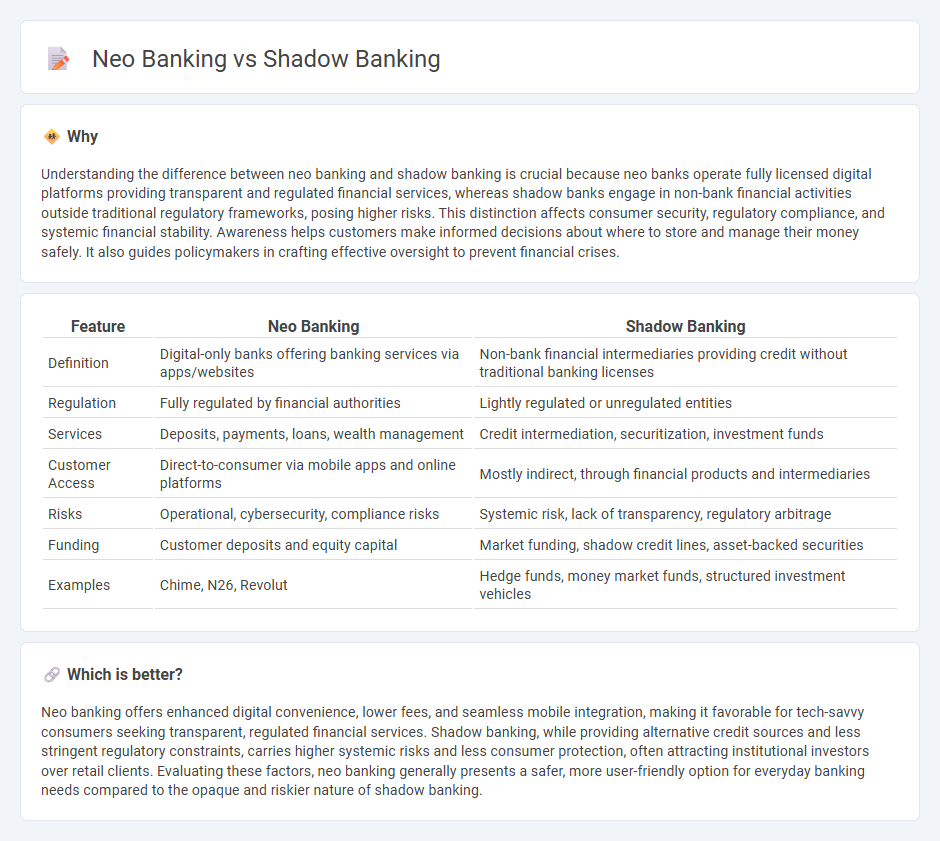

Understanding the difference between neo banking and shadow banking is crucial because neo banks operate fully licensed digital platforms providing transparent and regulated financial services, whereas shadow banks engage in non-bank financial activities outside traditional regulatory frameworks, posing higher risks. This distinction affects consumer security, regulatory compliance, and systemic financial stability. Awareness helps customers make informed decisions about where to store and manage their money safely. It also guides policymakers in crafting effective oversight to prevent financial crises.

Comparison Table

| Feature | Neo Banking | Shadow Banking |

|---|---|---|

| Definition | Digital-only banks offering banking services via apps/websites | Non-bank financial intermediaries providing credit without traditional banking licenses |

| Regulation | Fully regulated by financial authorities | Lightly regulated or unregulated entities |

| Services | Deposits, payments, loans, wealth management | Credit intermediation, securitization, investment funds |

| Customer Access | Direct-to-consumer via mobile apps and online platforms | Mostly indirect, through financial products and intermediaries |

| Risks | Operational, cybersecurity, compliance risks | Systemic risk, lack of transparency, regulatory arbitrage |

| Funding | Customer deposits and equity capital | Market funding, shadow credit lines, asset-backed securities |

| Examples | Chime, N26, Revolut | Hedge funds, money market funds, structured investment vehicles |

Which is better?

Neo banking offers enhanced digital convenience, lower fees, and seamless mobile integration, making it favorable for tech-savvy consumers seeking transparent, regulated financial services. Shadow banking, while providing alternative credit sources and less stringent regulatory constraints, carries higher systemic risks and less consumer protection, often attracting institutional investors over retail clients. Evaluating these factors, neo banking generally presents a safer, more user-friendly option for everyday banking needs compared to the opaque and riskier nature of shadow banking.

Connection

Neo banking leverages digital platforms to provide financial services without traditional bank branches, focusing on enhanced user experience and cost efficiency. Shadow banking consists of non-bank financial intermediaries performing banking-like activities outside regulated frameworks, often providing credit and liquidity. Both systems intersect by offering alternative financing solutions that challenge conventional banking, with neo banks sometimes partnering with shadow banking entities to expand service offerings and access untapped customer segments.

Key Terms

Regulation

Shadow banking operates outside traditional regulatory frameworks, involving non-bank financial intermediaries that provide credit and other financial services without direct oversight from central banks or regulatory authorities. Neo banking, fully digital banking platforms, are subject to regulatory compliance similar to traditional banks, including licensing, anti-money laundering (AML) measures, and customer data protection under financial regulatory bodies. Explore the regulatory landscapes shaping shadow banking and neo banking to understand their impact on financial stability and innovation.

Intermediation

Shadow banking involves non-bank financial intermediaries that facilitate credit and liquidity without traditional bank oversight, often including entities like hedge funds, money market funds, and securitization vehicles. Neo banking, on the other hand, refers to digital-only banks offering streamlined financial services through technology platforms, emphasizing direct customer interaction and minimal physical infrastructure. Explore more about how these models reshape financial intermediation and regulatory landscapes.

Digital Platforms

Shadow banking refers to non-traditional financial intermediaries that operate outside regular banking regulations, often facilitating credit and liquidity through digital platforms without direct government oversight. Neo banking revolves around fully digital banks offering enhanced user experiences, streamlined services, and real-time financial management via specially designed mobile apps and online interfaces. Explore the evolving roles and regulatory landscapes of these cutting-edge financial platforms to understand their impact on the modern economy.

Source and External Links

Shadow Banking - Shadow banking consists of credit, maturity, and liquidity transformation by non-bank financial intermediaries that operate without direct access to public liquidity or credit backstops, often using securitization and short-term liabilities against risky assets prior to the 2007-09 financial crisis.

Shadow banking system - Wikipedia - The shadow banking system is a network of non-bank financial intermediaries that provide credit and liquidity similar to banks but lack central bank support and deposit insurance, relying on short-term funding methods such as asset-backed commercial paper and repos.

Regulation Shadow Banking FSB - Globally, shadow banking accounts for about 25% of financial system assets, involving institutions like money market funds, finance companies, and hedge funds that conduct credit, maturity, and liquidity transformations without public sector guarantees, often through securitization and wholesale funding instruments.

dowidth.com

dowidth.com