Sustainable banking focuses on environmental, social, and governance (ESG) criteria to promote responsible investment and ethical financial practices, while private banking offers personalized wealth management services to high-net-worth individuals. Sustainable banking integrates impact investing and green financing to support eco-friendly projects, contrasting with private banking's emphasis on asset growth, tax optimization, and legacy planning. Discover how these two banking models can align with your financial values and goals.

Why it is important

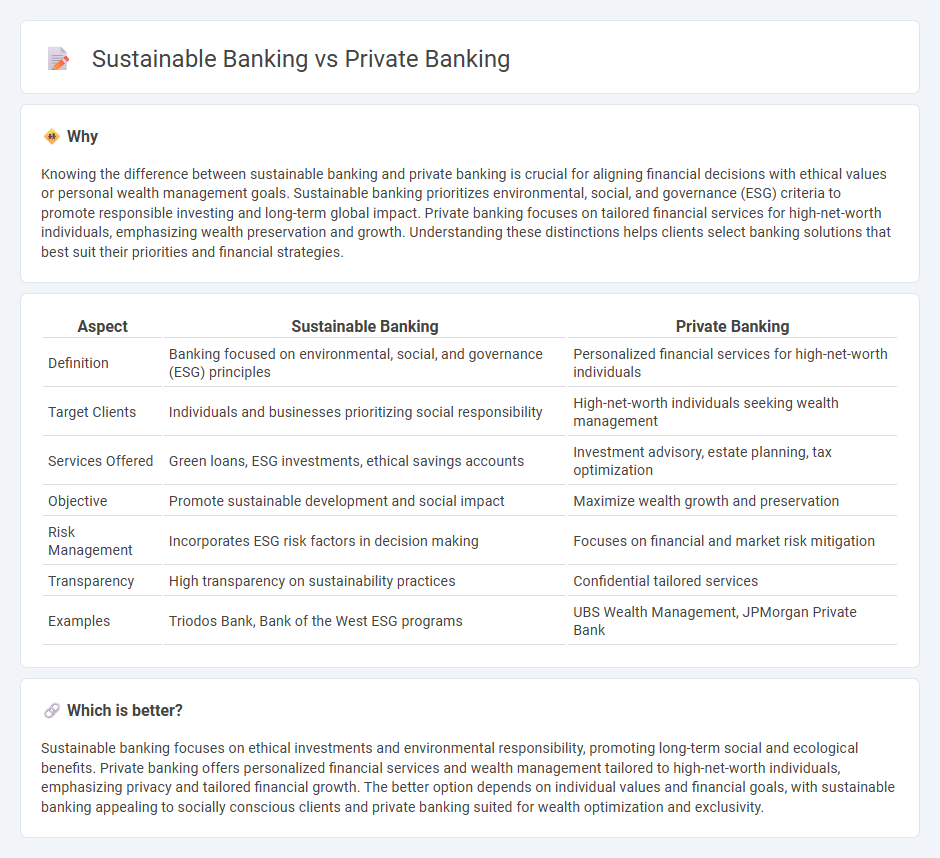

Knowing the difference between sustainable banking and private banking is crucial for aligning financial decisions with ethical values or personal wealth management goals. Sustainable banking prioritizes environmental, social, and governance (ESG) criteria to promote responsible investing and long-term global impact. Private banking focuses on tailored financial services for high-net-worth individuals, emphasizing wealth preservation and growth. Understanding these distinctions helps clients select banking solutions that best suit their priorities and financial strategies.

Comparison Table

| Aspect | Sustainable Banking | Private Banking |

|---|---|---|

| Definition | Banking focused on environmental, social, and governance (ESG) principles | Personalized financial services for high-net-worth individuals |

| Target Clients | Individuals and businesses prioritizing social responsibility | High-net-worth individuals seeking wealth management |

| Services Offered | Green loans, ESG investments, ethical savings accounts | Investment advisory, estate planning, tax optimization |

| Objective | Promote sustainable development and social impact | Maximize wealth growth and preservation |

| Risk Management | Incorporates ESG risk factors in decision making | Focuses on financial and market risk mitigation |

| Transparency | High transparency on sustainability practices | Confidential tailored services |

| Examples | Triodos Bank, Bank of the West ESG programs | UBS Wealth Management, JPMorgan Private Bank |

Which is better?

Sustainable banking focuses on ethical investments and environmental responsibility, promoting long-term social and ecological benefits. Private banking offers personalized financial services and wealth management tailored to high-net-worth individuals, emphasizing privacy and tailored financial growth. The better option depends on individual values and financial goals, with sustainable banking appealing to socially conscious clients and private banking suited for wealth optimization and exclusivity.

Connection

Sustainable banking integrates environmental, social, and governance (ESG) criteria into financial services, aligning with private banking's growing emphasis on ethical investment portfolios tailored for high-net-worth clients. Private banks increasingly offer sustainable investment products, enabling clients to support green technologies and socially responsible enterprises while achieving financial goals. The synergy between sustainable banking practices and private banking services drives long-term value creation and risk mitigation in wealth management.

Key Terms

Wealth Management

Private banking focuses on personalized wealth management services for high-net-worth individuals, emphasizing tailored investment strategies, estate planning, and tax optimization. Sustainable banking integrates environmental, social, and governance (ESG) criteria into wealth management, promoting responsible investing and the allocation of assets to support sustainable development goals. Explore the advantages and detailed approaches of both private and sustainable banking to optimize your wealth management strategy.

Environmental, Social, and Governance (ESG)

Private banking typically centers on personalized wealth management and investment strategies tailored to high-net-worth individuals, whereas sustainable banking integrates Environmental, Social, and Governance (ESG) criteria into financial products and services to promote ethical and responsible investing. ESG-focused sustainable banking prioritizes minimizing environmental impact, advancing social equity, and ensuring transparent governance, aligning investment portfolios with broader societal goals. Explore how merging private banking expertise with ESG principles can optimize financial performance and societal benefits.

Client Personalization

Private banking emphasizes exclusive, tailored financial services including wealth management, investment advice, and estate planning to meet high-net-worth clients' unique needs. Sustainable banking integrates environmental, social, and governance (ESG) criteria into personalized financial solutions, aligning with clients' values for responsible investing and impact-driven wealth growth. Explore how personalized strategies in private and sustainable banking can optimize your financial goals while reflecting your ethical priorities.

Source and External Links

Private banking - Wikipedia - Private banking offers exclusive banking, investment, and financial services to high-net-worth individuals, typically requiring significant minimum asset thresholds for access.

Private Banking and Wealth Management | First National Bank - FNB provides personalized private banking and wealth management services, including customized checking, savings, mortgages, and loans, all aimed at helping clients achieve financial success and legacy planning.

Private Banking Services - Wells Fargo - Wells Fargo's Private Bank delivers tailored cash management, credit, and lending solutions--such as premium deposit accounts, foreign exchange, and specialized financing--to meet the complex needs of affluent clients.

dowidth.com

dowidth.com