Behavioral biometrics analyzes unique patterns such as typing rhythm, mouse movements, and gait to enhance security in banking transactions, providing continuous authentication without interrupting user experience. Iris scanning captures the intricate patterns of the colored ring around the eye's pupil, offering highly accurate and quick identity verification widely used in secure banking access. Discover how these cutting-edge biometric technologies are transforming fraud prevention and user authentication in modern banking.

Why it is important

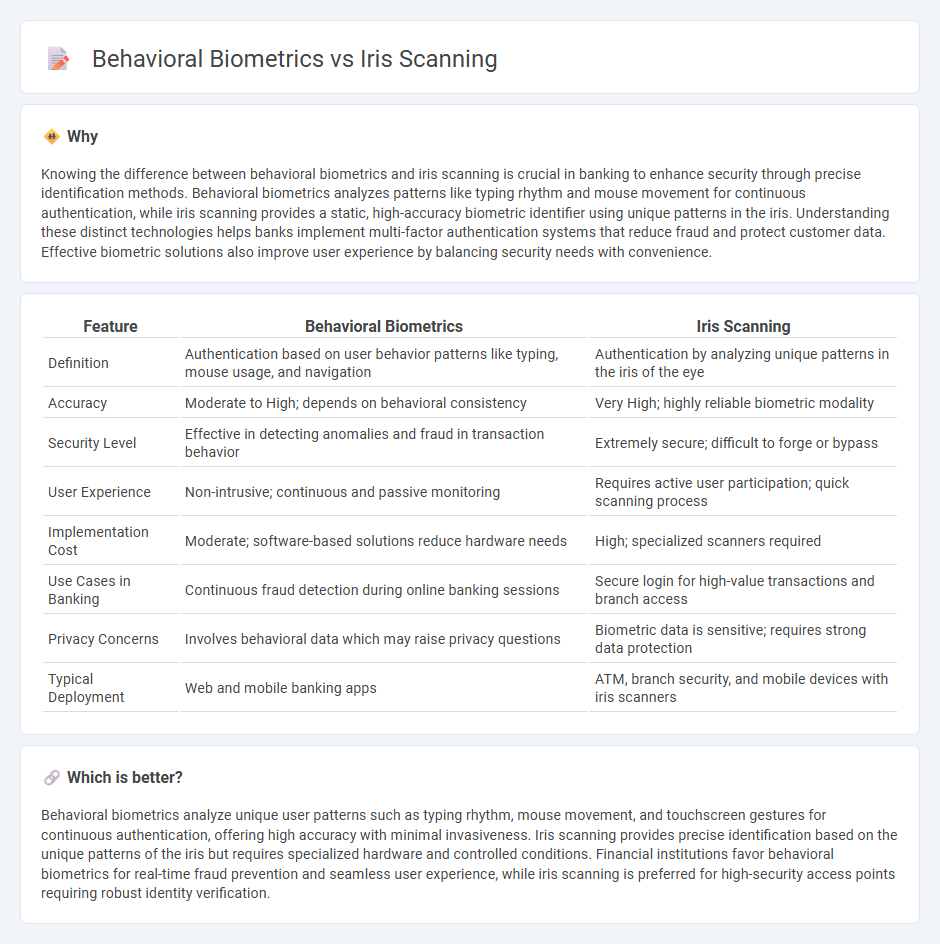

Knowing the difference between behavioral biometrics and iris scanning is crucial in banking to enhance security through precise identification methods. Behavioral biometrics analyzes patterns like typing rhythm and mouse movement for continuous authentication, while iris scanning provides a static, high-accuracy biometric identifier using unique patterns in the iris. Understanding these distinct technologies helps banks implement multi-factor authentication systems that reduce fraud and protect customer data. Effective biometric solutions also improve user experience by balancing security needs with convenience.

Comparison Table

| Feature | Behavioral Biometrics | Iris Scanning |

|---|---|---|

| Definition | Authentication based on user behavior patterns like typing, mouse usage, and navigation | Authentication by analyzing unique patterns in the iris of the eye |

| Accuracy | Moderate to High; depends on behavioral consistency | Very High; highly reliable biometric modality |

| Security Level | Effective in detecting anomalies and fraud in transaction behavior | Extremely secure; difficult to forge or bypass |

| User Experience | Non-intrusive; continuous and passive monitoring | Requires active user participation; quick scanning process |

| Implementation Cost | Moderate; software-based solutions reduce hardware needs | High; specialized scanners required |

| Use Cases in Banking | Continuous fraud detection during online banking sessions | Secure login for high-value transactions and branch access |

| Privacy Concerns | Involves behavioral data which may raise privacy questions | Biometric data is sensitive; requires strong data protection |

| Typical Deployment | Web and mobile banking apps | ATM, branch security, and mobile devices with iris scanners |

Which is better?

Behavioral biometrics analyze unique user patterns such as typing rhythm, mouse movement, and touchscreen gestures for continuous authentication, offering high accuracy with minimal invasiveness. Iris scanning provides precise identification based on the unique patterns of the iris but requires specialized hardware and controlled conditions. Financial institutions favor behavioral biometrics for real-time fraud prevention and seamless user experience, while iris scanning is preferred for high-security access points requiring robust identity verification.

Connection

Behavioral biometrics and iris scanning both enhance banking security by providing unique, non-replicable authentication methods. Behavioral biometrics analyze users' patterns such as typing rhythm and mouse movement, while iris scanning captures intricate patterns of the eye to verify identity. Integrating these technologies reduces fraud risk and strengthens multi-factor authentication in digital banking platforms.

Key Terms

Authentication

Iris scanning offers precise identification by analyzing unique patterns in the colored ring surrounding the pupil, ensuring high accuracy for authentication in secure environments. Behavioral biometrics relies on patterns like keystroke dynamics, gait, and voice recognition to authenticate users based on their unique interactions, providing continuous and non-intrusive verification. Discover how these advanced authentication methods enhance security and user experience.

Biometric identification

Iris scanning provides highly accurate biometric identification by analyzing unique patterns in the colored ring of the eye, offering fast and reliable authentication even in low-light conditions. Behavioral biometrics, on the other hand, identify individuals based on patterns in their actions such as typing rhythm, gait, or touchscreen interaction, which evolve over time and are difficult to replicate. Explore more about how these biometric technologies shape advanced security systems and user verification methods.

Fraud prevention

Iris scanning offers high accuracy in identity verification by analyzing unique patterns in the colored ring of the eye, making it effective for preventing fraud in secure environments. Behavioral biometrics monitors patterns such as keystroke dynamics, mouse movements, and touchscreen interactions to detect anomalies indicative of fraudulent activity in real-time. Explore further to understand how integrating these biometrics enhances fraud prevention strategies.

Source and External Links

Iris Recognition Software - Biometric Authentication - Iris recognition is a biometric identification method that uses near-infrared cameras to capture high-quality images of the iris, followed by quality checks, image compression, and template creation for authentication.

Iris Recognition Technology - Innovatrics - How it Works - Iris recognition identifies individuals by analyzing unique patterns in the colored ring around the pupil, converting these features into a digital template for secure and accurate identity verification.

Iris Recognition - The technology uses high-quality digital cameras, often with infrared light, to capture iris images, which are then analyzed using 2D Gabor wavelets to generate unique IrisCodes(r) for identification.

dowidth.com

dowidth.com