Instant payments enable real-time fund transfers, offering immediate access and improved cash flow management for both individuals and businesses. Scheduled payments allow users to plan and automate transactions on specific future dates, ensuring timely bill payments and financial organization. Discover how choosing between instant and scheduled payments can optimize your banking experience.

Why it is important

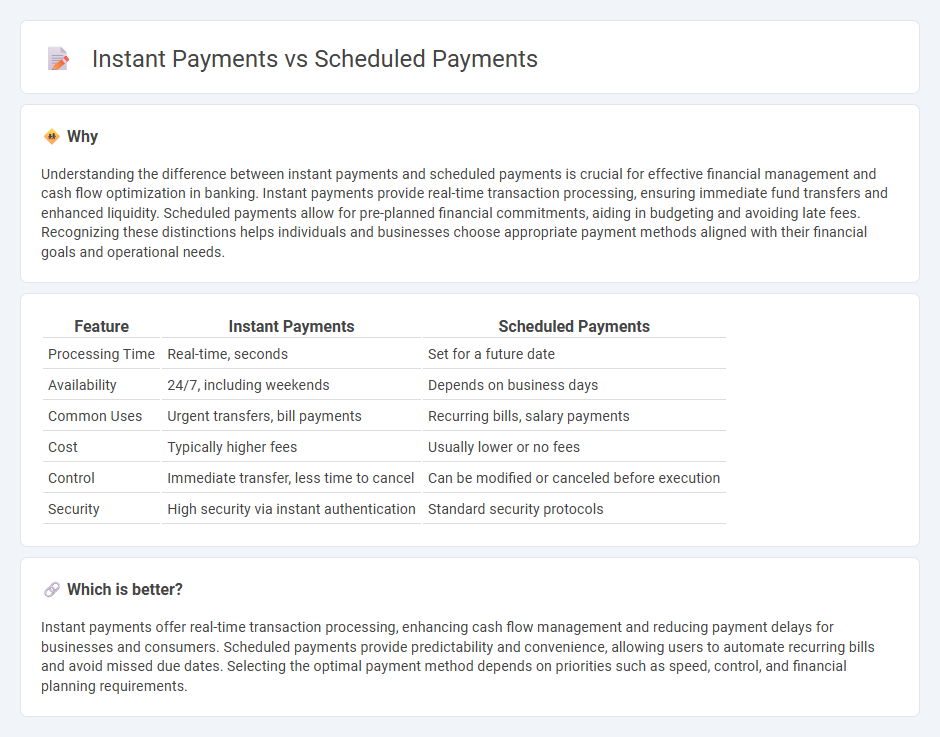

Understanding the difference between instant payments and scheduled payments is crucial for effective financial management and cash flow optimization in banking. Instant payments provide real-time transaction processing, ensuring immediate fund transfers and enhanced liquidity. Scheduled payments allow for pre-planned financial commitments, aiding in budgeting and avoiding late fees. Recognizing these distinctions helps individuals and businesses choose appropriate payment methods aligned with their financial goals and operational needs.

Comparison Table

| Feature | Instant Payments | Scheduled Payments |

|---|---|---|

| Processing Time | Real-time, seconds | Set for a future date |

| Availability | 24/7, including weekends | Depends on business days |

| Common Uses | Urgent transfers, bill payments | Recurring bills, salary payments |

| Cost | Typically higher fees | Usually lower or no fees |

| Control | Immediate transfer, less time to cancel | Can be modified or canceled before execution |

| Security | High security via instant authentication | Standard security protocols |

Which is better?

Instant payments offer real-time transaction processing, enhancing cash flow management and reducing payment delays for businesses and consumers. Scheduled payments provide predictability and convenience, allowing users to automate recurring bills and avoid missed due dates. Selecting the optimal payment method depends on priorities such as speed, control, and financial planning requirements.

Connection

Instant payments and scheduled payments are interconnected by enhancing transaction flexibility and timing control for customers. Instant payments enable immediate fund transfers, while scheduled payments automate future transfers at predetermined dates, ensuring timely bill settlements and cash flow management. Both payment types leverage real-time processing systems and digital banking platforms to improve financial efficiency and user experience.

Key Terms

Processing Time

Scheduled payments process transactions at predetermined times, often resulting in delays of hours or even days depending on banking hours and batch processing schedules. Instant payments complete transactions within seconds, offering real-time fund transfers crucial for time-sensitive financial activities. Explore the benefits and limitations of each payment method to choose the best fit for your financial needs.

Settlement Method

Scheduled payments settle at predetermined times, often through batch processing systems like Automated Clearing House (ACH), resulting in delayed fund availability. Instant payments utilize real-time settlement methods such as RTP (Real-Time Payments) or Faster Payments Service (FPS), ensuring immediate fund transfer and instant liquidity. Explore more to understand how settlement methods impact transaction efficiency and cash flow.

Fees

Scheduled payments typically incur lower fees due to batch processing and reduced operational costs, making them cost-effective for recurring transactions or large volumes. Instant payments, while offering immediate fund transfers and enhanced convenience, often come with higher fees to compensate for real-time processing and increased infrastructure demands. Explore the detailed fee structures and cost benefits of scheduled versus instant payments to optimize your payment strategies.

Source and External Links

Scheduled Payments: Legal Client Payment Solutions - Scheduled payments are prearranged transactions allowing businesses to maximize cash flow by automatically charging clients on a set schedule, which can be one-time or recurring, and payments are securely stored and updated to ensure timely collection without manual intervention.

Scheduled Payments - 3 Best Ways To Setup or Cancel - Scheduled payments are automatic debits from a payer's account on specific agreed dates and amounts, allowing bills or loans to be paid on time without having to manually initiate payment each time, with setup available through service provider websites or bank accounts using systems like ACH.

Scheduled Payments - Scheduled payments let you set up client charges in advance right from a secure portal with flexible frequency, enabling automatic recurring revenue collection with real-time tracking and automatic updates of payment details to avoid missed payments.

dowidth.com

dowidth.com