Instant payments enable real-time transfers, ensuring funds are available within seconds, while direct debits authorize scheduled, recurring withdrawals from a payer's account for consistent bill payments. Instant payments enhance liquidity and reduce settlement risks for businesses and consumers alike, whereas direct debits offer convenience and automation for managing regular expenses. Discover how these payment methods impact cash flow management and financial planning.

Why it is important

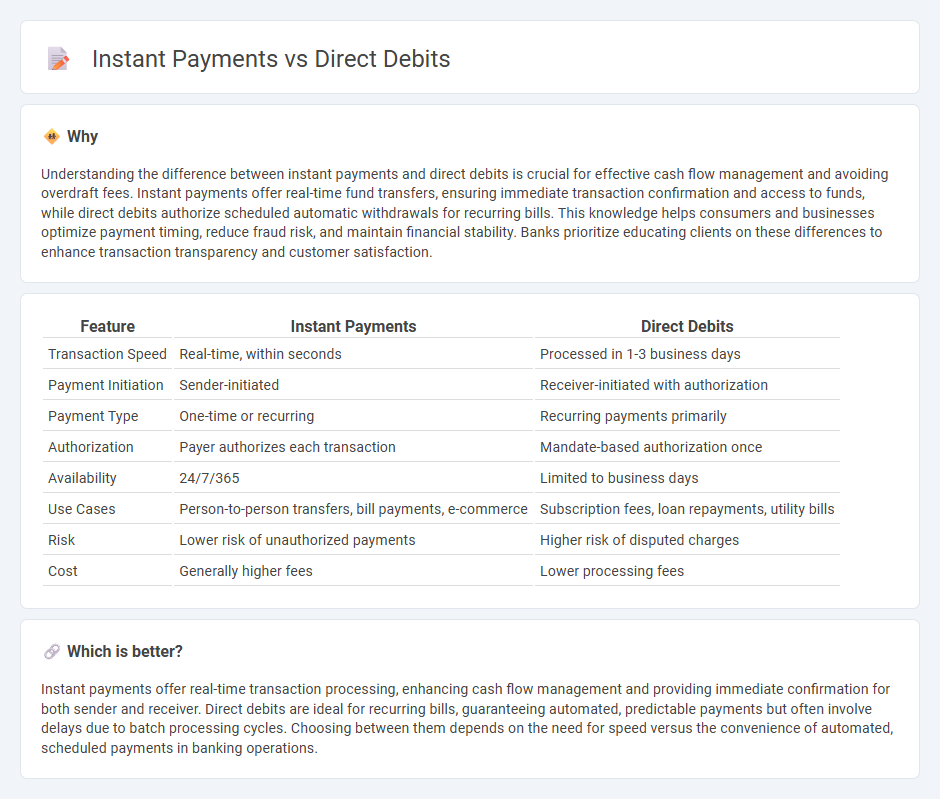

Understanding the difference between instant payments and direct debits is crucial for effective cash flow management and avoiding overdraft fees. Instant payments offer real-time fund transfers, ensuring immediate transaction confirmation and access to funds, while direct debits authorize scheduled automatic withdrawals for recurring bills. This knowledge helps consumers and businesses optimize payment timing, reduce fraud risk, and maintain financial stability. Banks prioritize educating clients on these differences to enhance transaction transparency and customer satisfaction.

Comparison Table

| Feature | Instant Payments | Direct Debits |

|---|---|---|

| Transaction Speed | Real-time, within seconds | Processed in 1-3 business days |

| Payment Initiation | Sender-initiated | Receiver-initiated with authorization |

| Payment Type | One-time or recurring | Recurring payments primarily |

| Authorization | Payer authorizes each transaction | Mandate-based authorization once |

| Availability | 24/7/365 | Limited to business days |

| Use Cases | Person-to-person transfers, bill payments, e-commerce | Subscription fees, loan repayments, utility bills |

| Risk | Lower risk of unauthorized payments | Higher risk of disputed charges |

| Cost | Generally higher fees | Lower processing fees |

Which is better?

Instant payments offer real-time transaction processing, enhancing cash flow management and providing immediate confirmation for both sender and receiver. Direct debits are ideal for recurring bills, guaranteeing automated, predictable payments but often involve delays due to batch processing cycles. Choosing between them depends on the need for speed versus the convenience of automated, scheduled payments in banking operations.

Connection

Instant payments and direct debits are connected through seamless transaction processing that enhances cash flow management for businesses and consumers. Direct debits enable automated, scheduled withdrawals, while instant payments provide real-time fund transfers, improving efficiency and reducing settlement risks. Integration of these mechanisms supports quicker reconciliation and financial transparency within banking systems.

Key Terms

Authorization

Direct debits require prior authorization through a signed mandate, giving payees permission to withdraw funds from the payer's bank account automatically on due dates. Instant payments use real-time authorization via secure authentication methods like OTP or biometric verification, ensuring immediate and consented fund transfers within seconds. Explore how these authorization mechanisms impact security and convenience in modern payment systems.

Settlement Speed

Direct debits typically settle within one to two business days, offering a reliable but slower payment method suitable for recurring transactions. Instant payments process and settle funds within seconds, providing immediate confirmation and enhanced cash flow management. Explore our detailed comparison to understand which settlement speed aligns with your business needs.

Reversal Handling

Direct debits allow for structured payment reversal windows, typically offering consumers a 8-week period to dispute authorized transactions under schemes like SEPA. Instant payments provide near-immediate settlement and finality, making reversal processes more complex and often requiring bilateral agreements or fraud detection mechanisms to handle exceptions efficiently. Explore the nuances of payment reversal handling to optimize transaction security and customer satisfaction.

Source and External Links

Direct Debit: How It Works, Key Benefits & More - Invoiced - Direct debit is a payment method where the buyer authorizes the seller to automatically collect recurring payments directly from the buyer's bank account on agreed terms, often processed via ACH in the US or SEPA in the EU.

Direct Debit Explained: How To Set It Up for Customers - Shopify - Direct debit automates recurring payments by pulling funds straight from customers' bank accounts, reducing manual errors and enabling easy billing for subscriptions, memberships, and invoices through the ACH network.

What is a direct debit and how does it work? - Stripe - Direct debit is a secure, cashless method allowing businesses to collect payments automatically with customer consent via a mandate, providing improved cash flow and efficiency especially for recurring payments like subscriptions or memberships.

dowidth.com

dowidth.com