Sustainable banking focuses on financing projects that promote environmental protection, social welfare, and ethical governance while minimizing ecological footprints. Offshore banking involves maintaining bank accounts in foreign countries to benefit from tax advantages, privacy, and flexible regulations. Explore the key differences and benefits of sustainable banking versus offshore banking to make informed financial decisions.

Why it is important

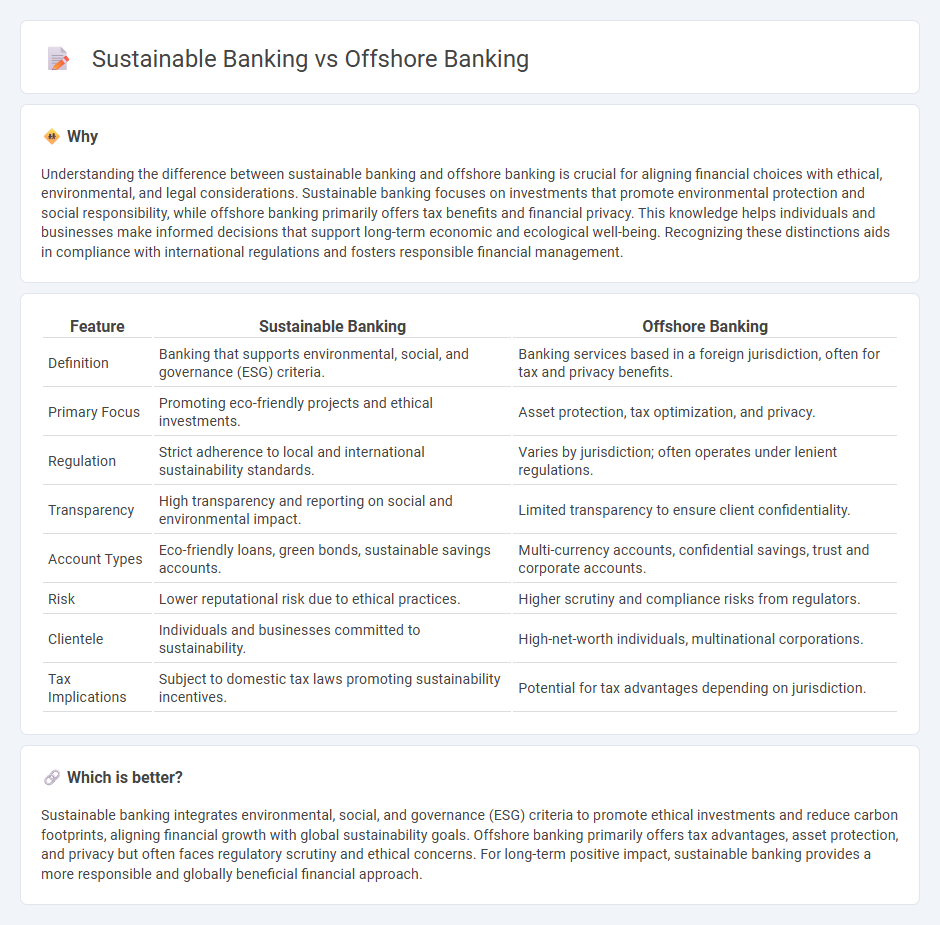

Understanding the difference between sustainable banking and offshore banking is crucial for aligning financial choices with ethical, environmental, and legal considerations. Sustainable banking focuses on investments that promote environmental protection and social responsibility, while offshore banking primarily offers tax benefits and financial privacy. This knowledge helps individuals and businesses make informed decisions that support long-term economic and ecological well-being. Recognizing these distinctions aids in compliance with international regulations and fosters responsible financial management.

Comparison Table

| Feature | Sustainable Banking | Offshore Banking |

|---|---|---|

| Definition | Banking that supports environmental, social, and governance (ESG) criteria. | Banking services based in a foreign jurisdiction, often for tax and privacy benefits. |

| Primary Focus | Promoting eco-friendly projects and ethical investments. | Asset protection, tax optimization, and privacy. |

| Regulation | Strict adherence to local and international sustainability standards. | Varies by jurisdiction; often operates under lenient regulations. |

| Transparency | High transparency and reporting on social and environmental impact. | Limited transparency to ensure client confidentiality. |

| Account Types | Eco-friendly loans, green bonds, sustainable savings accounts. | Multi-currency accounts, confidential savings, trust and corporate accounts. |

| Risk | Lower reputational risk due to ethical practices. | Higher scrutiny and compliance risks from regulators. |

| Clientele | Individuals and businesses committed to sustainability. | High-net-worth individuals, multinational corporations. |

| Tax Implications | Subject to domestic tax laws promoting sustainability incentives. | Potential for tax advantages depending on jurisdiction. |

Which is better?

Sustainable banking integrates environmental, social, and governance (ESG) criteria to promote ethical investments and reduce carbon footprints, aligning financial growth with global sustainability goals. Offshore banking primarily offers tax advantages, asset protection, and privacy but often faces regulatory scrutiny and ethical concerns. For long-term positive impact, sustainable banking provides a more responsible and globally beneficial financial approach.

Connection

Sustainable banking integrates environmental, social, and governance (ESG) criteria into financial services, promoting ethical investments and reducing ecological impact. Offshore banking offers tax efficiency and asset protection, yet incorporating sustainable banking principles ensures that offshore investments support responsible business practices and environmental stewardship. This connection enables global financial flows to foster sustainability while maintaining confidentiality and asset diversification benefits.

Key Terms

Tax Haven

Offshore banking often involves placing assets in tax haven jurisdictions like the Cayman Islands or Bermuda to benefit from low taxes and financial secrecy, which can raise concerns regarding transparency and ethical finance. Sustainable banking, by contrast, emphasizes environmental responsibility, social governance, and transparency, avoiding tax havens to promote ethical investment and corporate accountability. Discover more about the impact of tax havens on financial practices and sustainable banking principles.

Green Loans

Offshore banking provides access to tax advantages and asset protection but often lacks transparency and sustainability initiatives. Sustainable banking emphasizes environmental responsibility by offering green loans that fund renewable energy projects, energy-efficient upgrades, and eco-friendly business practices. Discover how green loans are transforming finance by supporting a low-carbon economy and driving corporate environmental accountability.

Regulatory Compliance

Offshore banking often faces intense scrutiny due to complex regulatory compliance requirements aimed at preventing tax evasion and money laundering, with jurisdictions enforcing strict anti-money laundering (AML) and know-your-customer (KYC) protocols. Sustainable banking prioritizes adherence to environmental, social, and governance (ESG) standards, aligning compliance frameworks with global sustainability goals and reporting mandates such as the Task Force on Climate-related Financial Disclosures (TCFD). Explore the evolving regulatory landscape shaping offshore and sustainable banking practices.

Source and External Links

Offshore bank - Wikipedia - An offshore bank is operated under an international banking license, offering strong privacy, low or no taxation, and protection from political or financial instability, often located in tax havens or financial centers like Switzerland or Luxembourg.

Pros and Cons of Offshore Bank Accounts - Alper Law - Offshore bank accounts provide asset protection since U.S. courts cannot easily seize funds held abroad, and when combined with offshore trusts, they offer robust legal protection while requiring full compliance with tax laws.

3 Key Benefits of Offshore Banking - Dominion - Key advantages of offshore banking include enhanced financial privacy, confidentiality via strict secrecy laws, and strategic benefits for individuals and companies seeking discretion and protection in financial dealings.

dowidth.com

dowidth.com