Crypto custody involves safeguarding digital assets through specialized wallets and secure protocols designed to prevent unauthorized access and theft. Clearinghouse custody pertains to traditional financial institutions managing the settlement and safekeeping of assets to ensure transaction finality and reduce counterparty risk. Explore the distinct roles and security measures of crypto custody and clearinghouse custody to understand their impact on modern banking.

Why it is important

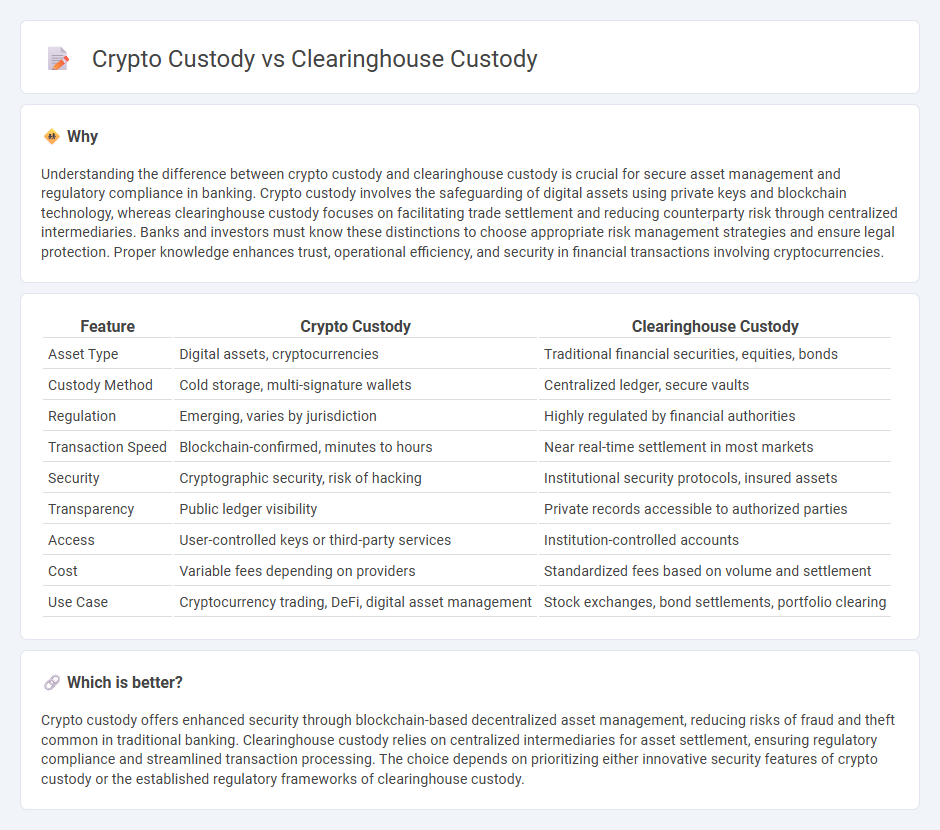

Understanding the difference between crypto custody and clearinghouse custody is crucial for secure asset management and regulatory compliance in banking. Crypto custody involves the safeguarding of digital assets using private keys and blockchain technology, whereas clearinghouse custody focuses on facilitating trade settlement and reducing counterparty risk through centralized intermediaries. Banks and investors must know these distinctions to choose appropriate risk management strategies and ensure legal protection. Proper knowledge enhances trust, operational efficiency, and security in financial transactions involving cryptocurrencies.

Comparison Table

| Feature | Crypto Custody | Clearinghouse Custody |

|---|---|---|

| Asset Type | Digital assets, cryptocurrencies | Traditional financial securities, equities, bonds |

| Custody Method | Cold storage, multi-signature wallets | Centralized ledger, secure vaults |

| Regulation | Emerging, varies by jurisdiction | Highly regulated by financial authorities |

| Transaction Speed | Blockchain-confirmed, minutes to hours | Near real-time settlement in most markets |

| Security | Cryptographic security, risk of hacking | Institutional security protocols, insured assets |

| Transparency | Public ledger visibility | Private records accessible to authorized parties |

| Access | User-controlled keys or third-party services | Institution-controlled accounts |

| Cost | Variable fees depending on providers | Standardized fees based on volume and settlement |

| Use Case | Cryptocurrency trading, DeFi, digital asset management | Stock exchanges, bond settlements, portfolio clearing |

Which is better?

Crypto custody offers enhanced security through blockchain-based decentralized asset management, reducing risks of fraud and theft common in traditional banking. Clearinghouse custody relies on centralized intermediaries for asset settlement, ensuring regulatory compliance and streamlined transaction processing. The choice depends on prioritizing either innovative security features of crypto custody or the established regulatory frameworks of clearinghouse custody.

Connection

Crypto custody and clearinghouse custody intersect through their roles in securing and facilitating asset transactions within financial markets. Crypto custody provides secure storage solutions for digital assets using advanced encryption and blockchain technology, while clearinghouse custody acts as an intermediary ensuring the proper settlement and transfer of traditional and digital assets between parties. This connection enhances trust, reduces counterparty risk, and streamlines transaction processes in integrated financial ecosystems.

Key Terms

Centralized Settlement

Centralized settlement in clearinghouse custody involves a trusted intermediary managing the transfer and holding of assets to ensure trade finality and reduce counterparty risk. Crypto custody in centralized settlement leverages digital wallets and blockchain technology but still relies on third-party custodians to safeguard private keys and facilitate asset transfers. Explore how these custody models impact efficiency and security in modern financial markets.

Asset Safekeeping

Clearinghouse custody involves centralized institutions holding and managing financial assets, ensuring regulatory compliance and streamlined settlement processes, whereas crypto custody relies on advanced cryptographic methods and blockchain technology to secure digital assets through private keys. Traditional asset safekeeping in clearinghouse custody prioritizes trust and oversight, while crypto custody emphasizes decentralized control and resistance to cyber threats. Explore the nuanced differences and security implications of both custody models to understand their impact on asset protection.

Private Key Management

Clearinghouse custody involves centralized management of assets with institutional-grade security protocols, often relying on third-party custodians to safeguard private keys, which can create single points of failure. Crypto custody emphasizes decentralized control, where private key management is handled through hardware wallets, multi-signature schemes, or distributed key generation to enhance security and reduce risk of unauthorized access. Explore detailed comparisons to understand which private key management model best suits your digital asset strategy.

Source and External Links

Custody Services Provided by Banks are Important to the ... - Bank-chartered custodians provide safekeeping and administrative services for client assets, facilitating access to and participation in global financial markets, while also ensuring investor protection through regulatory compliance.

Clearinghouses and Custodians: Financial Intermediaries 101 - Clearinghouses act as intermediaries in securities transactions, managing and guaranteeing the transfer of assets between buyers and sellers, while custodians physically hold and safeguard investors' assets for security.

Drug & Alcohol Clearinghouse - Department of Transportation - This Clearinghouse is a centralized database for employers to report and check drug and alcohol violations among commercial drivers, supporting compliance with safety-sensitive regulations through mandatory queries and reporting.

dowidth.com

dowidth.com