Neo brokerages offer a digital-first platform focusing on low-cost, self-directed investment opportunities, leveraging advanced technology to provide real-time trading and streamlined user interfaces. Retail banks provide comprehensive financial services including savings accounts, loans, and in-branch customer support, catering to a broader range of personal and business banking needs. Explore more about how these financial institutions differ in service models and customer benefits.

Why it is important

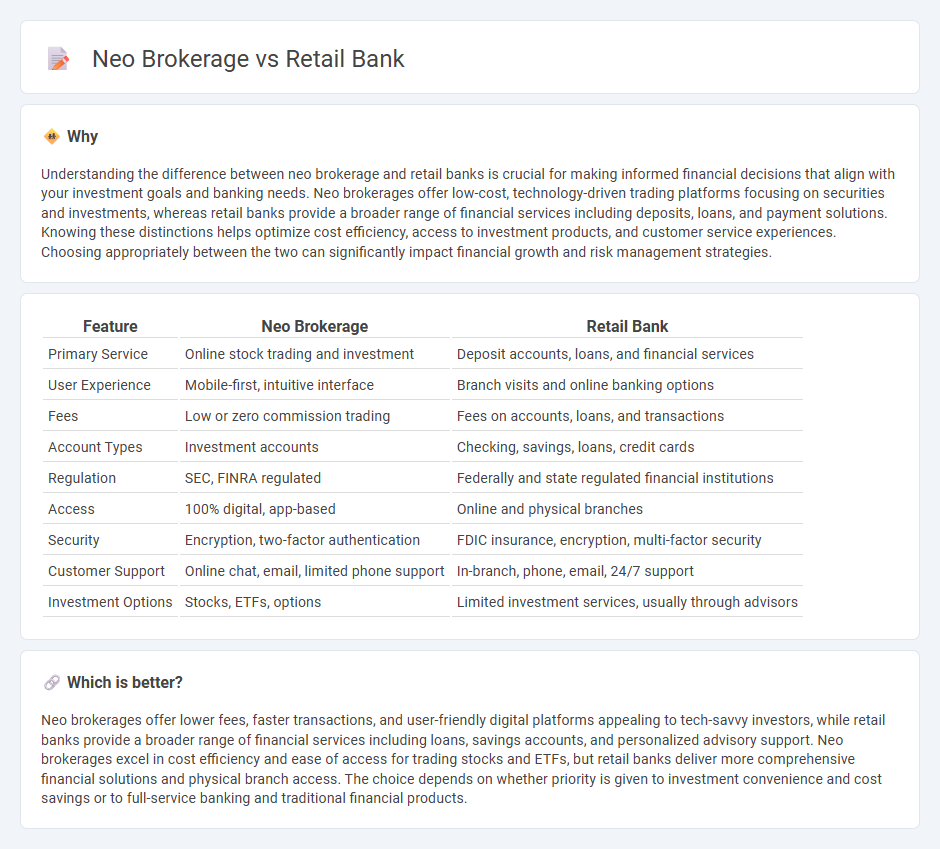

Understanding the difference between neo brokerage and retail banks is crucial for making informed financial decisions that align with your investment goals and banking needs. Neo brokerages offer low-cost, technology-driven trading platforms focusing on securities and investments, whereas retail banks provide a broader range of financial services including deposits, loans, and payment solutions. Knowing these distinctions helps optimize cost efficiency, access to investment products, and customer service experiences. Choosing appropriately between the two can significantly impact financial growth and risk management strategies.

Comparison Table

| Feature | Neo Brokerage | Retail Bank |

|---|---|---|

| Primary Service | Online stock trading and investment | Deposit accounts, loans, and financial services |

| User Experience | Mobile-first, intuitive interface | Branch visits and online banking options |

| Fees | Low or zero commission trading | Fees on accounts, loans, and transactions |

| Account Types | Investment accounts | Checking, savings, loans, credit cards |

| Regulation | SEC, FINRA regulated | Federally and state regulated financial institutions |

| Access | 100% digital, app-based | Online and physical branches |

| Security | Encryption, two-factor authentication | FDIC insurance, encryption, multi-factor security |

| Customer Support | Online chat, email, limited phone support | In-branch, phone, email, 24/7 support |

| Investment Options | Stocks, ETFs, options | Limited investment services, usually through advisors |

Which is better?

Neo brokerages offer lower fees, faster transactions, and user-friendly digital platforms appealing to tech-savvy investors, while retail banks provide a broader range of financial services including loans, savings accounts, and personalized advisory support. Neo brokerages excel in cost efficiency and ease of access for trading stocks and ETFs, but retail banks deliver more comprehensive financial solutions and physical branch access. The choice depends on whether priority is given to investment convenience and cost savings or to full-service banking and traditional financial products.

Connection

Neo brokerages and retail banks are connected through their shared focus on enhancing customer financial services by integrating digital platforms for seamless investment and banking experiences. Retail banks increasingly collaborate with neo brokerages to offer diversified investment products directly within banking apps, facilitating real-time trading and portfolio management. This convergence drives innovation in financial technology, improving accessibility, reducing costs, and expanding personalized banking solutions for a broader consumer base.

Key Terms

Branch Network vs. Digital Platform

Retail banks leverage extensive branch networks, providing customers with in-person services and personalized financial advice. Neo brokerages operate exclusively on digital platforms, offering low-cost trades and real-time market access without physical locations. Explore the evolving landscape of financial services to understand which model suits your investment needs best.

Traditional Accounts vs. Investment Products

Traditional retail banks primarily offer standard savings and checking accounts, along with mortgage and personal loan services, focusing on secure, accessible financial management. Neo brokerages specialize in investment products such as stocks, ETFs, and cryptocurrencies, providing low-cost, user-friendly digital platforms tailored for active investors. Explore our detailed comparison to understand how these financial institutions align with your personal banking and investment goals.

Deposit Taking vs. Commission-Based Model

Retail banks primarily generate revenue through deposit-taking activities, offering savings and checking accounts with interest payments and maintaining customer deposits to fund loans and investments. Neo brokerages rely on a commission-based model, earning income from transaction fees, subscription services, and premium features within digital trading platforms. Explore the differences in financial structures and customer benefits between retail banks and neo brokerages to understand their unique market positions.

Source and External Links

Retail banking - Retail banking, also known as consumer or personal banking, provides financial services directly to the general public rather than companies.

All About Retail Banking: What It Is and How It Works - Retail banking offers basic financial services like checking and savings accounts, loans, and credit cards to individual consumers, distinguishing itself from corporate banking by focusing on personal financial needs.

Retail vs. Commercial Banking: What's the Difference? - Retail banks serve individuals and small businesses by providing products such as mortgages, debit cards, and personal loans, playing a key role in financial inclusion and economic growth at local and national levels.

dowidth.com

dowidth.com