Wealthtech platforms leverage advanced algorithms and digital tools to offer personalized investment management and financial planning services, making wealth management more accessible and cost-effective. Private banking technology, on the other hand, focuses on enhancing personalized client interactions, high-touch service, and secure transactions for ultra-high-net-worth individuals through sophisticated CRM and cybersecurity systems. Explore how the integration of these technologies is transforming the future of financial services.

Why it is important

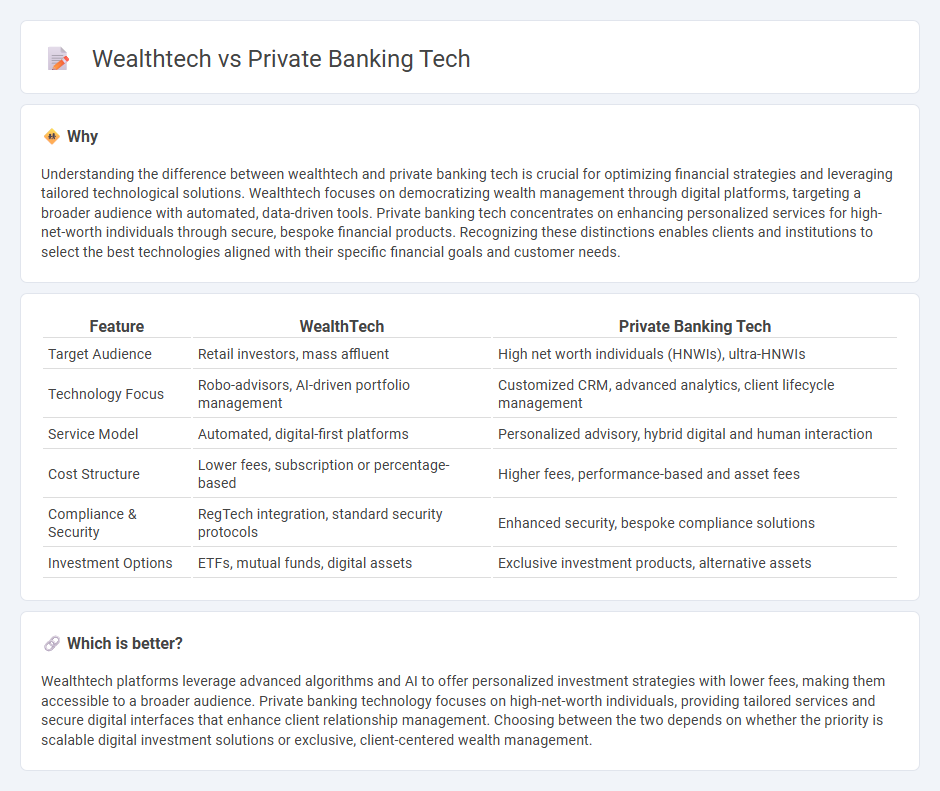

Understanding the difference between wealthtech and private banking tech is crucial for optimizing financial strategies and leveraging tailored technological solutions. Wealthtech focuses on democratizing wealth management through digital platforms, targeting a broader audience with automated, data-driven tools. Private banking tech concentrates on enhancing personalized services for high-net-worth individuals through secure, bespoke financial products. Recognizing these distinctions enables clients and institutions to select the best technologies aligned with their specific financial goals and customer needs.

Comparison Table

| Feature | WealthTech | Private Banking Tech |

|---|---|---|

| Target Audience | Retail investors, mass affluent | High net worth individuals (HNWIs), ultra-HNWIs |

| Technology Focus | Robo-advisors, AI-driven portfolio management | Customized CRM, advanced analytics, client lifecycle management |

| Service Model | Automated, digital-first platforms | Personalized advisory, hybrid digital and human interaction |

| Cost Structure | Lower fees, subscription or percentage-based | Higher fees, performance-based and asset fees |

| Compliance & Security | RegTech integration, standard security protocols | Enhanced security, bespoke compliance solutions |

| Investment Options | ETFs, mutual funds, digital assets | Exclusive investment products, alternative assets |

Which is better?

Wealthtech platforms leverage advanced algorithms and AI to offer personalized investment strategies with lower fees, making them accessible to a broader audience. Private banking technology focuses on high-net-worth individuals, providing tailored services and secure digital interfaces that enhance client relationship management. Choosing between the two depends on whether the priority is scalable digital investment solutions or exclusive, client-centered wealth management.

Connection

Wealthtech integrates advanced digital tools such as AI-driven portfolio management and robo-advisors, enhancing private banking services with personalized investment strategies and real-time data analytics. Private banking tech leverages these innovations to offer seamless, high-touch client experiences while optimizing operational efficiency and security through blockchain and biometric authentication. This synergy drives the evolution of tailored wealth management solutions that meet the demands of high-net-worth individuals in a digital-first banking landscape.

Key Terms

Personalization Algorithms

Private banking technology leverages advanced personalization algorithms to tailor financial products and services for ultra-high-net-worth clients, enhancing client experience through bespoke portfolio management and risk assessment. Wealthtech platforms utilize similar algorithms but focus on scalability and accessibility, offering automated investment advice and personalized financial planning for a broader client base. Explore how these personalization algorithms are transforming wealth management by balancing exclusivity and inclusivity.

Digital Onboarding

Private banking technology prioritizes personalized, high-touch digital onboarding processes tailored for ultra-high-net-worth clients, integrating robust KYC (Know Your Customer) protocols and compliance measures to ensure security and trust. Wealthtech platforms emphasize scalable, user-friendly digital onboarding solutions that leverage AI-driven identity verification and automated risk assessment, catering to a broader client base seeking efficiency and accessibility. Explore deeper insights into how digital onboarding innovations are transforming client acquisition in both private banking tech and wealthtech sectors.

Robo-Advisory

Private banking technology emphasizes personalized, high-touch services supported by sophisticated client management systems, while wealthtech broadly leverages automation and AI to democratize investment management. Robo-advisory platforms excel within wealthtech by providing algorithm-driven portfolio management, offering scalable and cost-effective solutions with real-time data analysis. Discover how these innovations are reshaping investment strategies and client experiences.

Source and External Links

How Does Private Banking Adapt to Technological Innovations? - Private banking uses AI, blockchain, online platforms, and enhanced cybersecurity to provide personalized experiences, automate workflows, improve investment strategies, and secure transactions while maintaining exclusivity.

What Are the Key Technologies Reshaping Private Banking Operations? - Key technologies such as artificial intelligence, machine learning, and cloud computing are transforming private banking operations by enabling data-driven insights, personalized advice, process automation, and enhanced customer experience.

How private banks can stay ahead with digital banking - Private banks leverage data analytics, AI, and digital platforms to optimize customer experience, personalize services, transform business models, and combine traditional high-touch approaches with digital convenience and security.

dowidth.com

dowidth.com