Alternative credit data, such as rent payments, utility bills, and mobile phone usage, provides banks with broader insights into a borrower's financial behavior beyond traditional credit reports. Insurance claim data offers valuable information on risk profiles and financial resilience by highlighting past incidents and claim histories. Explore how integrating these data sources can enhance credit risk assessment and lending decisions.

Why it is important

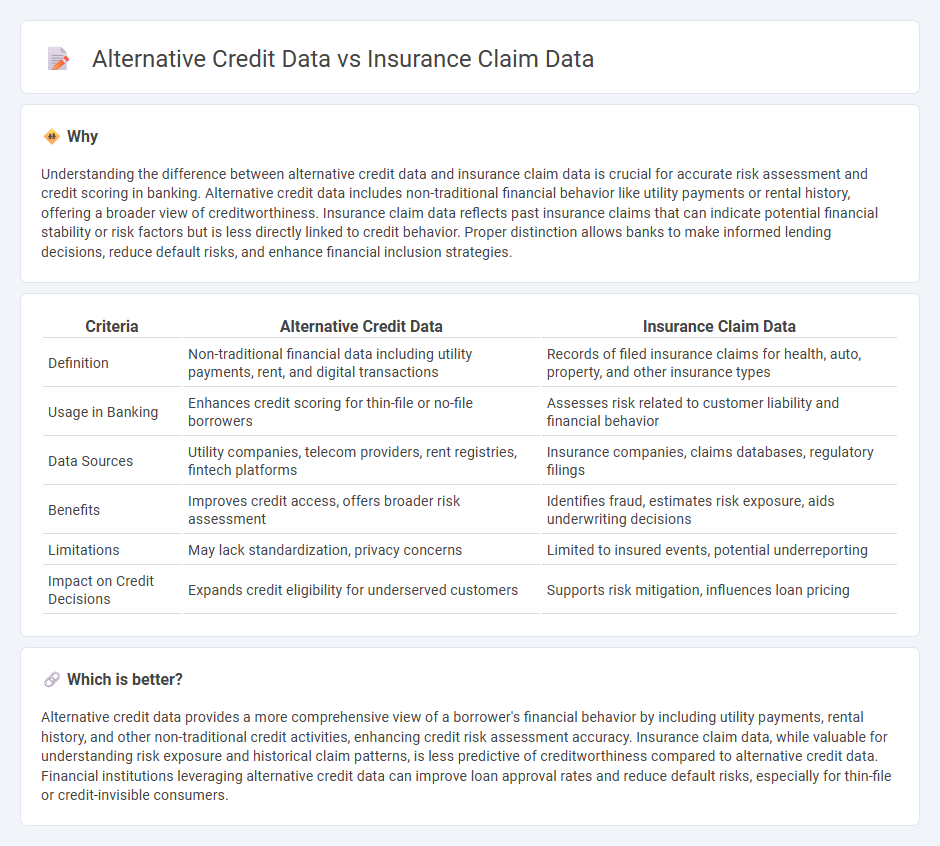

Understanding the difference between alternative credit data and insurance claim data is crucial for accurate risk assessment and credit scoring in banking. Alternative credit data includes non-traditional financial behavior like utility payments or rental history, offering a broader view of creditworthiness. Insurance claim data reflects past insurance claims that can indicate potential financial stability or risk factors but is less directly linked to credit behavior. Proper distinction allows banks to make informed lending decisions, reduce default risks, and enhance financial inclusion strategies.

Comparison Table

| Criteria | Alternative Credit Data | Insurance Claim Data |

|---|---|---|

| Definition | Non-traditional financial data including utility payments, rent, and digital transactions | Records of filed insurance claims for health, auto, property, and other insurance types |

| Usage in Banking | Enhances credit scoring for thin-file or no-file borrowers | Assesses risk related to customer liability and financial behavior |

| Data Sources | Utility companies, telecom providers, rent registries, fintech platforms | Insurance companies, claims databases, regulatory filings |

| Benefits | Improves credit access, offers broader risk assessment | Identifies fraud, estimates risk exposure, aids underwriting decisions |

| Limitations | May lack standardization, privacy concerns | Limited to insured events, potential underreporting |

| Impact on Credit Decisions | Expands credit eligibility for underserved customers | Supports risk mitigation, influences loan pricing |

Which is better?

Alternative credit data provides a more comprehensive view of a borrower's financial behavior by including utility payments, rental history, and other non-traditional credit activities, enhancing credit risk assessment accuracy. Insurance claim data, while valuable for understanding risk exposure and historical claim patterns, is less predictive of creditworthiness compared to alternative credit data. Financial institutions leveraging alternative credit data can improve loan approval rates and reduce default risks, especially for thin-file or credit-invisible consumers.

Connection

Alternative credit data, including utility payments and rental history, combined with insurance claim data provide a comprehensive risk profile for banks assessing loan applicants. Insurance claim records reveal patterns in risk behavior and financial responsibility, enhancing predictive models for creditworthiness beyond traditional credit scores. Integrating these data sources enables financial institutions to make more informed lending decisions, expanding credit access to underserved populations.

Key Terms

Risk Assessment

Insurance claim data provides detailed records of past incidents, helping insurers assess the likelihood of future claims and evaluate individual risk profiles more accurately. Alternative credit data, including utility payments and rental history, enhances risk assessment by offering a broader view of a person's financial behavior beyond traditional credit scores. Explore how integrating insurance claim and alternative credit data revolutionizes risk modeling and underwriting precision.

Underwriting

Insurance claim data provides historical insights into policyholder risk, enabling underwriters to assess potential future losses based on past claims frequency and severity. Alternative credit data, such as utility payments and rental history, enriches underwriting by offering a broader financial behavior profile for applicants with limited traditional credit histories. Explore how integrating these data sources can enhance underwriting accuracy and drive better risk management.

Predictive Modeling

Insurance claim data offers granular insights into past risk behaviors and loss patterns crucial for predictive modeling in underwriting accuracy. Alternative credit data, encompassing utility payments, rental history, and telecom records, enhances predictive models by providing broader behavioral trends, especially for thin-file or non-traditional borrowers. Explore how integrating these diverse data sources revolutionizes risk assessment and credit scoring precision.

Source and External Links

insurance_claims - Mendeley Data - A detailed dataset of individual insurance claim records including various claim features and a key fraud report indicator, sourced from multiple insurance providers, anonymized for privacy and rigorously assessed for fraud.

What is Claims Data and Its Advantages and Disadvantages? - Explains claims data types (open vs closed), their sources in healthcare, and their usefulness and limitations in capturing healthcare transactions and patient interactions with providers and insurers.

What to Expect with Claims Data - Provides insight into claims data submission, processing timing, and analytical applications such as cost analysis, utilization studies, chronic condition investigation, and quality of care assessment using claims information.

dowidth.com

dowidth.com