Alternative credit data includes non-traditional financial information such as utility payments, rental history, and employment records to assess creditworthiness beyond standard credit reports. Mobile phone payment data captures transaction histories, top-ups, and peer-to-peer transfers conducted via mobile wallets, offering real-time financial behavior insights. Explore how integrating these data sources enhances risk assessment and expands access to financial services.

Why it is important

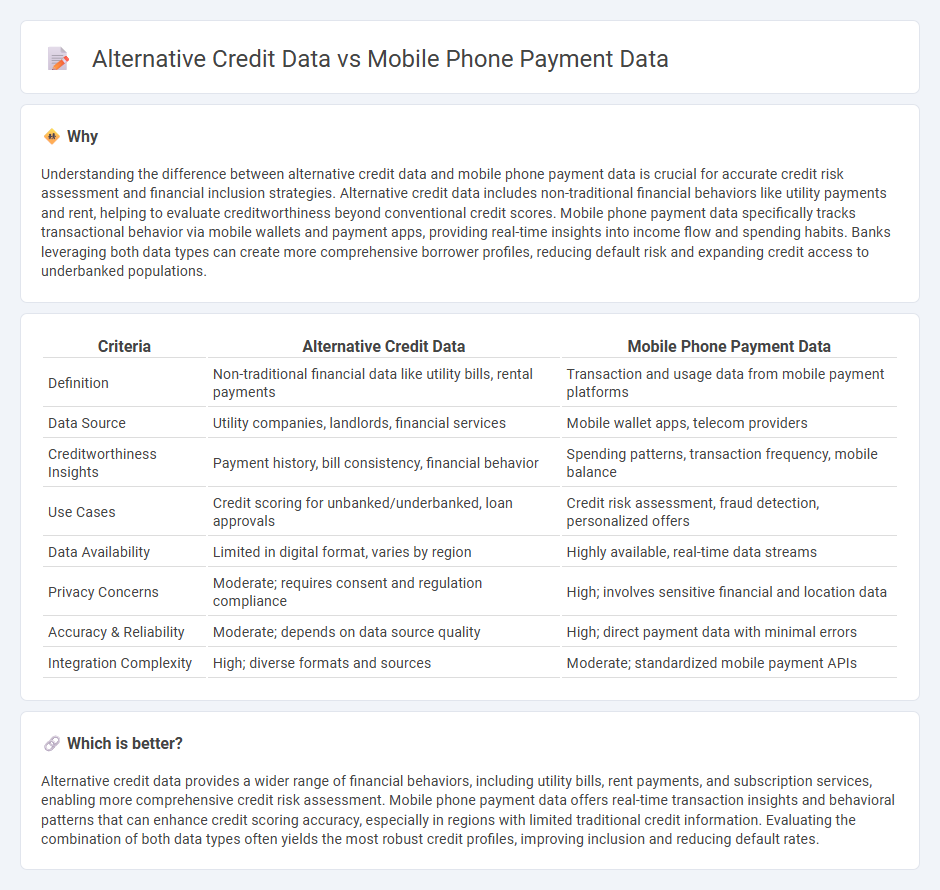

Understanding the difference between alternative credit data and mobile phone payment data is crucial for accurate credit risk assessment and financial inclusion strategies. Alternative credit data includes non-traditional financial behaviors like utility payments and rent, helping to evaluate creditworthiness beyond conventional credit scores. Mobile phone payment data specifically tracks transactional behavior via mobile wallets and payment apps, providing real-time insights into income flow and spending habits. Banks leveraging both data types can create more comprehensive borrower profiles, reducing default risk and expanding credit access to underbanked populations.

Comparison Table

| Criteria | Alternative Credit Data | Mobile Phone Payment Data |

|---|---|---|

| Definition | Non-traditional financial data like utility bills, rental payments | Transaction and usage data from mobile payment platforms |

| Data Source | Utility companies, landlords, financial services | Mobile wallet apps, telecom providers |

| Creditworthiness Insights | Payment history, bill consistency, financial behavior | Spending patterns, transaction frequency, mobile balance |

| Use Cases | Credit scoring for unbanked/underbanked, loan approvals | Credit risk assessment, fraud detection, personalized offers |

| Data Availability | Limited in digital format, varies by region | Highly available, real-time data streams |

| Privacy Concerns | Moderate; requires consent and regulation compliance | High; involves sensitive financial and location data |

| Accuracy & Reliability | Moderate; depends on data source quality | High; direct payment data with minimal errors |

| Integration Complexity | High; diverse formats and sources | Moderate; standardized mobile payment APIs |

Which is better?

Alternative credit data provides a wider range of financial behaviors, including utility bills, rent payments, and subscription services, enabling more comprehensive credit risk assessment. Mobile phone payment data offers real-time transaction insights and behavioral patterns that can enhance credit scoring accuracy, especially in regions with limited traditional credit information. Evaluating the combination of both data types often yields the most robust credit profiles, improving inclusion and reducing default rates.

Connection

Alternative credit data and mobile phone payment data are interconnected through their ability to enhance credit scoring models by providing real-time, non-traditional financial behaviors. Mobile phone payment data reveals transaction patterns, spending habits, and bill payment punctuality, which serve as valuable inputs for alternative credit assessments. This integration improves financial inclusion by allowing lenders to evaluate creditworthiness beyond conventional credit histories.

Key Terms

Transaction History

Mobile phone payment data offers detailed transaction history showcasing payment patterns, frequency, and consistency, which can be more current and dynamic compared to alternative credit data sourced from utilities or rental payments. This transaction history provides granular insights into consumer behavior, enhancing credit risk assessment beyond traditional credit bureau records. Explore how leveraging mobile payment transaction history can revolutionize credit scoring models.

Geolocation Data

Geolocation data extracted from mobile phone payments offers granular insights into consumer behavior by tracking precise locations and movement patterns, enhancing credit risk assessment beyond traditional financial metrics. Alternative credit data, including geolocation, improves the accuracy of credit scoring models by capturing real-time, location-based activity that reflects spending habits and lifestyle stability. Explore how integrating geolocation data with payment histories can transform credit evaluation frameworks and drive financial inclusion.

Social Media Activity

Social media activity provides a rich alternative credit data source by analyzing user behavior, engagement patterns, and network connections to assess creditworthiness beyond traditional mobile phone payment data. Mobile phone payment data primarily tracks transactional history and payment consistency, offering insights into financial habits but lacking social context and behavioral indicators. Explore how integrating social media activity with traditional data can enhance credit scoring models and financial inclusion opportunities.

Source and External Links

Exploring Data Elements in Mobile Payment Transactions - Mobile payment transactions collect expanded data elements like EMV 3-D Secure, geolocation, digital wallet behavior, and device fingerprinting, which are used for enhanced security, fraud prevention, and improved user experience compared to traditional payment methods.

What is mobile payment technology? What businesses need to know - Mobile payment technology securely transfers funds via smartphones or tablets using digital wallets, tokenization to protect card details, and authentication methods like PINs or biometrics, with transactions initiated via NFC, QR codes, or Bluetooth.

Understanding the Mobile Payments Landscape | Square - Mobile payments use NFC technology to enable fast, secure contactless transactions at POS terminals, with tokenization replacing actual card details with unique, non-cloneable numbers to prevent fraud.

dowidth.com

dowidth.com