Alternative data lending leverages non-traditional information such as social media activity, utility payments, and mobile phone usage to assess creditworthiness, broadening access to finance for underserved populations. Microfinance focuses on providing small loans and financial services to low-income individuals or small businesses lacking access to conventional banking, often relying on community-based trust and group lending models. Explore how these innovative financial approaches transform lending landscapes and empower diverse borrowers worldwide.

Why it is important

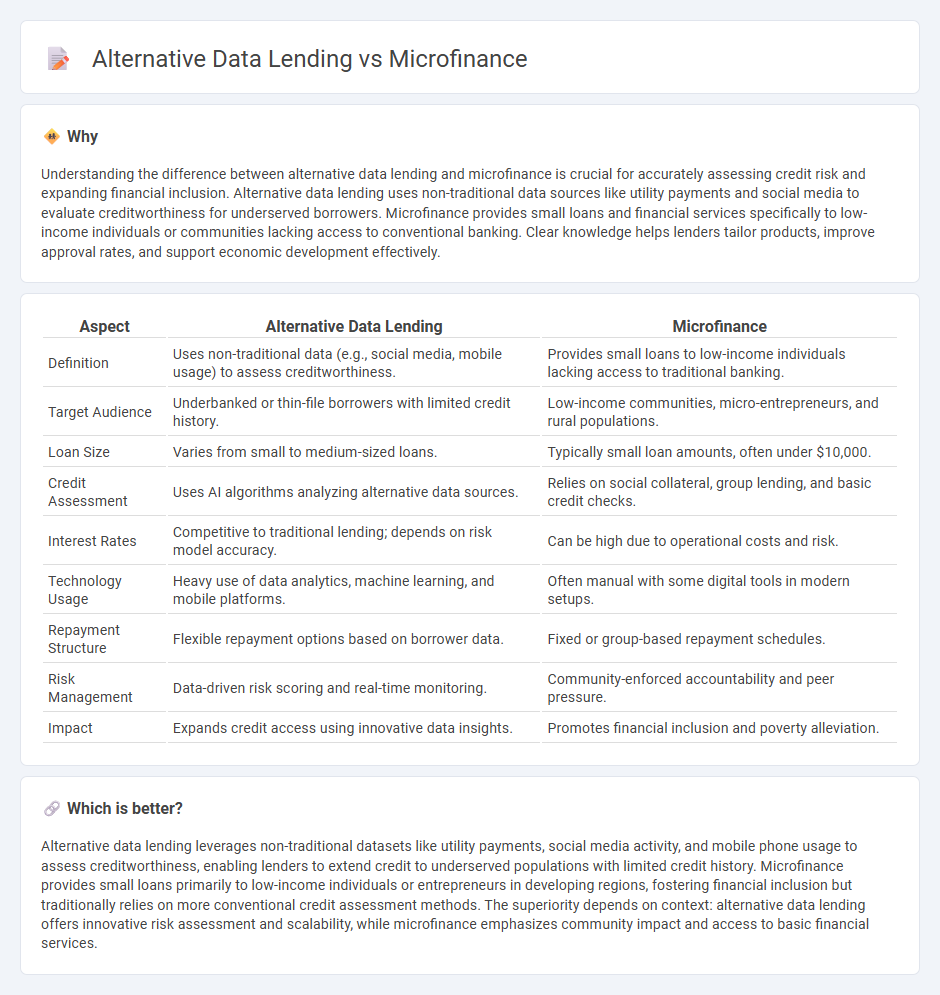

Understanding the difference between alternative data lending and microfinance is crucial for accurately assessing credit risk and expanding financial inclusion. Alternative data lending uses non-traditional data sources like utility payments and social media to evaluate creditworthiness for underserved borrowers. Microfinance provides small loans and financial services specifically to low-income individuals or communities lacking access to conventional banking. Clear knowledge helps lenders tailor products, improve approval rates, and support economic development effectively.

Comparison Table

| Aspect | Alternative Data Lending | Microfinance |

|---|---|---|

| Definition | Uses non-traditional data (e.g., social media, mobile usage) to assess creditworthiness. | Provides small loans to low-income individuals lacking access to traditional banking. |

| Target Audience | Underbanked or thin-file borrowers with limited credit history. | Low-income communities, micro-entrepreneurs, and rural populations. |

| Loan Size | Varies from small to medium-sized loans. | Typically small loan amounts, often under $10,000. |

| Credit Assessment | Uses AI algorithms analyzing alternative data sources. | Relies on social collateral, group lending, and basic credit checks. |

| Interest Rates | Competitive to traditional lending; depends on risk model accuracy. | Can be high due to operational costs and risk. |

| Technology Usage | Heavy use of data analytics, machine learning, and mobile platforms. | Often manual with some digital tools in modern setups. |

| Repayment Structure | Flexible repayment options based on borrower data. | Fixed or group-based repayment schedules. |

| Risk Management | Data-driven risk scoring and real-time monitoring. | Community-enforced accountability and peer pressure. |

| Impact | Expands credit access using innovative data insights. | Promotes financial inclusion and poverty alleviation. |

Which is better?

Alternative data lending leverages non-traditional datasets like utility payments, social media activity, and mobile phone usage to assess creditworthiness, enabling lenders to extend credit to underserved populations with limited credit history. Microfinance provides small loans primarily to low-income individuals or entrepreneurs in developing regions, fostering financial inclusion but traditionally relies on more conventional credit assessment methods. The superiority depends on context: alternative data lending offers innovative risk assessment and scalability, while microfinance emphasizes community impact and access to basic financial services.

Connection

Alternative data lending leverages non-traditional information such as utility payments, social media activity, and mobile phone usage to assess creditworthiness, enabling financial inclusion for underserved populations. Microfinance institutions utilize alternative data to extend small loans to individuals lacking formal credit histories, thus reducing risk and enhancing loan accessibility. This connection fosters expanded access to credit, driving economic empowerment and financial stability in low-income communities.

Key Terms

Microfinance:

Microfinance provides small loans to underserved populations without access to traditional banking, fueling entrepreneurship and economic empowerment in low-income communities. Alternative data lending uses non-traditional credit information, such as social media activity and utility payments, to assess creditworthiness beyond standard financial records. Explore how microfinance continues to transform financial inclusion by leveraging innovative lending methods.

Group Lending

Microfinance group lending leverages social collateral and peer monitoring to provide credit access to underserved populations, enhancing repayment rates through collective responsibility. Alternative data lending incorporates non-traditional information such as mobile phone usage, utility payments, and social media activity to assess creditworthiness, expanding financial inclusion beyond conventional credit scores. Discover how integrating group dynamics with alternative data analytics transforms lending models and empowers marginalized communities.

Microcredit

Microcredit in microfinance provides small loans to underserved populations, enabling entrepreneurship and financial inclusion without the need for traditional credit history. Alternative data lending leverages non-traditional data sources such as mobile usage and social media activity to assess creditworthiness, often improving loan access for those lacking formal financial records. Explore the evolving dynamics between microcredit and alternative data lending to understand their impact on inclusive finance.

Source and External Links

Microfinance - Definition, Benefits, Drawbacks, Models - Microfinance provides financial services like small loans, savings, and insurance to individuals of lower socioeconomic backgrounds who lack access to traditional banking, aiming to foster entrepreneurship and economic development.

Microfinance 101: All you need to know - Microfinance offers a range of financial products--including loans, savings, and insurance--to the unbanked, addressing barriers like poverty, lack of collateral, and limited access to banking infrastructure.

Microfinancing Basics - Microfinance delivers small-scale financial services, mainly loans but also savings and insurance, to entrepreneurs typically excluded from mainstream banking, often through specialized institutions.

dowidth.com

dowidth.com