Credit builder cards focus on helping users establish or improve their credit scores by reporting payment activity to credit bureaus and often feature low credit limits and minimal rewards. Rewards credit cards offer benefits like cashback, travel points, or discounts, targeting consumers with established credit who seek value from everyday spending. Explore the features and benefits of each card type to find the best fit for your financial goals.

Why it is important

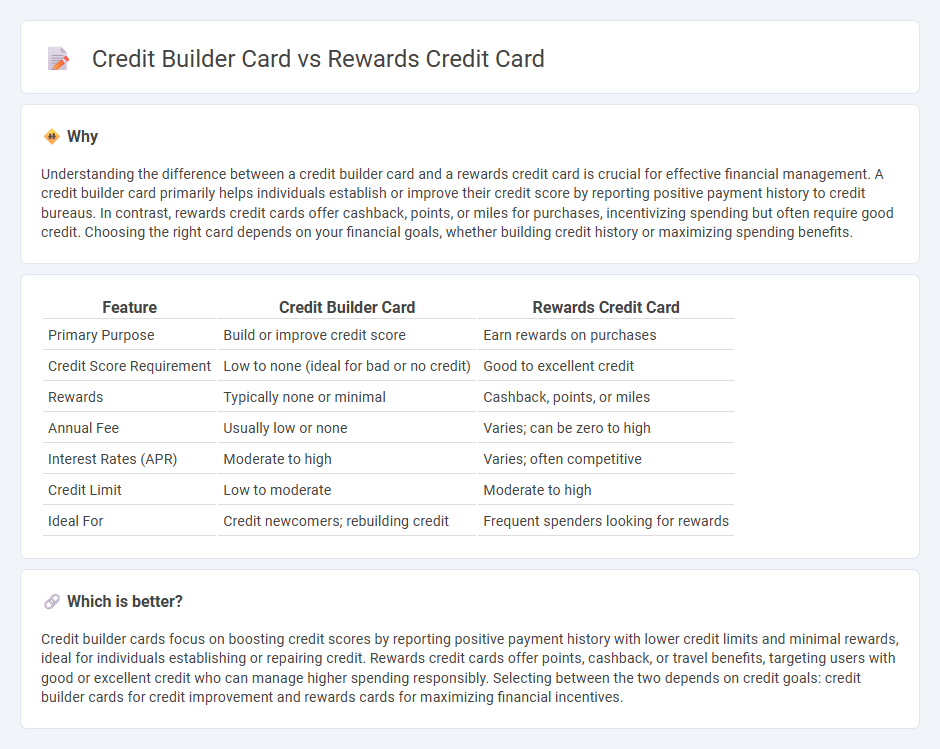

Understanding the difference between a credit builder card and a rewards credit card is crucial for effective financial management. A credit builder card primarily helps individuals establish or improve their credit score by reporting positive payment history to credit bureaus. In contrast, rewards credit cards offer cashback, points, or miles for purchases, incentivizing spending but often require good credit. Choosing the right card depends on your financial goals, whether building credit history or maximizing spending benefits.

Comparison Table

| Feature | Credit Builder Card | Rewards Credit Card |

|---|---|---|

| Primary Purpose | Build or improve credit score | Earn rewards on purchases |

| Credit Score Requirement | Low to none (ideal for bad or no credit) | Good to excellent credit |

| Rewards | Typically none or minimal | Cashback, points, or miles |

| Annual Fee | Usually low or none | Varies; can be zero to high |

| Interest Rates (APR) | Moderate to high | Varies; often competitive |

| Credit Limit | Low to moderate | Moderate to high |

| Ideal For | Credit newcomers; rebuilding credit | Frequent spenders looking for rewards |

Which is better?

Credit builder cards focus on boosting credit scores by reporting positive payment history with lower credit limits and minimal rewards, ideal for individuals establishing or repairing credit. Rewards credit cards offer points, cashback, or travel benefits, targeting users with good or excellent credit who can manage higher spending responsibly. Selecting between the two depends on credit goals: credit builder cards for credit improvement and rewards cards for maximizing financial incentives.

Connection

Credit builder cards and rewards credit cards both serve to enhance an individual's credit profile by promoting responsible credit use and timely payments. While credit builder cards primarily focus on establishing and improving credit scores through low limits and regular usage data reported to credit bureaus, rewards credit cards incentivize spending by offering points, cash back, or travel miles. Together, they enable consumers to build credit history while benefiting from financial incentives tied to their everyday purchases.

Key Terms

Points/Miles (Rewards Credit Card)

Rewards credit cards offer points or miles for every dollar spent, which can be redeemed for travel, merchandise, or statement credits, making them ideal for frequent travelers and shoppers. These cards often provide sign-up bonuses and enhanced rewards in categories like dining, groceries, and gas, maximizing earning potential with everyday expenses. Explore the best rewards credit card options to optimize your points and miles earnings today.

Credit Limit (Credit Builder Card)

Credit builder cards typically offer lower credit limits compared to rewards credit cards, as their primary goal is to help individuals establish or rebuild credit history with manageable spending. These cards often start with a credit limit as low as $200 to $500, gradually increasing with responsible use over time. Explore how credit builder cards can help you build financial strength through tailored credit limits designed for gradual credit improvement.

Annual Fee

Rewards credit cards often carry higher annual fees, typically ranging from $95 to $550, justified by extensive benefits like cashback, travel points, and exclusive perks. Credit builder cards usually feature low or no annual fees, designed to minimize costs while helping users improve their credit scores through responsible usage. Explore detailed comparisons to find which card aligns best with your financial goals and budget.

Source and External Links

Best Rewards Credit Cards for July 2025 - Highlights top rewards credit cards including Chase Freedom Unlimited(r) for cash back and Capital One Venture Rewards Credit Card for travel rewards, detailing their benefits and no annual fee options.

12 Best Rewards Credit Cards of July 2025 - Explains how rewards credit cards work, including cash back and points/miles types, and describes common redemption options for travel, gift cards, and statement credits.

The best rewards credit cards to add to your wallet - Offers an expert overview of top rewards cards like Chase Sapphire Reserve(r) and American Express Gold Card, emphasizing the value of transferable points for travel and advising responsible card use.

dowidth.com

dowidth.com