Real-time payments enable instant fund transfers, offering immediate settlement and enhanced convenience for both individuals and businesses. NEFT (National Electronic Funds Transfer) processes transactions in hourly batches, resulting in delayed settlement times compared to real-time systems. Explore the benefits and use cases of real-time payments versus NEFT for optimized financial operations.

Why it is important

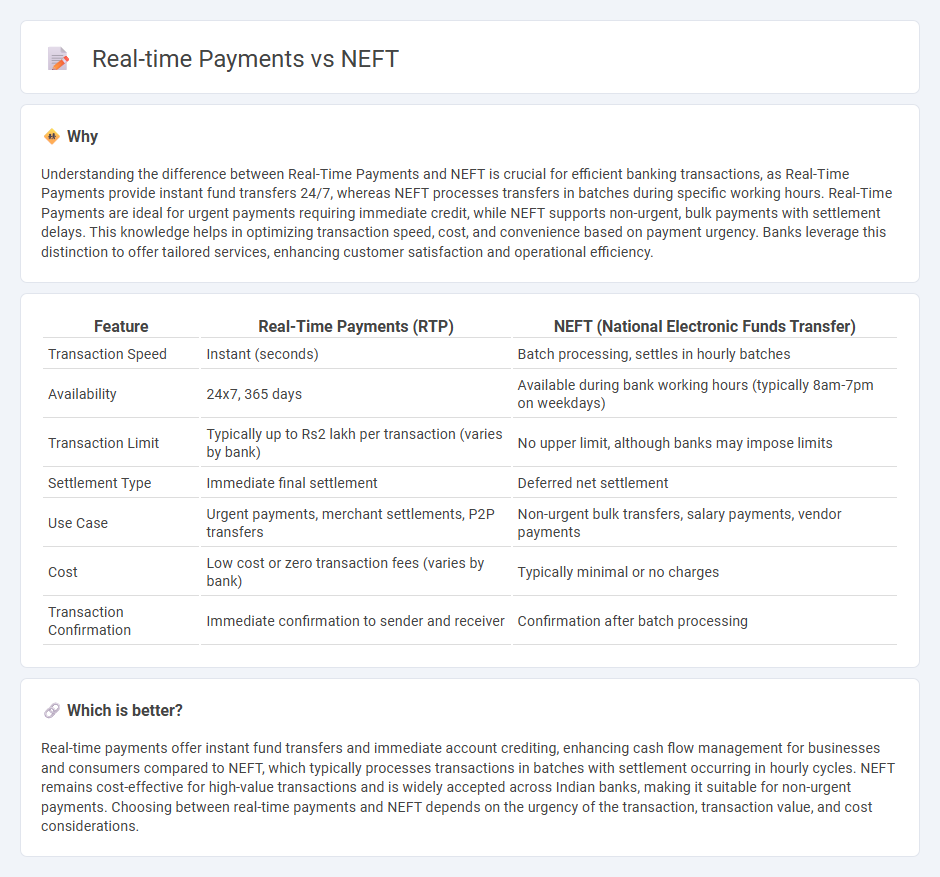

Understanding the difference between Real-Time Payments and NEFT is crucial for efficient banking transactions, as Real-Time Payments provide instant fund transfers 24/7, whereas NEFT processes transfers in batches during specific working hours. Real-Time Payments are ideal for urgent payments requiring immediate credit, while NEFT supports non-urgent, bulk payments with settlement delays. This knowledge helps in optimizing transaction speed, cost, and convenience based on payment urgency. Banks leverage this distinction to offer tailored services, enhancing customer satisfaction and operational efficiency.

Comparison Table

| Feature | Real-Time Payments (RTP) | NEFT (National Electronic Funds Transfer) |

|---|---|---|

| Transaction Speed | Instant (seconds) | Batch processing, settles in hourly batches |

| Availability | 24x7, 365 days | Available during bank working hours (typically 8am-7pm on weekdays) |

| Transaction Limit | Typically up to Rs2 lakh per transaction (varies by bank) | No upper limit, although banks may impose limits |

| Settlement Type | Immediate final settlement | Deferred net settlement |

| Use Case | Urgent payments, merchant settlements, P2P transfers | Non-urgent bulk transfers, salary payments, vendor payments |

| Cost | Low cost or zero transaction fees (varies by bank) | Typically minimal or no charges |

| Transaction Confirmation | Immediate confirmation to sender and receiver | Confirmation after batch processing |

Which is better?

Real-time payments offer instant fund transfers and immediate account crediting, enhancing cash flow management for businesses and consumers compared to NEFT, which typically processes transactions in batches with settlement occurring in hourly cycles. NEFT remains cost-effective for high-value transactions and is widely accepted across Indian banks, making it suitable for non-urgent payments. Choosing between real-time payments and NEFT depends on the urgency of the transaction, transaction value, and cost considerations.

Connection

Real-time payments and NEFT (National Electronic Funds Transfer) are integral components of modern banking systems that facilitate electronic fund transfers. Real-time payments enable instant transfer of funds, accessible 24/7, while NEFT processes transactions in hourly batches, typically settling within a few hours on business days. Banks leverage both systems to offer customers flexible options for transferring money efficiently across different time frames and settlement speeds.

Key Terms

Settlement Time

NEFT transactions typically settle in batches every half hour, resulting in settlement times ranging from 30 minutes to a few hours, whereas real-time payments enable instant fund transfers within seconds. Real-time payments leverage advanced payment infrastructure to ensure 24/7 availability and immediate transaction confirmation, significantly enhancing liquidity and cash flow management. Discover more about how settlement times impact financial operations and choose the best payment method for your needs.

Transaction Limit

NEFT (National Electronic Funds Transfer) typically imposes higher transaction limits, often up to Rs10 lakh or more per transaction, making it suitable for bulk transfers across banks in India. Real-time payments, such as IMPS (Immediate Payment Service), generally have lower limits, commonly capped around Rs2 lakh, but provide instant fund transfer 24/7. Explore more detailed comparisons to select the best option for your transaction needs.

Processing Mode

NEFT (National Electronic Funds Transfer) processes transactions in batches, typically settling payments in predefined time slots throughout the day, whereas Real-Time Payments (RTP) enable immediate fund transfers with continuous, instant settlement. The batch processing mode of NEFT may introduce delays in fund availability, while RTP's real-time processing ensures near-instantaneous credit to the beneficiary's account. Explore detailed comparisons to understand which electronic payment system best suits your transactional needs.

Source and External Links

What is NEFT: How NEFT Works, Full Form, NEFT Transfer ... - Paytm - NEFT stands for National Electronic Funds Transfer, a secure, electronic payment system in India that enables batch-based, hourly fund transfers between bank accounts for individuals, companies, and organizations, with no fees for online transactions.

NEFT Meaning in Banking - What is NEFT Transfer | DBS Bank - NEFT is a domestic, one-to-one electronic fund transfer system in India, owned and operated by the Reserve Bank of India, allowing 24/7 transfers processed in half-hourly batches, requiring beneficiary details like IFSC code, and typically delivering funds within minutes to a couple of hours.

National Electronic Funds Transfer - Wikipedia - NEFT is maintained by the Reserve Bank of India, established in 2005, enabling customers to transfer any amount between NEFT-enabled bank accounts via electronic messages, with no minimum or maximum transfer limits, and settling funds in 48 half-hourly batches every day.

dowidth.com

dowidth.com