Sustainable investing integrates environmental, social, and governance (ESG) criteria to promote long-term economic growth while minimizing negative impacts on society and the planet. Microfinance focuses on providing small loans and financial services to underserved populations, empowering them to achieve financial independence and improve livelihoods. Explore how these distinct approaches reshape the future of banking and social impact.

Why it is important

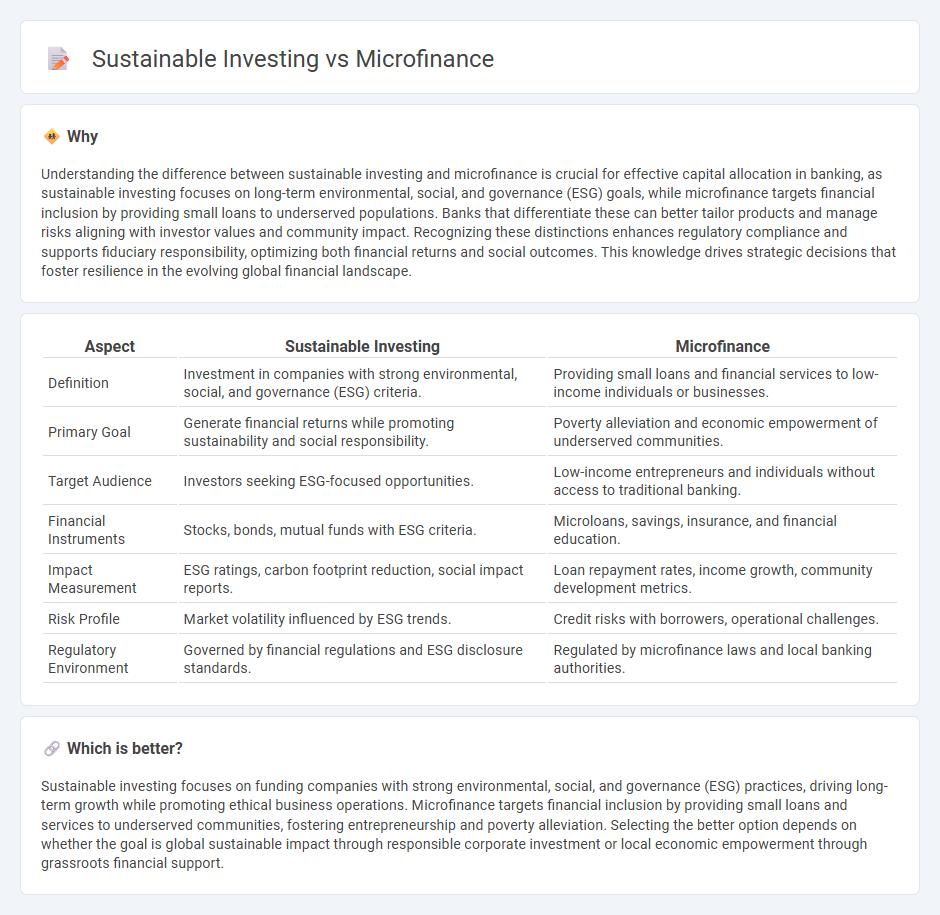

Understanding the difference between sustainable investing and microfinance is crucial for effective capital allocation in banking, as sustainable investing focuses on long-term environmental, social, and governance (ESG) goals, while microfinance targets financial inclusion by providing small loans to underserved populations. Banks that differentiate these can better tailor products and manage risks aligning with investor values and community impact. Recognizing these distinctions enhances regulatory compliance and supports fiduciary responsibility, optimizing both financial returns and social outcomes. This knowledge drives strategic decisions that foster resilience in the evolving global financial landscape.

Comparison Table

| Aspect | Sustainable Investing | Microfinance |

|---|---|---|

| Definition | Investment in companies with strong environmental, social, and governance (ESG) criteria. | Providing small loans and financial services to low-income individuals or businesses. |

| Primary Goal | Generate financial returns while promoting sustainability and social responsibility. | Poverty alleviation and economic empowerment of underserved communities. |

| Target Audience | Investors seeking ESG-focused opportunities. | Low-income entrepreneurs and individuals without access to traditional banking. |

| Financial Instruments | Stocks, bonds, mutual funds with ESG criteria. | Microloans, savings, insurance, and financial education. |

| Impact Measurement | ESG ratings, carbon footprint reduction, social impact reports. | Loan repayment rates, income growth, community development metrics. |

| Risk Profile | Market volatility influenced by ESG trends. | Credit risks with borrowers, operational challenges. |

| Regulatory Environment | Governed by financial regulations and ESG disclosure standards. | Regulated by microfinance laws and local banking authorities. |

Which is better?

Sustainable investing focuses on funding companies with strong environmental, social, and governance (ESG) practices, driving long-term growth while promoting ethical business operations. Microfinance targets financial inclusion by providing small loans and services to underserved communities, fostering entrepreneurship and poverty alleviation. Selecting the better option depends on whether the goal is global sustainable impact through responsible corporate investment or local economic empowerment through grassroots financial support.

Connection

Sustainable investing and microfinance are interconnected through their shared goal of promoting social and environmental impact alongside financial returns. Microfinance offers financial services to underserved populations, fostering economic inclusion and poverty alleviation, which aligns with sustainable investing's emphasis on environmental, social, and governance (ESG) criteria. By channeling capital into microfinance institutions, sustainable investors drive positive change in communities while achieving long-term value creation.

Key Terms

**Microfinance:**

Microfinance provides small loans and financial services to low-income individuals or groups lacking access to traditional banking, empowering entrepreneurship and poverty alleviation. Sustainable investing prioritizes environmental, social, and governance (ESG) criteria to generate long-term positive impacts alongside financial returns. Explore how microfinance drives social change and its role within the broader sustainable investing landscape.

Microcredit

Microcredit, a cornerstone of microfinance, provides small loans to low-income entrepreneurs lacking access to traditional banking, fostering financial inclusion and poverty alleviation in emerging markets. Sustainable investing integrates environmental, social, and governance (ESG) criteria, targeting long-term impact alongside financial returns, often emphasizing projects that support economic resilience and community development. Explore further to understand how microcredit aligns with sustainable investing goals and transforms underserved communities worldwide.

Financial Inclusion

Microfinance provides small loans and financial services to underserved populations, promoting financial inclusion by enabling entrepreneurship and poverty reduction. Sustainable investing allocates capital toward companies and projects with positive social and environmental impact, advancing broader financial inclusion through ethical and responsible investing. Explore how combining microfinance and sustainable investing can drive inclusive economic growth and social equity.

Source and External Links

What Is Microfinance? - Microfinance provides basic financial services like credit and deposit-taking on a small scale to marginalized populations who lack access to traditional banking due to insufficient collateral.

Microfinance 101: All you need to know - Microfinance offers a suite of financial services--including loans, savings, insurance, and fund transfers--to individuals, entrepreneurs, and small businesses excluded from conventional banking, often due to poverty or systemic barriers.

Microfinancing Basics - Microfinance delivers small-scale financial services, mainly loans but also savings and insurance, to entrepreneurs typically unable to access mainstream financial institutions.

dowidth.com

dowidth.com