Loyalty fintech companies leverage advanced analytics and personalized rewards to enhance customer retention and engagement, creating tailored financial experiences that traditional banks often cannot match. Community banks emphasize local relationships and personalized service, fostering trust and community support through face-to-face interactions. Discover how both models shape the future of banking by exploring their unique strengths and innovations.

Why it is important

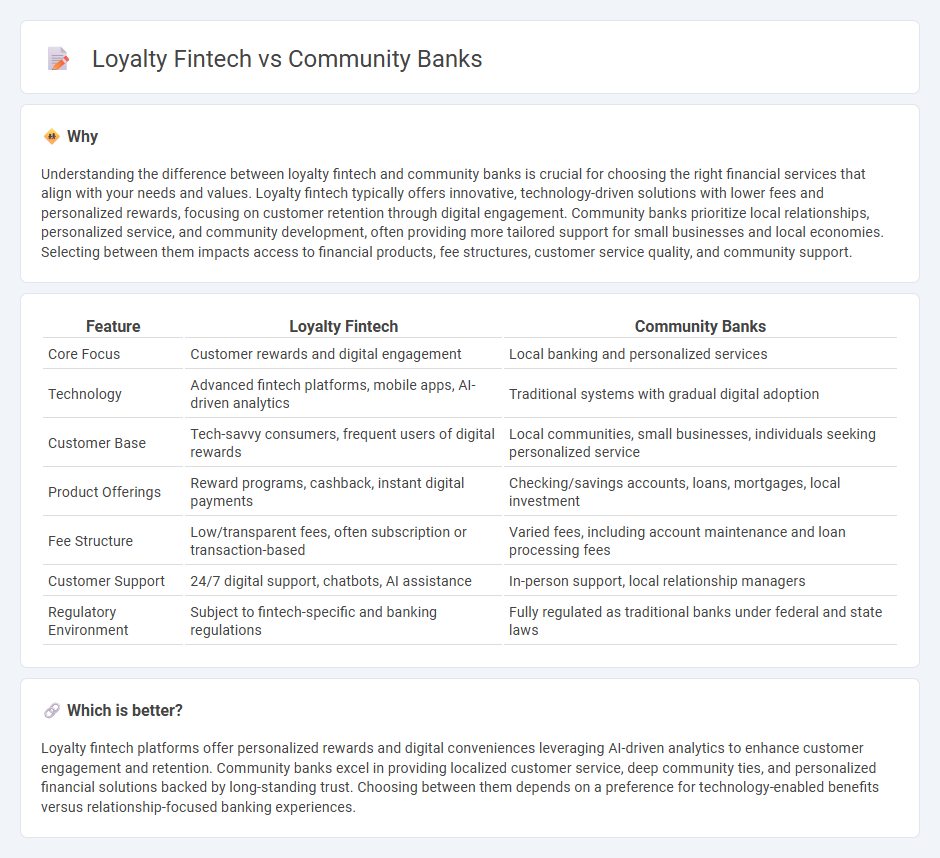

Understanding the difference between loyalty fintech and community banks is crucial for choosing the right financial services that align with your needs and values. Loyalty fintech typically offers innovative, technology-driven solutions with lower fees and personalized rewards, focusing on customer retention through digital engagement. Community banks prioritize local relationships, personalized service, and community development, often providing more tailored support for small businesses and local economies. Selecting between them impacts access to financial products, fee structures, customer service quality, and community support.

Comparison Table

| Feature | Loyalty Fintech | Community Banks |

|---|---|---|

| Core Focus | Customer rewards and digital engagement | Local banking and personalized services |

| Technology | Advanced fintech platforms, mobile apps, AI-driven analytics | Traditional systems with gradual digital adoption |

| Customer Base | Tech-savvy consumers, frequent users of digital rewards | Local communities, small businesses, individuals seeking personalized service |

| Product Offerings | Reward programs, cashback, instant digital payments | Checking/savings accounts, loans, mortgages, local investment |

| Fee Structure | Low/transparent fees, often subscription or transaction-based | Varied fees, including account maintenance and loan processing fees |

| Customer Support | 24/7 digital support, chatbots, AI assistance | In-person support, local relationship managers |

| Regulatory Environment | Subject to fintech-specific and banking regulations | Fully regulated as traditional banks under federal and state laws |

Which is better?

Loyalty fintech platforms offer personalized rewards and digital conveniences leveraging AI-driven analytics to enhance customer engagement and retention. Community banks excel in providing localized customer service, deep community ties, and personalized financial solutions backed by long-standing trust. Choosing between them depends on a preference for technology-enabled benefits versus relationship-focused banking experiences.

Connection

Loyalty fintech platforms enhance customer retention by providing personalized rewards and seamless digital experiences, directly benefiting community banks focused on local engagement. Community banks leverage these fintech solutions to differentiate their services through tailored loyalty programs that increase customer satisfaction and foster strong community ties. This collaboration drives growth by integrating advanced technology with community-centered banking, creating a competitive edge in a traditionally localized market.

Key Terms

Relationship Banking

Community banks excel in relationship banking by offering personalized financial services tailored to local customers, leveraging deep community ties and trust. Loyalty fintech platforms enhance customer engagement through rewards programs and digital convenience, yet often lack the personal interaction that builds long-term relationships. Discover how combining the strengths of community banks and loyalty fintech can redefine relationship banking for modern consumers.

Customer Retention

Community banks leverage personalized service and local market knowledge to boost customer retention, while loyalty fintechs utilize advanced data analytics and digital rewards to enhance engagement. The integration of AI-driven insights and tailored incentives from loyalty fintechs often results in higher retention rates compared to traditional banking methods. Explore how the fusion of community banking trust and fintech innovation can redefine customer loyalty strategies.

Digital Engagement

Community banks leverage local relationships and trust to foster personalized digital engagement, utilizing tailored mobile apps and online platforms to enhance customer interactions. Loyalty fintech companies focus primarily on advanced reward systems and AI-driven insights to drive user retention and engagement through gamified experiences and seamless integration with payment methods. Explore how combining community banking values with fintech innovation can revolutionize digital engagement strategies.

Source and External Links

About Community Banking - ICBA - Community banks prioritize local investment and relationships, offering personalized loan decisions, innovative financial products, and strong community engagement, making them the small business lender of choice compared to large banks.

Community bank - Wikipedia - Community banks are locally owned depository institutions focusing on the needs of families and businesses in the areas they serve, with varying asset size definitions and a historically significant role in the U.S. banking system.

Stellar Bank: Business Banking Solutions - Stellar Bank exemplifies community banking by providing personalized service, expert guidance, local focus, and significant community development loans while maintaining easy access for customers.

dowidth.com

dowidth.com