Sustainable finance focuses on investments that generate positive environmental and social impacts alongside financial returns, promoting long-term ecological balance. Transition finance supports companies in high-emission sectors to shift towards greener operations through targeted funding and strategies. Explore detailed insights to understand how these financial approaches drive sustainable economic transformation.

Why it is important

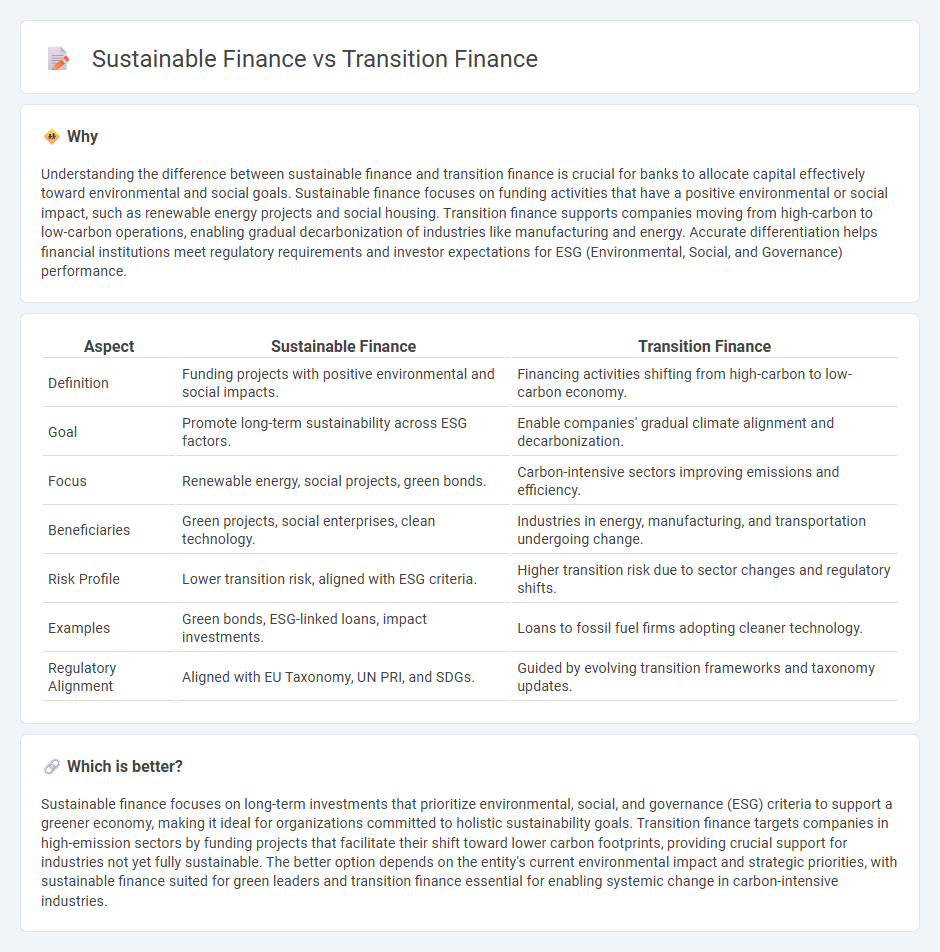

Understanding the difference between sustainable finance and transition finance is crucial for banks to allocate capital effectively toward environmental and social goals. Sustainable finance focuses on funding activities that have a positive environmental or social impact, such as renewable energy projects and social housing. Transition finance supports companies moving from high-carbon to low-carbon operations, enabling gradual decarbonization of industries like manufacturing and energy. Accurate differentiation helps financial institutions meet regulatory requirements and investor expectations for ESG (Environmental, Social, and Governance) performance.

Comparison Table

| Aspect | Sustainable Finance | Transition Finance |

|---|---|---|

| Definition | Funding projects with positive environmental and social impacts. | Financing activities shifting from high-carbon to low-carbon economy. |

| Goal | Promote long-term sustainability across ESG factors. | Enable companies' gradual climate alignment and decarbonization. |

| Focus | Renewable energy, social projects, green bonds. | Carbon-intensive sectors improving emissions and efficiency. |

| Beneficiaries | Green projects, social enterprises, clean technology. | Industries in energy, manufacturing, and transportation undergoing change. |

| Risk Profile | Lower transition risk, aligned with ESG criteria. | Higher transition risk due to sector changes and regulatory shifts. |

| Examples | Green bonds, ESG-linked loans, impact investments. | Loans to fossil fuel firms adopting cleaner technology. |

| Regulatory Alignment | Aligned with EU Taxonomy, UN PRI, and SDGs. | Guided by evolving transition frameworks and taxonomy updates. |

Which is better?

Sustainable finance focuses on long-term investments that prioritize environmental, social, and governance (ESG) criteria to support a greener economy, making it ideal for organizations committed to holistic sustainability goals. Transition finance targets companies in high-emission sectors by funding projects that facilitate their shift toward lower carbon footprints, providing crucial support for industries not yet fully sustainable. The better option depends on the entity's current environmental impact and strategic priorities, with sustainable finance suited for green leaders and transition finance essential for enabling systemic change in carbon-intensive industries.

Connection

Sustainable finance integrates environmental, social, and governance (ESG) criteria into banking decisions to promote long-term ecological balance and social responsibility. Transition finance specifically supports companies and projects in shifting from high-carbon to low-carbon operations, enabling banks to manage risks linked to climate change while fostering economic transformation. Both approaches are interconnected as they drive investment flows toward sustainable development goals and contribute to decarbonizing the global economy through informed banking strategies.

Key Terms

Decarbonization (Transition Finance)

Transition finance specifically targets funding for companies shifting from high-carbon to low-carbon technologies, enabling decarbonization efforts aligned with the Paris Agreement goals. Sustainable finance encompasses a broader spectrum, supporting environmental, social, and governance (ESG) initiatives beyond just carbon reduction. Explore more about how transition finance drives the critical shift toward a net-zero economy.

Green Bonds (Sustainable Finance)

Green bonds, a key instrument in sustainable finance, fund projects aimed at environmental benefits such as renewable energy and climate resilience. Transition finance, distinct from sustainable finance, focuses on supporting companies and industries in reducing carbon emissions through intermediary steps toward sustainability. Discover how green bonds drive impactful change and support global decarbonization efforts by exploring their role in sustainable finance.

Emissions Reduction Pathways

Transition finance supports companies shifting from high to lower carbon emissions through targeted investments, enabling adherence to established emissions reduction pathways such as the Science Based Targets initiative (SBTi). Sustainable finance encompasses a broader approach, integrating environmental, social, and governance (ESG) criteria to fund projects that advance overall sustainability goals beyond just emissions reductions. Explore more to understand how both finance types drive the global shift toward a low-carbon economy.

Source and External Links

Bringing Sustainable Finance to the next level - Transition finance is the use of financial strategies and instruments designed to support the transition from a high-carbon to a low-carbon economy, often through traditional finance tools like loans or capital market instruments, especially in developed markets.

Transition Finance Resource Hub - Transition finance helps financial institutions align portfolios with net zero goals by focusing on priority sectors and transition pathways, offering guidance on designing and implementing effective transition finance strategies.

What is transition finance, and why it matters - Transition finance refers to investments aimed at decarbonizing high-emitting and hard-to-abate sectors like steel, aviation, and shipping, representing a multitrillion-dollar opportunity but lacking a standardized framework yet to unify definitions and approaches.

dowidth.com

dowidth.com