Pay by bank transactions offer a secure, real-time transfer of funds directly between bank accounts, minimizing fees and processing delays. Money orders provide a prepaid, paper-based payment method widely accepted for individuals without bank accounts or credit cards. Explore the advantages and use cases of each payment method to determine the best fit for your financial needs.

Why it is important

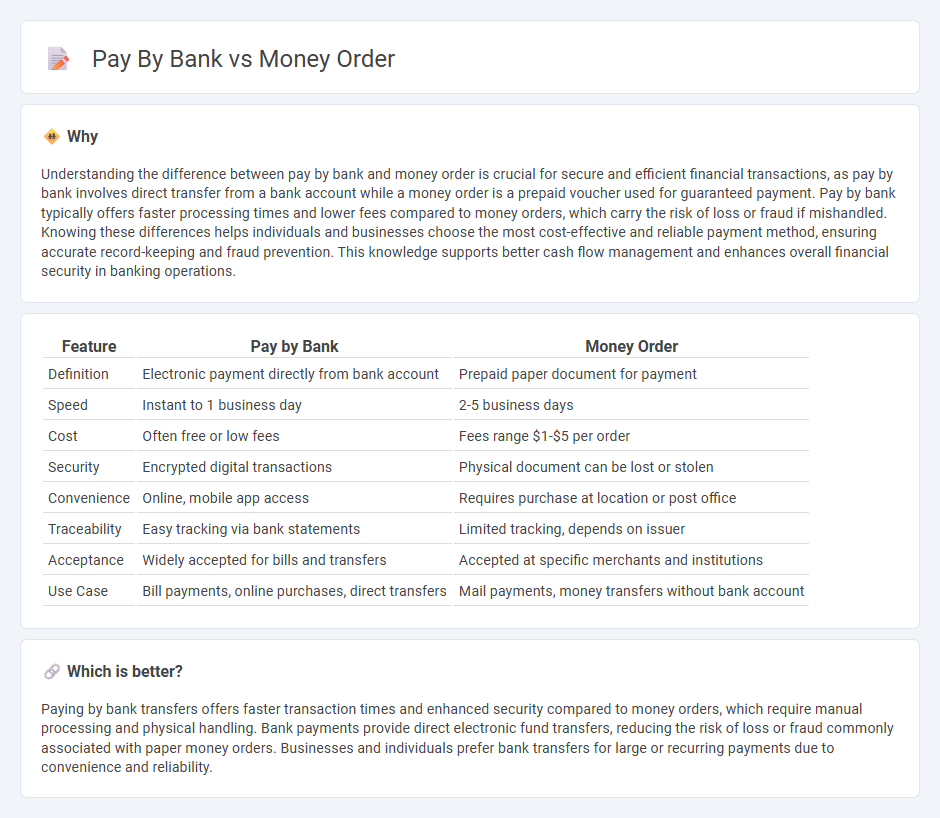

Understanding the difference between pay by bank and money order is crucial for secure and efficient financial transactions, as pay by bank involves direct transfer from a bank account while a money order is a prepaid voucher used for guaranteed payment. Pay by bank typically offers faster processing times and lower fees compared to money orders, which carry the risk of loss or fraud if mishandled. Knowing these differences helps individuals and businesses choose the most cost-effective and reliable payment method, ensuring accurate record-keeping and fraud prevention. This knowledge supports better cash flow management and enhances overall financial security in banking operations.

Comparison Table

| Feature | Pay by Bank | Money Order |

|---|---|---|

| Definition | Electronic payment directly from bank account | Prepaid paper document for payment |

| Speed | Instant to 1 business day | 2-5 business days |

| Cost | Often free or low fees | Fees range $1-$5 per order |

| Security | Encrypted digital transactions | Physical document can be lost or stolen |

| Convenience | Online, mobile app access | Requires purchase at location or post office |

| Traceability | Easy tracking via bank statements | Limited tracking, depends on issuer |

| Acceptance | Widely accepted for bills and transfers | Accepted at specific merchants and institutions |

| Use Case | Bill payments, online purchases, direct transfers | Mail payments, money transfers without bank account |

Which is better?

Paying by bank transfers offers faster transaction times and enhanced security compared to money orders, which require manual processing and physical handling. Bank payments provide direct electronic fund transfers, reducing the risk of loss or fraud commonly associated with paper money orders. Businesses and individuals prefer bank transfers for large or recurring payments due to convenience and reliability.

Connection

Pay by bank and money order are connected through their use as secure payment methods that minimize the risk of fraud and provide traceable transaction records. Both options involve transferring funds from one party to another, with pay by bank typically utilizing electronic transfers such as ACH or wire payments, while money orders rely on prepaid, paper-based instruments issued by financial institutions or postal services. These methods support consumer and business needs for reliable, documented payment solutions in banking and financial operations.

Key Terms

Remittance

Money orders provide a secure, prepaid payment method often used for small to medium remittance transactions without requiring bank accounts, making them accessible to unbanked populations. Paying by bank offers faster, traceable, and typically lower-cost remittance transfers through electronic funds transfers or wire services, benefiting from established banking networks. Discover the best remittance option tailored to your needs and transfer preferences.

Settlement

Money orders provide a prepaid, guaranteed settlement method often used for secure transactions without direct bank involvement. Payments by bank, such as wire transfers or ACH payments, settle through interconnected banking networks, offering faster clearance and direct account debiting. Explore more to understand which settlement option fits your transaction needs best.

Authorization

Money orders require prepayment and are authorized through the issuance process by financial institutions or authorized vendors, providing a guaranteed payment form without direct bank account access. Payments by bank involve direct authorization through electronic fund transfers or checks, relying on the payer's account and banking credentials to validate and process the transaction securely. Explore the detailed differences in payment authorization mechanisms to choose the best method for your financial needs.

Source and External Links

What is a money order and how do you fill one out? - A money order is a prepaid, secure payment method issued by third parties--such as banks, post offices, or retailers--for a set amount, typically up to $1,000, and can only be cashed by the named recipient.

Money order - A money order is a directive to pay a specified sum from prepaid funds, functioning as a more trusted alternative to personal checks, often with a maximum value limit and requiring the payee's name for redemption.

Sending Money Orders - You can purchase U.S. Postal Service money orders at any Post Office for up to $1,000 using cash or a debit card, and these money orders are widely accepted, never expire, and can be replaced if lost or stolen.

dowidth.com

dowidth.com