Personal finance automation enhances budgeting and expense tracking by using algorithms to categorize transactions and provide real-time financial insights. Fraud detection algorithms analyze patterns and anomalies in banking data to identify and prevent unauthorized activities, safeguarding customers from financial losses. Discover how these advanced banking technologies improve security and financial management.

Why it is important

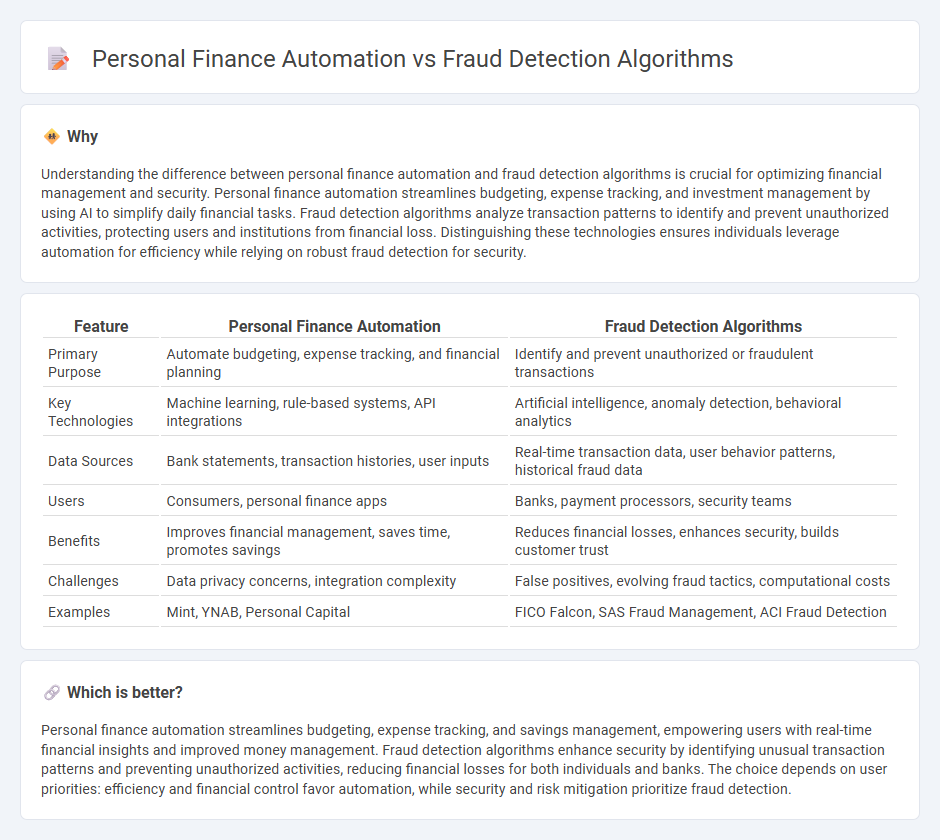

Understanding the difference between personal finance automation and fraud detection algorithms is crucial for optimizing financial management and security. Personal finance automation streamlines budgeting, expense tracking, and investment management by using AI to simplify daily financial tasks. Fraud detection algorithms analyze transaction patterns to identify and prevent unauthorized activities, protecting users and institutions from financial loss. Distinguishing these technologies ensures individuals leverage automation for efficiency while relying on robust fraud detection for security.

Comparison Table

| Feature | Personal Finance Automation | Fraud Detection Algorithms |

|---|---|---|

| Primary Purpose | Automate budgeting, expense tracking, and financial planning | Identify and prevent unauthorized or fraudulent transactions |

| Key Technologies | Machine learning, rule-based systems, API integrations | Artificial intelligence, anomaly detection, behavioral analytics |

| Data Sources | Bank statements, transaction histories, user inputs | Real-time transaction data, user behavior patterns, historical fraud data |

| Users | Consumers, personal finance apps | Banks, payment processors, security teams |

| Benefits | Improves financial management, saves time, promotes savings | Reduces financial losses, enhances security, builds customer trust |

| Challenges | Data privacy concerns, integration complexity | False positives, evolving fraud tactics, computational costs |

| Examples | Mint, YNAB, Personal Capital | FICO Falcon, SAS Fraud Management, ACI Fraud Detection |

Which is better?

Personal finance automation streamlines budgeting, expense tracking, and savings management, empowering users with real-time financial insights and improved money management. Fraud detection algorithms enhance security by identifying unusual transaction patterns and preventing unauthorized activities, reducing financial losses for both individuals and banks. The choice depends on user priorities: efficiency and financial control favor automation, while security and risk mitigation prioritize fraud detection.

Connection

Personal finance automation leverages advanced fraud detection algorithms to secure transactions and protect user accounts by continuously monitoring for suspicious activities. These algorithms analyze patterns in spending behavior, flagging anomalies that indicate potential fraud while streamlining financial management processes. The integration enhances accuracy in identifying threats, reduces false positives, and ensures seamless user experience in automated banking services.

Key Terms

**Fraud Detection Algorithms:**

Fraud detection algorithms analyze transaction patterns, user behavior, and real-time data to identify suspicious activities and prevent financial losses in personal finance systems. These algorithms leverage machine learning, anomaly detection, and predictive analytics to enhance security and accuracy in fraud prevention. Explore how integrating advanced fraud detection algorithms can safeguard your personal finance automation tools.

Anomaly Detection

Fraud detection algorithms leverage anomaly detection techniques to identify irregular patterns in transaction data that deviate from an individual's typical financial behavior, thereby preventing unauthorized activities and reducing financial losses. Personal finance automation uses similar anomaly detection tools to monitor spending habits and flag unusual expenses, enhancing budgeting accuracy and financial health management. Explore how integrating advanced anomaly detection can optimize both fraud prevention and personal finance automation strategies.

Machine Learning

Machine learning enhances fraud detection algorithms by analyzing transaction patterns and identifying anomalies with high precision, thereby reducing false positives and preventing financial losses. Personal finance automation leverages machine learning to provide tailored budgeting, expense tracking, and investment recommendations, optimizing financial decision-making and efficiency. Explore how machine learning transforms both fraud detection and finance automation for smarter, safer money management.

Source and External Links

How to Improve Fraud Detection With Machine Learning - DataDome - This webpage discusses various machine learning algorithms such as logistic regression, decision trees, random forests, and neural networks used in fraud detection.

Mastering The Art of Algorithm Tuning in Fraud Detection - Flagright - This post highlights the importance of algorithm tuning in fraud detection, focusing on algorithms like decision trees, random forests, and gradient boosting machines.

5 New Fraud Detection Machine Learning Algorithms | TrustDecision - This article introduces innovative algorithms for fraud detection, including XGBoost, neural networks, and autoencoders, which offer high accuracy in identifying fraudulent activities.

dowidth.com

dowidth.com