Credit builder cards focus on helping individuals establish or improve their credit scores by reporting timely payments and maintaining low credit utilization, ideal for those new to credit or rebuilding their financial profile. Balance transfer cards offer low or zero introductory interest rates on transferred balances, enabling users to consolidate and pay down existing high-interest credit card debt more efficiently. Explore more to determine which card aligns best with your financial goals and credit needs.

Why it is important

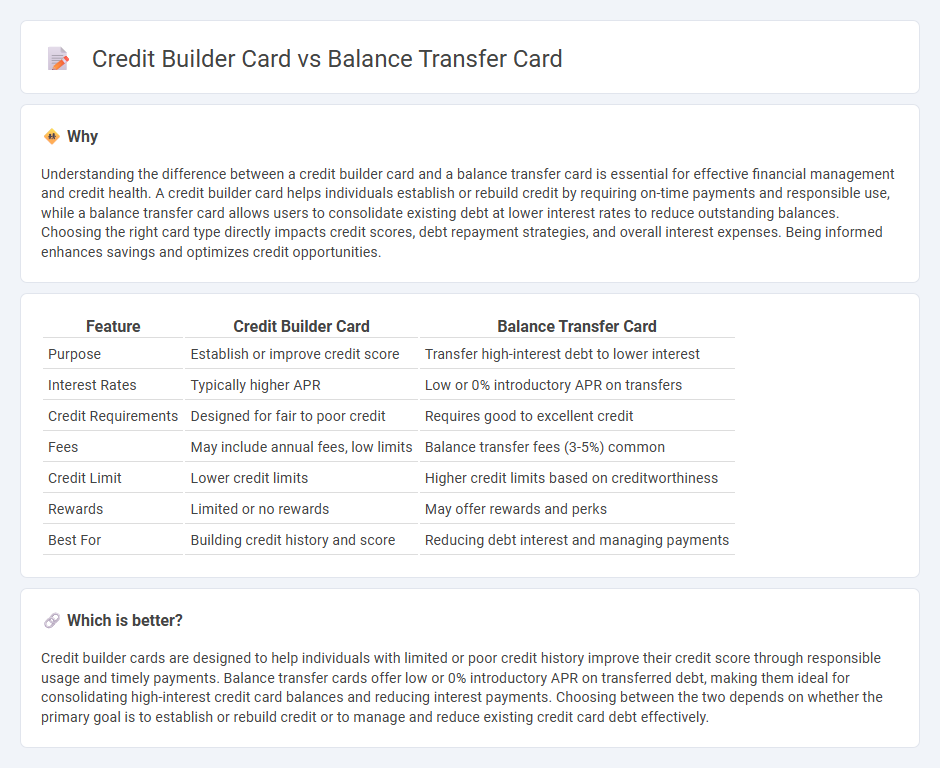

Understanding the difference between a credit builder card and a balance transfer card is essential for effective financial management and credit health. A credit builder card helps individuals establish or rebuild credit by requiring on-time payments and responsible use, while a balance transfer card allows users to consolidate existing debt at lower interest rates to reduce outstanding balances. Choosing the right card type directly impacts credit scores, debt repayment strategies, and overall interest expenses. Being informed enhances savings and optimizes credit opportunities.

Comparison Table

| Feature | Credit Builder Card | Balance Transfer Card |

|---|---|---|

| Purpose | Establish or improve credit score | Transfer high-interest debt to lower interest |

| Interest Rates | Typically higher APR | Low or 0% introductory APR on transfers |

| Credit Requirements | Designed for fair to poor credit | Requires good to excellent credit |

| Fees | May include annual fees, low limits | Balance transfer fees (3-5%) common |

| Credit Limit | Lower credit limits | Higher credit limits based on creditworthiness |

| Rewards | Limited or no rewards | May offer rewards and perks |

| Best For | Building credit history and score | Reducing debt interest and managing payments |

Which is better?

Credit builder cards are designed to help individuals with limited or poor credit history improve their credit score through responsible usage and timely payments. Balance transfer cards offer low or 0% introductory APR on transferred debt, making them ideal for consolidating high-interest credit card balances and reducing interest payments. Choosing between the two depends on whether the primary goal is to establish or rebuild credit or to manage and reduce existing credit card debt effectively.

Connection

Credit builder cards and balance transfer cards both serve to improve credit management by targeting different aspects of debt handling; credit builder cards help establish or rebuild credit history through responsible usage and timely payments, while balance transfer cards enable users to consolidate existing high-interest debt onto a new card with lower or 0% introductory APR. Utilizing a credit builder card can improve credit scores, making it easier to qualify for balance transfer offers with favorable terms. Together, these cards provide a strategic approach to managing credit utilization and reducing overall interest payments, ultimately enhancing financial health.

Key Terms

Interest Rate

Balance transfer cards typically offer low or 0% introductory interest rates on transferred balances for a specified period, making them ideal for paying off existing debt without accruing high interest. Credit builder cards generally have higher interest rates, reflecting their target users with limited or poor credit history aiming to improve credit scores through responsible use. Explore detailed comparisons to determine which card suits your financial goals and interest rate preferences.

Credit Limit

Balance transfer cards typically offer higher credit limits to accommodate large existing balances, helping users consolidate debt efficiently. Credit builder cards generally have lower credit limits, designed to minimize risk while users establish or improve their credit scores. Explore the differences in credit limits to choose the card that best supports your financial goals.

Credit Score Impact

Balance transfer cards primarily help manage existing debt by consolidating high-interest balances onto a single card with lower or zero percent introductory rates, which can improve credit utilization and potentially boost credit scores if managed responsibly. Credit builder cards are designed to help individuals establish or rebuild credit by reporting timely payments to credit bureaus and often have lower credit limits and higher approval chances. Explore more about how each card type can strategically influence your credit score and financial health.

Source and External Links

Best Balance Transfer Cards for July 2025 - Credit Karma - The Wells Fargo Reflect(r) Card offers a 0% intro APR for 21 months on purchases and balance transfers made within 120 days of opening, with a 5% balance transfer fee (minimum $5), after which the APR rises to 17.24%-28.99% variable.

10 Best Balance Transfer Credit Cards of July 2025 - NerdWallet - The best balance transfer cards charge no annual fee, offer at least 15 months of 0% intro APR for balance transfers, and typically have transfer fees of 3-5%, while you generally cannot transfer balances between cards from the same issuer.

Best Balance Transfer Credit Cards of 2025 - Experian - Balance transfer limits are usually up to your card's credit limit, and transfers can take from a few days to weeks, so continue paying your old card until the transfer posts; shop around for the best promo length, fees, and ongoing rates based on your credit profile.

dowidth.com

dowidth.com