Instant settlement enables real-time transaction processing, ensuring funds are transferred immediately between accounts, which enhances cash flow management and reduces counterparty risk. Batch settlement processes multiple transactions at scheduled intervals, optimizing operational efficiency and lowering processing costs but potentially delaying fund availability. Discover how choosing the right settlement method can improve your banking experience and financial operations.

Why it is important

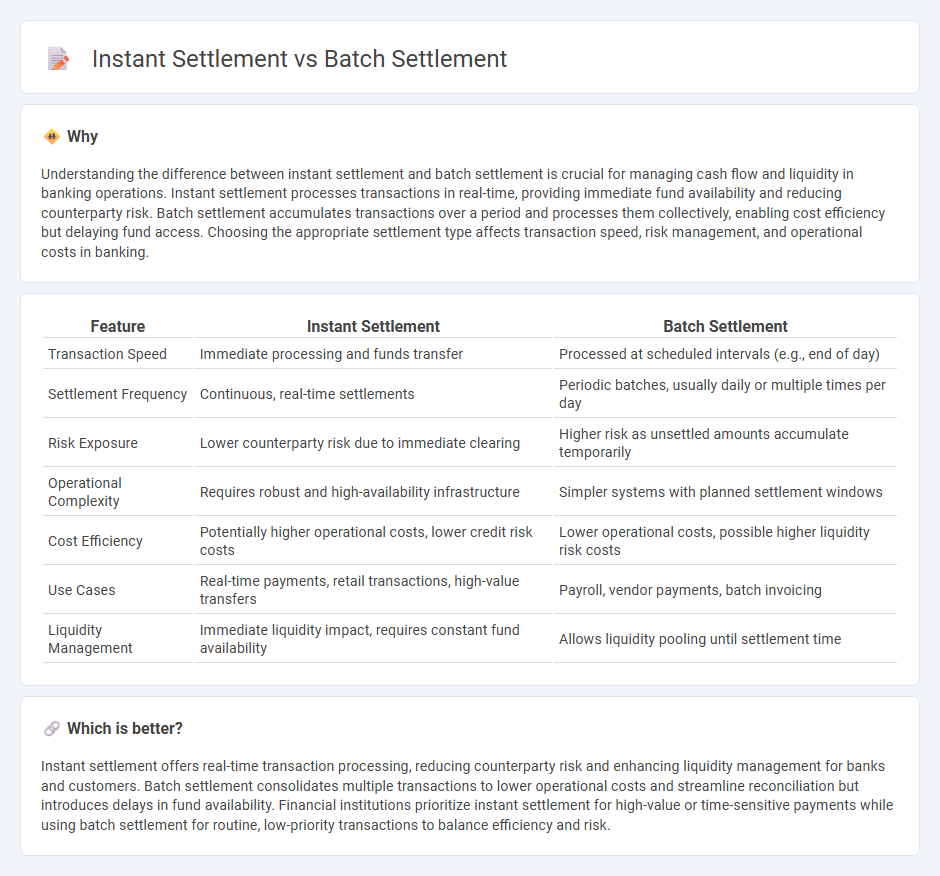

Understanding the difference between instant settlement and batch settlement is crucial for managing cash flow and liquidity in banking operations. Instant settlement processes transactions in real-time, providing immediate fund availability and reducing counterparty risk. Batch settlement accumulates transactions over a period and processes them collectively, enabling cost efficiency but delaying fund access. Choosing the appropriate settlement type affects transaction speed, risk management, and operational costs in banking.

Comparison Table

| Feature | Instant Settlement | Batch Settlement |

|---|---|---|

| Transaction Speed | Immediate processing and funds transfer | Processed at scheduled intervals (e.g., end of day) |

| Settlement Frequency | Continuous, real-time settlements | Periodic batches, usually daily or multiple times per day |

| Risk Exposure | Lower counterparty risk due to immediate clearing | Higher risk as unsettled amounts accumulate temporarily |

| Operational Complexity | Requires robust and high-availability infrastructure | Simpler systems with planned settlement windows |

| Cost Efficiency | Potentially higher operational costs, lower credit risk costs | Lower operational costs, possible higher liquidity risk costs |

| Use Cases | Real-time payments, retail transactions, high-value transfers | Payroll, vendor payments, batch invoicing |

| Liquidity Management | Immediate liquidity impact, requires constant fund availability | Allows liquidity pooling until settlement time |

Which is better?

Instant settlement offers real-time transaction processing, reducing counterparty risk and enhancing liquidity management for banks and customers. Batch settlement consolidates multiple transactions to lower operational costs and streamline reconciliation but introduces delays in fund availability. Financial institutions prioritize instant settlement for high-value or time-sensitive payments while using batch settlement for routine, low-priority transactions to balance efficiency and risk.

Connection

Instant settlement processes transactions immediately, enhancing liquidity and reducing counterparty risk by confirming fund transfers in real-time. Batch settlement accumulates multiple transactions over a defined period before processing them collectively, optimizing operational efficiency and reducing transaction costs. Both methods integrate within banking systems to balance the immediacy of cash flow with the efficiencies of bulk transaction management.

Key Terms

Processing Time

Batch settlement processes multiple transactions together at scheduled intervals, resulting in longer processing times that can range from hours to days. Instant settlement completes each transaction individually in real-time, significantly reducing processing time to seconds or minutes, enhancing cash flow and customer experience. Explore more to understand how processing time impacts your choice between batch and instant settlement methods.

Liquidity

Batch settlement processes multiple transactions together at scheduled intervals, potentially delaying fund availability and impacting liquidity management for businesses. Instant settlement transfers funds in real-time, enhancing cash flow and providing immediate access to liquidity, which is crucial for maintaining operational efficiency. Explore how choosing the right settlement method can optimize your liquidity strategy and financial health.

Risk Exposure

Batch settlement processes multiple transactions collectively at set intervals, increasing risk exposure by delaying fund transfer and extending the window for potential fraud or default. Instant settlement transfers funds in real-time, significantly reducing credit risk and enhancing liquidity for businesses by ensuring immediate payment finality. Explore the benefits and challenges of both methods to optimize your payment processing strategy.

Source and External Links

Batch Settlement & Your Merchant Account Explained - Batch settlement processes all transactions a merchant handled within a set time period, usually 24 hours, at once, where funds are actually issued to the merchant only after the batch is settled at day's end.

Batch Settlement | Payments Glossary - Batch settlement is the process, usually at the end of the business day, of sending all stored transaction data to the payment processor, which facilitates fund transfer from customers' accounts to the merchant's account.

What You Need to Know About Batch Settlement - A batch is a group of approved transactions that are settled together by transferring the funds from the issuing bank through the processor to the merchant, typically aggregated over a 24-hour period.

dowidth.com

dowidth.com