Robo advisors utilize advanced algorithms and AI to offer personalized investment advice with lower fees and 24/7 accessibility. Traditional bank relationship managers provide tailored financial guidance based on personal interactions and a comprehensive understanding of clients' unique financial situations. Discover the strengths and differences of both to choose the best option for your financial goals.

Why it is important

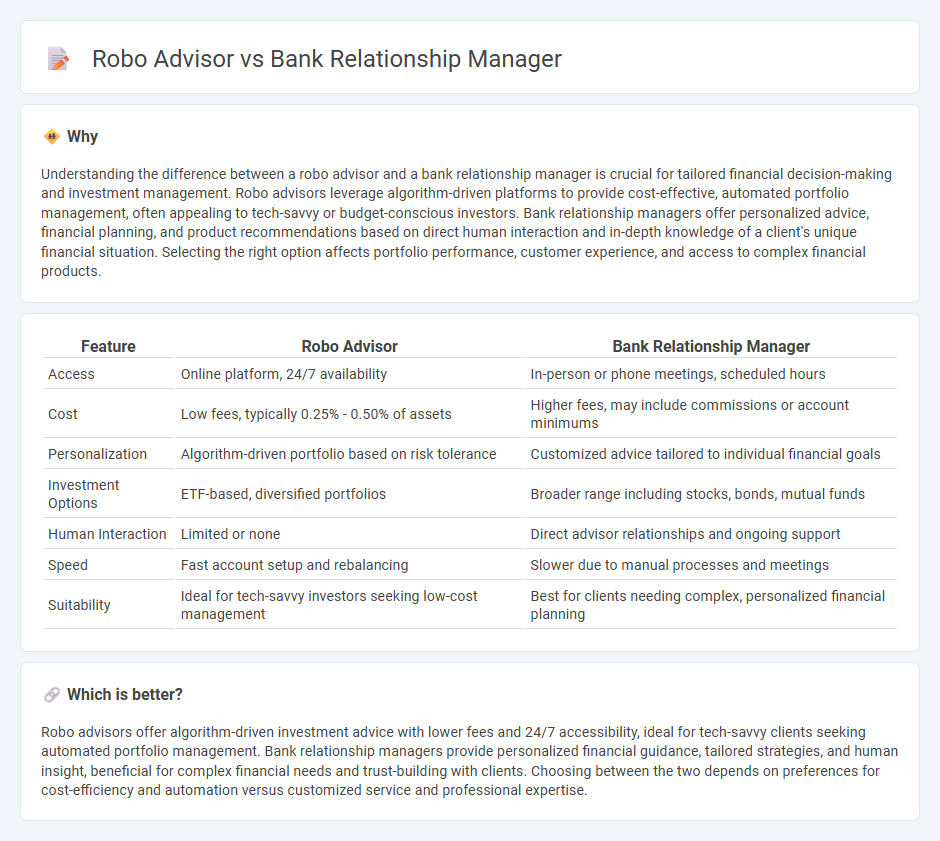

Understanding the difference between a robo advisor and a bank relationship manager is crucial for tailored financial decision-making and investment management. Robo advisors leverage algorithm-driven platforms to provide cost-effective, automated portfolio management, often appealing to tech-savvy or budget-conscious investors. Bank relationship managers offer personalized advice, financial planning, and product recommendations based on direct human interaction and in-depth knowledge of a client's unique financial situation. Selecting the right option affects portfolio performance, customer experience, and access to complex financial products.

Comparison Table

| Feature | Robo Advisor | Bank Relationship Manager |

|---|---|---|

| Access | Online platform, 24/7 availability | In-person or phone meetings, scheduled hours |

| Cost | Low fees, typically 0.25% - 0.50% of assets | Higher fees, may include commissions or account minimums |

| Personalization | Algorithm-driven portfolio based on risk tolerance | Customized advice tailored to individual financial goals |

| Investment Options | ETF-based, diversified portfolios | Broader range including stocks, bonds, mutual funds |

| Human Interaction | Limited or none | Direct advisor relationships and ongoing support |

| Speed | Fast account setup and rebalancing | Slower due to manual processes and meetings |

| Suitability | Ideal for tech-savvy investors seeking low-cost management | Best for clients needing complex, personalized financial planning |

Which is better?

Robo advisors offer algorithm-driven investment advice with lower fees and 24/7 accessibility, ideal for tech-savvy clients seeking automated portfolio management. Bank relationship managers provide personalized financial guidance, tailored strategies, and human insight, beneficial for complex financial needs and trust-building with clients. Choosing between the two depends on preferences for cost-efficiency and automation versus customized service and professional expertise.

Connection

Robo advisors and bank relationship managers complement each other by combining automated investment algorithms with personalized client insights, enhancing wealth management services. Robo advisors provide data-driven portfolio recommendations, while relationship managers offer tailored advice based on individual financial goals and emotional intelligence. This integration optimizes customer experience, blending technology efficiency with human expertise in banking.

Key Terms

**Bank Relationship Manager:**

A Bank Relationship Manager offers personalized financial advice, tailored investment strategies, and in-depth understanding of client needs, fostering trust through direct human interaction. They provide comprehensive support, including managing complex portfolios and addressing unique financial situations that automated systems often cannot fully grasp. Discover how a Bank Relationship Manager can enhance your financial planning with expert guidance.

Personalized Service

Bank relationship managers provide tailored financial advice by understanding clients' unique goals, risk tolerance, and financial histories through direct human interaction. Robo advisors offer automated, algorithm-driven investment management that prioritizes efficiency and low costs but lacks nuanced personalization. Explore how choosing between human expertise and digital automation can impact your financial planning.

Client Portfolio Management

Bank relationship managers provide personalized client portfolio management by tailoring investment strategies based on individual risk profiles, financial goals, and market conditions, leveraging deep human insight and trust-building. Robo advisors use algorithms and AI to manage portfolios with low fees and high efficiency, offering automated rebalancing and tax-loss harvesting but limited customization and emotional understanding. Explore the advantages and limitations of each approach to optimize your client portfolio management strategy.

Source and External Links

A guide for what to expect as a relation manager in a bank - Indeed - A bank relationship manager is responsible for managing interactions between the bank and its clients, focusing on acquiring new clients, retaining existing ones, and providing financial advice to optimize client portfolios and generate income for both the client and the bank.

Banking relationship manager - ACCA career navigator - A banking relationship manager advises clients on investments and financial services, manages diverse client portfolios including high-net-worth individuals and institutions, and must understand clients' financial goals and risk to provide informed recommendations.

Commercial Banking Relationship Manager - Seattle Bank - The role involves ownership of client relationships, consultative financial needs analysis, portfolio management with risk monitoring and compliance, and effective teamwork to ensure exceptional client experiences in commercial banking.

dowidth.com

dowidth.com