Sustainable finance integrates environmental, social, and governance (ESG) criteria into financial decision-making to support long-term economic growth and reduce environmental risks. Socially Responsible Investing (SRI) focuses specifically on ethical considerations, avoiding industries like tobacco or fossil fuels to align investments with moral values. Explore deeper insights to understand how these approaches shape the future of banking and investment strategies.

Why it is important

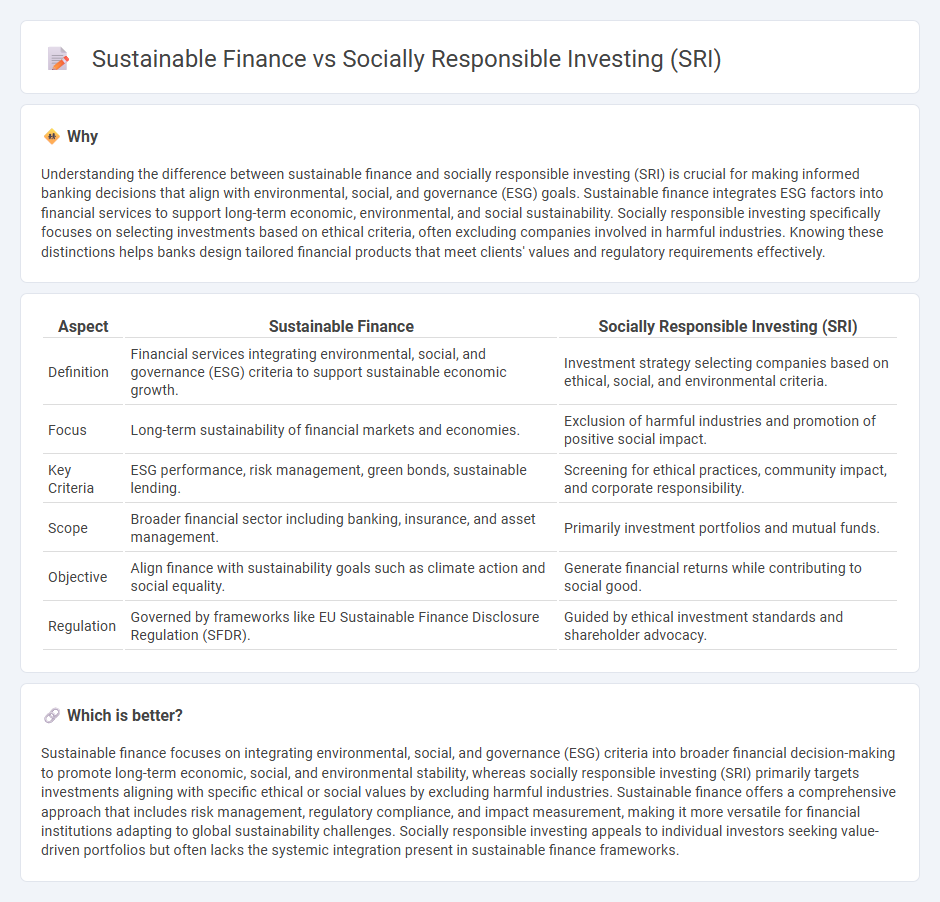

Understanding the difference between sustainable finance and socially responsible investing (SRI) is crucial for making informed banking decisions that align with environmental, social, and governance (ESG) goals. Sustainable finance integrates ESG factors into financial services to support long-term economic, environmental, and social sustainability. Socially responsible investing specifically focuses on selecting investments based on ethical criteria, often excluding companies involved in harmful industries. Knowing these distinctions helps banks design tailored financial products that meet clients' values and regulatory requirements effectively.

Comparison Table

| Aspect | Sustainable Finance | Socially Responsible Investing (SRI) |

|---|---|---|

| Definition | Financial services integrating environmental, social, and governance (ESG) criteria to support sustainable economic growth. | Investment strategy selecting companies based on ethical, social, and environmental criteria. |

| Focus | Long-term sustainability of financial markets and economies. | Exclusion of harmful industries and promotion of positive social impact. |

| Key Criteria | ESG performance, risk management, green bonds, sustainable lending. | Screening for ethical practices, community impact, and corporate responsibility. |

| Scope | Broader financial sector including banking, insurance, and asset management. | Primarily investment portfolios and mutual funds. |

| Objective | Align finance with sustainability goals such as climate action and social equality. | Generate financial returns while contributing to social good. |

| Regulation | Governed by frameworks like EU Sustainable Finance Disclosure Regulation (SFDR). | Guided by ethical investment standards and shareholder advocacy. |

Which is better?

Sustainable finance focuses on integrating environmental, social, and governance (ESG) criteria into broader financial decision-making to promote long-term economic, social, and environmental stability, whereas socially responsible investing (SRI) primarily targets investments aligning with specific ethical or social values by excluding harmful industries. Sustainable finance offers a comprehensive approach that includes risk management, regulatory compliance, and impact measurement, making it more versatile for financial institutions adapting to global sustainability challenges. Socially responsible investing appeals to individual investors seeking value-driven portfolios but often lacks the systemic integration present in sustainable finance frameworks.

Connection

Sustainable finance integrates environmental, social, and governance (ESG) criteria into financial services, promoting investments that support long-term ecological balance and social equity. Socially responsible investing (SRI) is a subset of sustainable finance focusing specifically on selecting assets based on ethical values and positive societal impact. Both approaches drive capital towards enterprises prioritizing sustainability, enhancing risk management and contributing to global goals like the United Nations Sustainable Development Goals (SDGs).

Key Terms

ESG (Environmental, Social, and Governance)

Socially responsible investing (SRI) emphasizes screening investments based on ethical criteria, often excluding companies that do not meet specific environmental, social, or governance (ESG) standards, whereas sustainable finance integrates ESG factors into financial decision-making to promote long-term economic, environmental, and social value. SRI typically centers on avoiding harm, while sustainable finance seeks to generate measurable positive outcomes aligned with global sustainability goals such as the UN Sustainable Development Goals (SDGs). Explore how ESG metrics drive both SRI and sustainable finance strategies to balance profit with purpose.

Impact Investing

Impact investing, a key component of socially responsible investing (SRI), directs capital toward companies and projects generating measurable social and environmental benefits alongside financial returns. Sustainable finance encompasses a broader range of financial services that integrate environmental, social, and governance (ESG) criteria to support long-term economic growth without harming society or the environment. Discover how impact investing bridges SRI and sustainable finance to drive meaningful change.

Green Bonds

Green Bonds play a pivotal role in both Socially Responsible Investing (SRI) and Sustainable Finance by directing capital towards environmental projects that reduce carbon footprints and promote renewable energy. SRI emphasizes ethical investment choices based on social values, while Sustainable Finance integrates environmental, social, and governance (ESG) criteria to foster long-term economic resilience. Explore how Green Bonds create impactful investment opportunities that align both financial returns and environmental objectives.

Source and External Links

Socially responsible investing - Socially responsible investing (SRI) is an investment strategy that seeks to combine financial returns with ethical, social, or environmental goals, often linked to environmental, social, and governance (ESG) criteria, and may include positive impact investing and shareholder advocacy.

What Is Socially Responsible Investing (SRI) and How to ... - SRI aims to generate both social change and financial returns by investing in companies with positive sustainable or social impact, such as renewable energy firms, while excluding those causing negative impact; it is also known as values-based, sustainable, or ethical investing.

Socially Responsible Investment (SRI) - Overview, Types - SRI is an investment strategy focused on achieving financial gains alongside positive societal and environmental impact by considering ethical, social, and environmental factors in portfolio decisions.

dowidth.com

dowidth.com