Virtual cards provide enhanced security by generating temporary card numbers for online transactions, reducing the risk of fraud compared to traditional credit cards. Credit cards offer broader acceptance worldwide and often come with rewards programs, purchase protections, and credit-building opportunities. Explore the key differences between virtual cards and credit cards to choose the best payment solution for your needs.

Why it is important

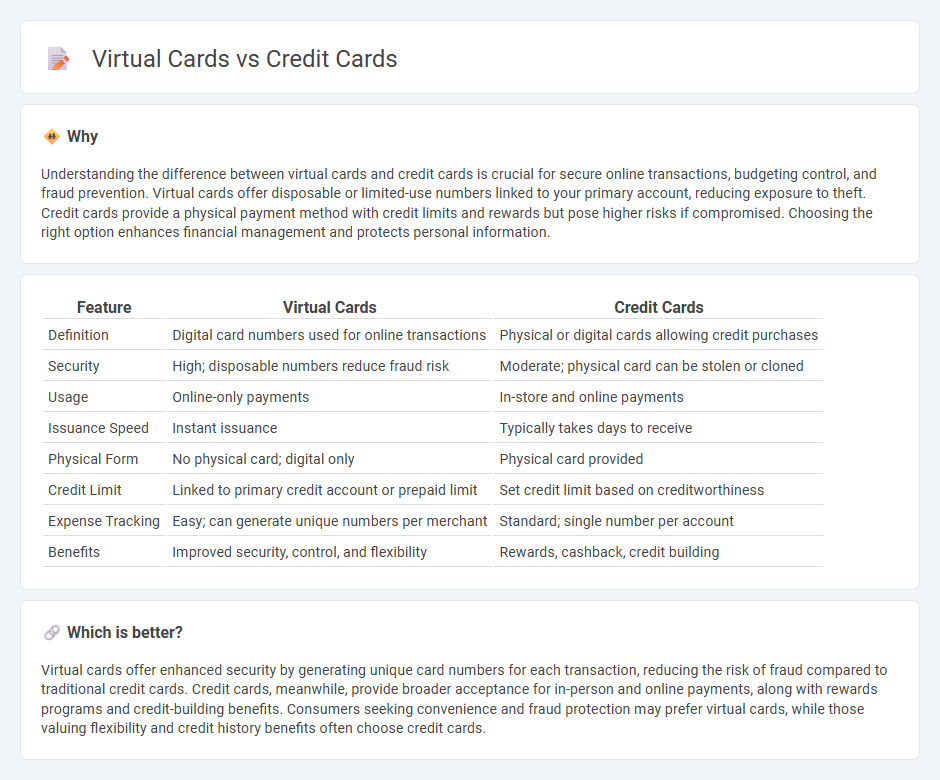

Understanding the difference between virtual cards and credit cards is crucial for secure online transactions, budgeting control, and fraud prevention. Virtual cards offer disposable or limited-use numbers linked to your primary account, reducing exposure to theft. Credit cards provide a physical payment method with credit limits and rewards but pose higher risks if compromised. Choosing the right option enhances financial management and protects personal information.

Comparison Table

| Feature | Virtual Cards | Credit Cards |

|---|---|---|

| Definition | Digital card numbers used for online transactions | Physical or digital cards allowing credit purchases |

| Security | High; disposable numbers reduce fraud risk | Moderate; physical card can be stolen or cloned |

| Usage | Online-only payments | In-store and online payments |

| Issuance Speed | Instant issuance | Typically takes days to receive |

| Physical Form | No physical card; digital only | Physical card provided |

| Credit Limit | Linked to primary credit account or prepaid limit | Set credit limit based on creditworthiness |

| Expense Tracking | Easy; can generate unique numbers per merchant | Standard; single number per account |

| Benefits | Improved security, control, and flexibility | Rewards, cashback, credit building |

Which is better?

Virtual cards offer enhanced security by generating unique card numbers for each transaction, reducing the risk of fraud compared to traditional credit cards. Credit cards, meanwhile, provide broader acceptance for in-person and online payments, along with rewards programs and credit-building benefits. Consumers seeking convenience and fraud protection may prefer virtual cards, while those valuing flexibility and credit history benefits often choose credit cards.

Connection

Virtual cards and credit cards are connected through their shared use of credit card networks, allowing virtual cards to function as digital counterparts for secure online transactions. Virtual cards are essentially temporary, digitally generated credit card numbers linked to a primary credit card account, enhancing fraud protection and spending control. This integration enables users to make seamless payments while maintaining the benefits and protections of traditional credit cards.

Key Terms

Fraud Protection

Credit cards offer robust fraud protection through zero-liability policies and real-time monitoring by issuers, providing consumers with strong safeguards against unauthorized transactions. Virtual cards enhance security by generating unique card numbers for each transaction, reducing exposure of actual card details and minimizing the risk of fraudulent use. Discover more about how these payment methods protect your financial information and help you choose the right option for secure spending.

Issuance Process

Credit card issuance typically involves a thorough credit check, application review, and physical card production, leading to a waiting period of several days. Virtual cards are generated instantly through digital platforms or banking apps, eliminating the need for physical delivery and credit approval in some cases. Explore how these differences impact convenience and security in your payment methods.

Source and External Links

Best Credit Cards | July 2025 - Credit Karma - Offers a comprehensive list of the best credit cards across categories like no annual fee, cash back, travel, rewards, low interest, balance transfers, building credit, secured and student credit cards to help you find the right fit for your financial goals.

Credit Cards for Rebuilding Credit - Mastercard - Provides options for credit cards designed to help rebuild credit, such as the Capital One Platinum Secured Credit Card which requires a refundable security deposit and offers no annual fee.

Credit cards: Find the Right Card For You at Creditcards.com - Allows you to compare various credit cards focused on balance transfers, rewards, and low interest rates, including reviews of popular cards like the Citi(r) Diamond Preferred(r) Card known for its long introductory balance transfer offer.

dowidth.com

dowidth.com