Neobanking refers to fully digital banks that operate without physical branches, offering seamless online financial services primarily through mobile apps. Fintech encompasses a broader range of technology-driven financial innovations, including payment platforms, lending solutions, and investment tools designed to enhance traditional banking experiences. Explore how neobanks and fintech companies are transforming the future of finance for individuals and businesses.

Why it is important

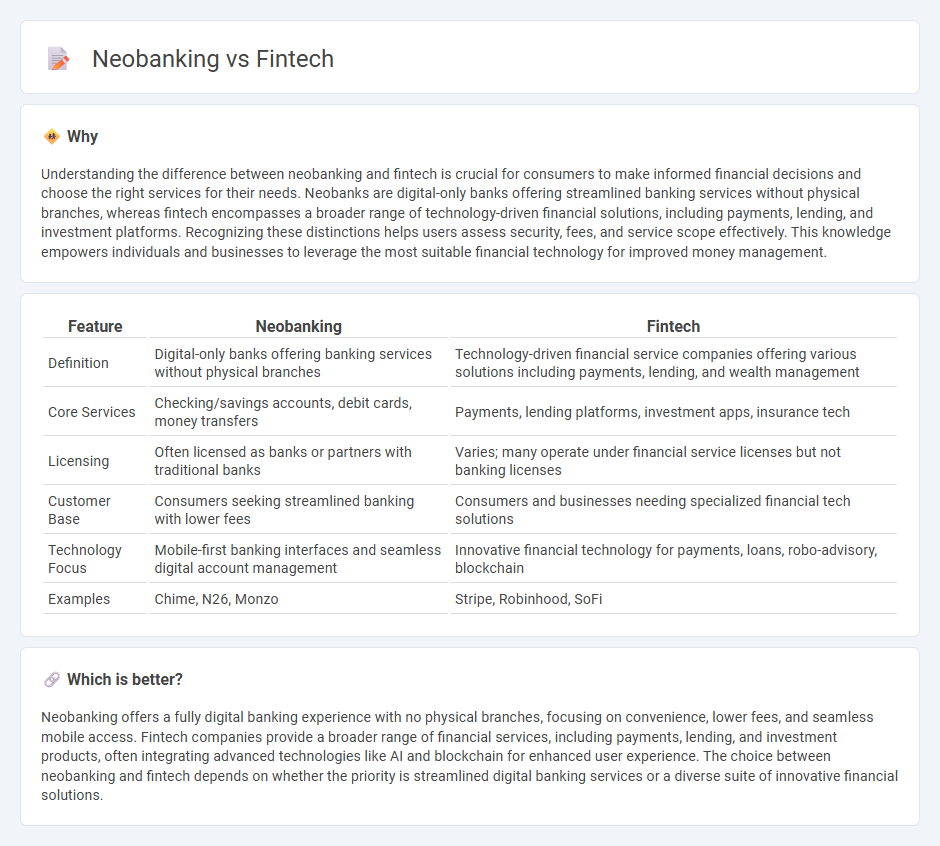

Understanding the difference between neobanking and fintech is crucial for consumers to make informed financial decisions and choose the right services for their needs. Neobanks are digital-only banks offering streamlined banking services without physical branches, whereas fintech encompasses a broader range of technology-driven financial solutions, including payments, lending, and investment platforms. Recognizing these distinctions helps users assess security, fees, and service scope effectively. This knowledge empowers individuals and businesses to leverage the most suitable financial technology for improved money management.

Comparison Table

| Feature | Neobanking | Fintech |

|---|---|---|

| Definition | Digital-only banks offering banking services without physical branches | Technology-driven financial service companies offering various solutions including payments, lending, and wealth management |

| Core Services | Checking/savings accounts, debit cards, money transfers | Payments, lending platforms, investment apps, insurance tech |

| Licensing | Often licensed as banks or partners with traditional banks | Varies; many operate under financial service licenses but not banking licenses |

| Customer Base | Consumers seeking streamlined banking with lower fees | Consumers and businesses needing specialized financial tech solutions |

| Technology Focus | Mobile-first banking interfaces and seamless digital account management | Innovative financial technology for payments, loans, robo-advisory, blockchain |

| Examples | Chime, N26, Monzo | Stripe, Robinhood, SoFi |

Which is better?

Neobanking offers a fully digital banking experience with no physical branches, focusing on convenience, lower fees, and seamless mobile access. Fintech companies provide a broader range of financial services, including payments, lending, and investment products, often integrating advanced technologies like AI and blockchain for enhanced user experience. The choice between neobanking and fintech depends on whether the priority is streamlined digital banking services or a diverse suite of innovative financial solutions.

Connection

Neobanking leverages fintech innovations to deliver digital-first financial services without traditional branch networks, enhancing user experience through seamless mobile and online platforms. Fintech's advancements in AI, blockchain, and data analytics empower neobanks to offer personalized banking products, faster transactions, and improved security. This synergy accelerates financial inclusion by providing accessible, efficient, and cost-effective banking solutions to underserved markets.

Key Terms

Digital-Only Banking

Digital-only banking, a core aspect of neobanking, operates exclusively online without traditional physical branches, offering streamlined services like instant account setup, mobile payments, and AI-driven customer support. Fintech encompasses a broader range of financial technologies, including payment platforms, lending apps, and blockchain innovations, often integrating with neobanks to enhance banking efficiency. Explore the evolving landscape of digital-only banking to understand its impact on financial services and consumer convenience.

API Integration

API integration in fintech enables seamless connectivity between diverse financial services, enhancing efficiency and user experience across platforms. Neobanks leverage robust API frameworks to integrate third-party services swiftly, offering personalized banking solutions without extensive legacy systems. Explore the evolving role of API integration to unlock new potentials in fintech and neobanking innovation.

Financial Technology Platforms

Financial technology platforms prioritize innovative digital solutions to enhance financial services, while neobanks operate exclusively online, offering streamlined banking without physical branches. Fintech platforms cover broader services like payments, lending, and wealth management, leveraging APIs and AI for personalized user experiences. Discover how these evolving financial technologies reshape modern banking and investment by exploring our detailed insights.

Source and External Links

What is Fintech? | IBM - Fintech refers to mobile applications, software, and technology enabling individuals and enterprises to access and manage finances, including personal finance, investing, lending, often enhanced by AI and machine learning for smarter decisions.

What is fintech? 6 main types of fintech and how they work - Fintech includes a broad range of technologies such as neobanks, digital payments, lending platforms, and financial management apps used across B2B, B2C, and P2P markets to digitize financial services and improve accessibility.

Financial technology - Fintech encompasses innovations applied across diverse financial categories like banking, payments, lending, investment, insurtech, blockchain, regtech, and infrastructure, creating new services and markets by leveraging technology such as blockchain and machine learning.

dowidth.com

dowidth.com