Digital KYC leverages online document verification and automated identity checks to streamline customer onboarding while maintaining regulatory compliance. Biometric KYC enhances security by using unique physiological traits such as fingerprints or facial recognition to accurately verify identities and prevent fraud. Explore the differences and benefits of digital versus biometric KYC to optimize your banking security and user experience.

Why it is important

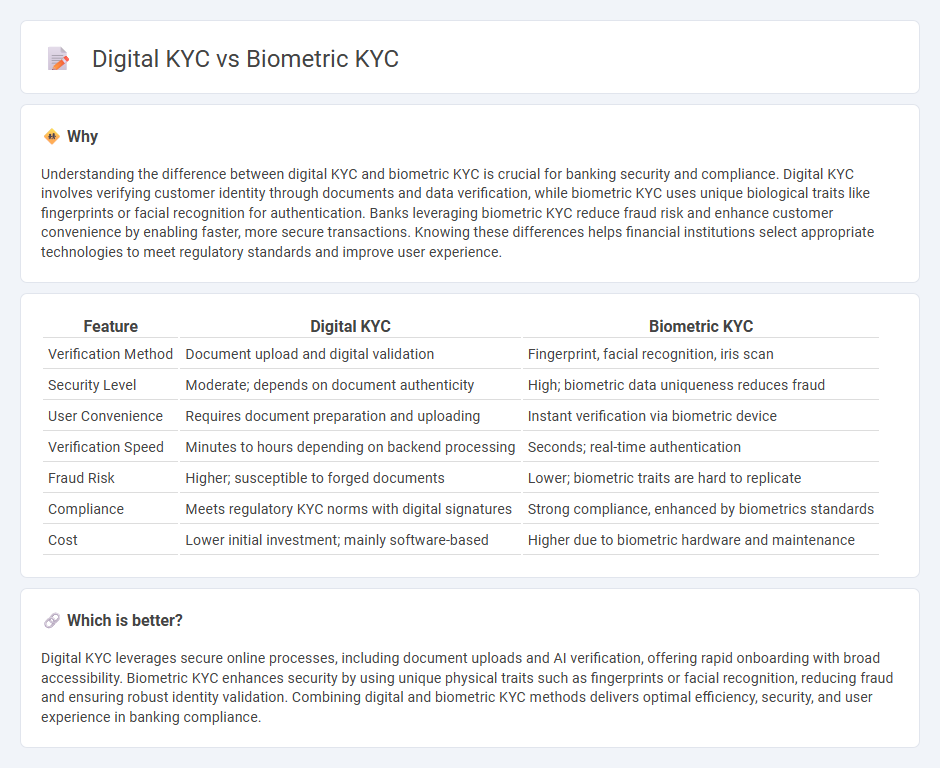

Understanding the difference between digital KYC and biometric KYC is crucial for banking security and compliance. Digital KYC involves verifying customer identity through documents and data verification, while biometric KYC uses unique biological traits like fingerprints or facial recognition for authentication. Banks leveraging biometric KYC reduce fraud risk and enhance customer convenience by enabling faster, more secure transactions. Knowing these differences helps financial institutions select appropriate technologies to meet regulatory standards and improve user experience.

Comparison Table

| Feature | Digital KYC | Biometric KYC |

|---|---|---|

| Verification Method | Document upload and digital validation | Fingerprint, facial recognition, iris scan |

| Security Level | Moderate; depends on document authenticity | High; biometric data uniqueness reduces fraud |

| User Convenience | Requires document preparation and uploading | Instant verification via biometric device |

| Verification Speed | Minutes to hours depending on backend processing | Seconds; real-time authentication |

| Fraud Risk | Higher; susceptible to forged documents | Lower; biometric traits are hard to replicate |

| Compliance | Meets regulatory KYC norms with digital signatures | Strong compliance, enhanced by biometrics standards |

| Cost | Lower initial investment; mainly software-based | Higher due to biometric hardware and maintenance |

Which is better?

Digital KYC leverages secure online processes, including document uploads and AI verification, offering rapid onboarding with broad accessibility. Biometric KYC enhances security by using unique physical traits such as fingerprints or facial recognition, reducing fraud and ensuring robust identity validation. Combining digital and biometric KYC methods delivers optimal efficiency, security, and user experience in banking compliance.

Connection

Digital KYC integrates biometric KYC by using biometric data such as fingerprints, facial recognition, or iris scans to verify customer identity securely and swiftly. This synergy enhances fraud prevention while streamlining the onboarding process for banks, providing a seamless, compliant digital verification experience. Biometric KYC methods improve accuracy and reduce reliance on physical documents, aligning with digital KYC's goal of efficient, remote customer authentication.

Key Terms

Authentication methods

Biometric KYC leverages unique physiological traits such as fingerprints, facial recognition, or iris scans to authenticate user identities with high precision, reducing fraud and enhancing security. Digital KYC employs electronic documents, OTPs (One-Time Passwords), and knowledge-based verification, offering flexibility and convenience but with varying levels of risk depending on implementation. Explore cutting-edge advancements in KYC authentication methods to optimize security and user experience.

Customer identification

Biometric KYC leverages unique physiological traits such as fingerprints, facial recognition, or iris scans to ensure highly accurate customer identification, minimizing fraud risks. Digital KYC utilizes document verification and data validation through online platforms but may rely on less distinctive identifiers, potentially increasing error margins. Explore how integrating both methods can optimize secure and efficient customer identification in your KYC processes.

Regulatory compliance

Biometric KYC enhances regulatory compliance by leveraging unique physical characteristics such as fingerprints or facial recognition to ensure accurate identity verification and reduce fraud risk. Digital KYC utilizes electronic document verification and data analytics to streamline customer onboarding while adhering to Know Your Customer (KYC) regulations and anti-money laundering (AML) standards. Explore how these innovative KYC methods align with global compliance frameworks and revolutionize customer identity verification.

Source and External Links

How Biometric Verification Strengthens KYC Compliance for ... - Biometric KYC uses unique physical traits like fingerprints and facial recognition to enhance identity verification, prevent fraud, ensure AML compliance, and improve customer experience in financial institutions.

Biometric KYC for AML Compliance - Biometric KYC leverages physiological traits (e.g., facial scans, fingerprinting) to secure identity verification, speed up onboarding, and meet anti-money laundering regulatory requirements effectively.

Biometric Authentication for Customer Verification (KYC) - Biometric identification such as face and voice recognition improves security and usability in KYC processes by reducing fraud risks and simplifying customer verification for banking and online services.

dowidth.com

dowidth.com