Loyalty fintech companies leverage advanced data analytics and personalized rewards to enhance customer retention and engagement in the banking sector. Branchless banks operate entirely online, offering seamless digital services without physical branches, emphasizing convenience and cost efficiency. Explore the evolving landscape of loyalty fintech and branchless banks to understand their impact on modern banking.

Why it is important

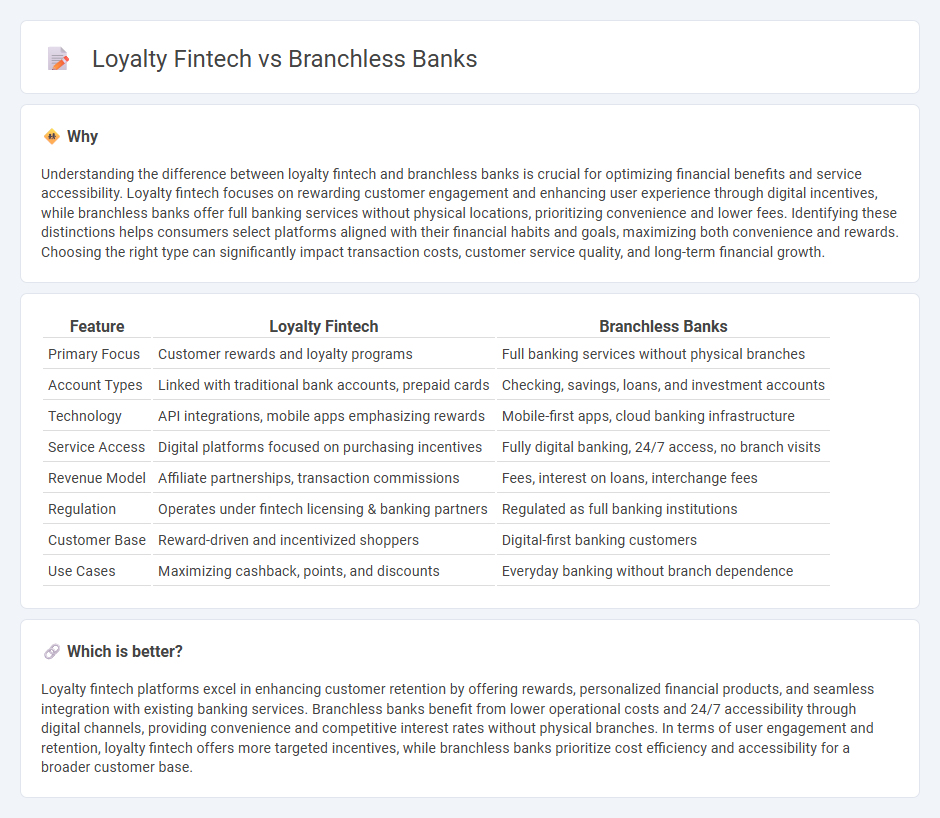

Understanding the difference between loyalty fintech and branchless banks is crucial for optimizing financial benefits and service accessibility. Loyalty fintech focuses on rewarding customer engagement and enhancing user experience through digital incentives, while branchless banks offer full banking services without physical locations, prioritizing convenience and lower fees. Identifying these distinctions helps consumers select platforms aligned with their financial habits and goals, maximizing both convenience and rewards. Choosing the right type can significantly impact transaction costs, customer service quality, and long-term financial growth.

Comparison Table

| Feature | Loyalty Fintech | Branchless Banks |

|---|---|---|

| Primary Focus | Customer rewards and loyalty programs | Full banking services without physical branches |

| Account Types | Linked with traditional bank accounts, prepaid cards | Checking, savings, loans, and investment accounts |

| Technology | API integrations, mobile apps emphasizing rewards | Mobile-first apps, cloud banking infrastructure |

| Service Access | Digital platforms focused on purchasing incentives | Fully digital banking, 24/7 access, no branch visits |

| Revenue Model | Affiliate partnerships, transaction commissions | Fees, interest on loans, interchange fees |

| Regulation | Operates under fintech licensing & banking partners | Regulated as full banking institutions |

| Customer Base | Reward-driven and incentivized shoppers | Digital-first banking customers |

| Use Cases | Maximizing cashback, points, and discounts | Everyday banking without branch dependence |

Which is better?

Loyalty fintech platforms excel in enhancing customer retention by offering rewards, personalized financial products, and seamless integration with existing banking services. Branchless banks benefit from lower operational costs and 24/7 accessibility through digital channels, providing convenience and competitive interest rates without physical branches. In terms of user engagement and retention, loyalty fintech offers more targeted incentives, while branchless banks prioritize cost efficiency and accessibility for a broader customer base.

Connection

Loyalty fintech integrates advanced rewards programs within branchless banks, enhancing customer retention through seamless digital experiences. Branchless banks leverage fintech innovations to offer personalized incentives and real-time rewards without physical branches, driving higher engagement and satisfaction. This synergy transforms traditional banking by combining loyalty strategies with digital-first, branchless banking models.

Key Terms

Branchless Banks:

Branchless banks leverage digital platforms to offer seamless banking services without physical branches, reducing operational costs and providing customers with 24/7 access to accounts, loans, and payments through mobile apps. These banks utilize advanced AI-driven customer support and biometric authentication to enhance security and user experience while maintaining competitive interest rates and minimal fees. Explore more to understand how branchless banks are transforming financial inclusion and reshaping traditional banking models.

Digital Onboarding

Branchless banks leverage advanced digital onboarding solutions to provide seamless, frictionless account opening experiences, reducing customer acquisition costs and enhancing user satisfaction. Loyalty fintech platforms integrate personalized rewards within their onboarding processes to boost engagement and retain customers from the first interaction. Discover how innovative digital onboarding strategies transform customer loyalty and banking experiences.

Mobile Banking

Branchless banks leverage digital platforms to provide seamless mobile banking experiences with reduced overhead costs, resulting in lower fees and better interest rates for customers. Loyalty fintech integrates rewards and personalized offers directly into mobile banking apps, enhancing user engagement and promoting financial habits through gamification and incentives. Discover how these innovations are transforming mobile banking convenience and customer loyalty.

Source and External Links

What is Branchless Banking? Meaning and Benefits - This article discusses branchless banking as a model that provides financial services without physical branches, leveraging digital channels like mobile and internet banking.

Branchless Banking is what revolutionizing the African banks - This piece highlights branchless banking, or agency banking, as a financial model that significantly increases financial inclusion in Africa by utilizing mobile technology and agent networks.

Branchless Banking: Evolution, Challenges and Potential - This article talks about the evolution of branchless banking, which has been around for nearly 25 years, offering convenience and cost savings, but also facing challenges like security threats.

dowidth.com

dowidth.com