Pay by bank offers a secure and efficient alternative to cash transactions by enabling direct transfers from a customer's bank account, reducing the risk of theft and eliminating the need to handle physical money. This method provides faster processing times, enhanced transaction tracking, and greater convenience for both merchants and consumers. Explore how pay by bank is transforming payment solutions compared to traditional cash usage.

Why it is important

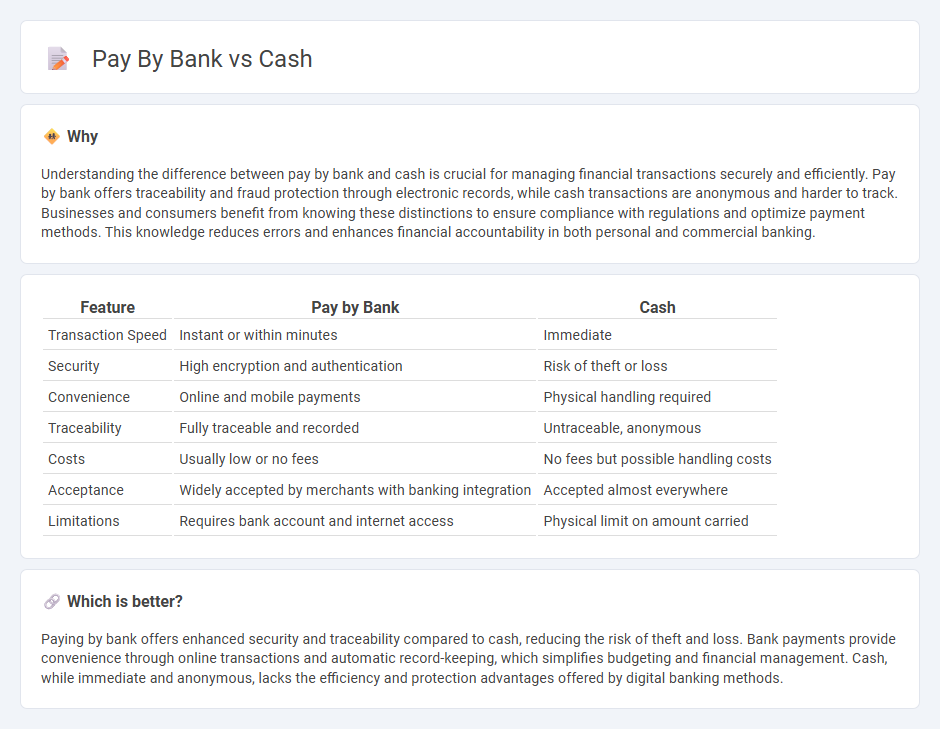

Understanding the difference between pay by bank and cash is crucial for managing financial transactions securely and efficiently. Pay by bank offers traceability and fraud protection through electronic records, while cash transactions are anonymous and harder to track. Businesses and consumers benefit from knowing these distinctions to ensure compliance with regulations and optimize payment methods. This knowledge reduces errors and enhances financial accountability in both personal and commercial banking.

Comparison Table

| Feature | Pay by Bank | Cash |

|---|---|---|

| Transaction Speed | Instant or within minutes | Immediate |

| Security | High encryption and authentication | Risk of theft or loss |

| Convenience | Online and mobile payments | Physical handling required |

| Traceability | Fully traceable and recorded | Untraceable, anonymous |

| Costs | Usually low or no fees | No fees but possible handling costs |

| Acceptance | Widely accepted by merchants with banking integration | Accepted almost everywhere |

| Limitations | Requires bank account and internet access | Physical limit on amount carried |

Which is better?

Paying by bank offers enhanced security and traceability compared to cash, reducing the risk of theft and loss. Bank payments provide convenience through online transactions and automatic record-keeping, which simplifies budgeting and financial management. Cash, while immediate and anonymous, lacks the efficiency and protection advantages offered by digital banking methods.

Connection

Pay by bank and cash connect through the fundamental role of currency as a liquidity medium, where pay by bank methods digitally transfer fiat currency from one account to another, reflecting electronic equivalents of physical cash. Both methods serve as primary transaction tools in the banking ecosystem, enabling consumer purchases, bill payments, and business settlements. Banks facilitate these transactions by providing secure accounts and payment infrastructures, bridging physical cash and digital payment options in the economy.

Key Terms

Liquidity

Cash offers immediate liquidity by providing instant access to funds for transactions without delays. Paying by bank often involves processing times, which can temporarily reduce available liquidity in business operations. Explore the benefits and impacts of cash versus bank payments to optimize your financial liquidity management.

Settlement

Cash settlements involve immediate exchange of physical currency, ensuring instant transaction finality and zero counterparty risk. Pay by bank settlements rely on electronic fund transfers that may require several processing hours or days, offering enhanced security and traceability through bank verification systems. Explore the advantages and considerations of each method to optimize your settlement process.

Authorization

Cash payments provide instant authorization through physical exchange, eliminating the need for electronic validation. Pay by bank methods rely on real-time digital authorization via bank networks, ensuring secure and verified transactions. Discover the nuances of authorization processes in different payment methods to choose the best fit for your business.

Source and External Links

Cash - Wikipedia - Cash is physical money in forms like banknotes and coins, held for motives including transactions, precaution, and speculation, and valued for its anonymity, trust, and inclusiveness in economic life.

Cash App - Wikipedia - Cash App is a digital wallet and mobile payment service by Block, Inc., launched in 2013, allowing users to send, save, invest money, access debit cards, and more, with over 57 million users as of 2024.

Cash App: Mobile Banking on the App Store - Cash App offers easy mobile banking features including peer-to-peer payments, customizable debit cards, direct deposits with early paychecks, and investment options in stocks and bitcoin.

dowidth.com

dowidth.com