Digital onboarding leverages biometric authentication, AI-driven identity verification, and real-time data validation to streamline customer acquisition, significantly reducing processing time compared to traditional in-person verification methods. In-person verification requires physical documentation review and face-to-face interaction, leading to longer wait times and higher operational costs for banks. Explore how these contrasting approaches impact security, customer experience, and operational efficiency in modern banking.

Why it is important

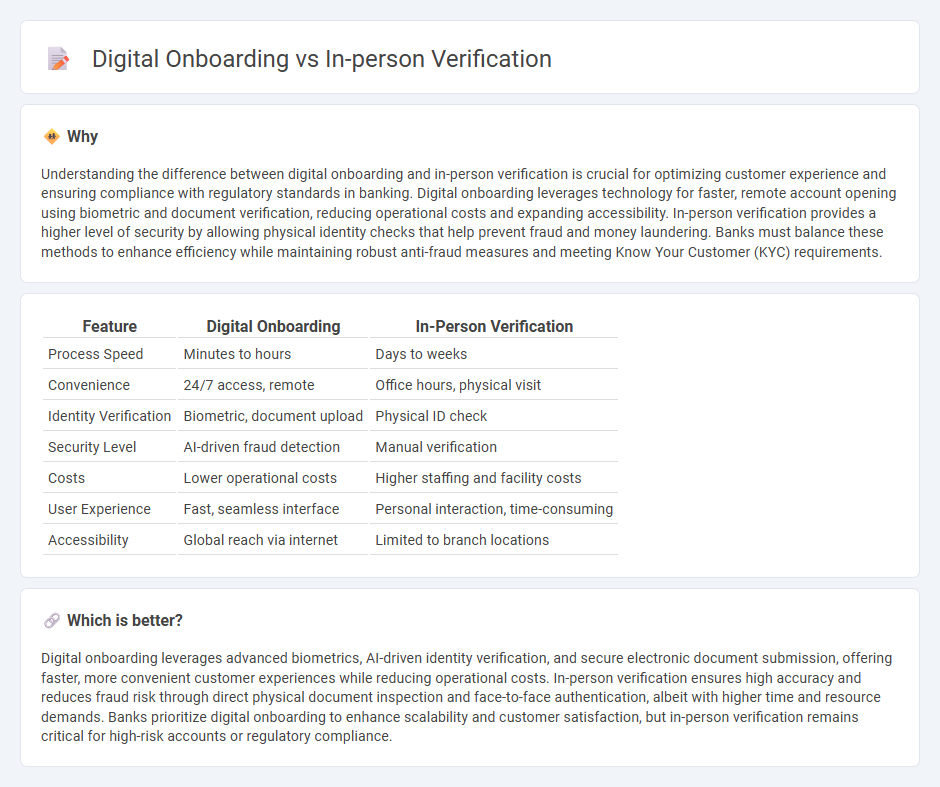

Understanding the difference between digital onboarding and in-person verification is crucial for optimizing customer experience and ensuring compliance with regulatory standards in banking. Digital onboarding leverages technology for faster, remote account opening using biometric and document verification, reducing operational costs and expanding accessibility. In-person verification provides a higher level of security by allowing physical identity checks that help prevent fraud and money laundering. Banks must balance these methods to enhance efficiency while maintaining robust anti-fraud measures and meeting Know Your Customer (KYC) requirements.

Comparison Table

| Feature | Digital Onboarding | In-Person Verification |

|---|---|---|

| Process Speed | Minutes to hours | Days to weeks |

| Convenience | 24/7 access, remote | Office hours, physical visit |

| Identity Verification | Biometric, document upload | Physical ID check |

| Security Level | AI-driven fraud detection | Manual verification |

| Costs | Lower operational costs | Higher staffing and facility costs |

| User Experience | Fast, seamless interface | Personal interaction, time-consuming |

| Accessibility | Global reach via internet | Limited to branch locations |

Which is better?

Digital onboarding leverages advanced biometrics, AI-driven identity verification, and secure electronic document submission, offering faster, more convenient customer experiences while reducing operational costs. In-person verification ensures high accuracy and reduces fraud risk through direct physical document inspection and face-to-face authentication, albeit with higher time and resource demands. Banks prioritize digital onboarding to enhance scalability and customer satisfaction, but in-person verification remains critical for high-risk accounts or regulatory compliance.

Connection

Digital onboarding streamlines customer registration by collecting personal data and documents online, while in-person verification ensures security through biometric checks or ID validation at physical branches. This hybrid approach enhances fraud prevention and regulatory compliance by linking remote digital inputs with tangible identity confirmation. Financial institutions benefit from faster customer acquisition and improved trust by integrating both digital onboarding and in-person verification processes.

Key Terms

KYC (Know Your Customer)

In-person verification ensures robust identity validation through physical document inspection and biometric checks, reducing fraud risks in KYC processes. Digital onboarding leverages AI-driven facial recognition and document scanning to enhance customer convenience while maintaining compliance with regulatory standards. Explore detailed comparisons to understand which KYC method suits your business needs best.

Biometric Authentication

In-person verification relies on physical presence to authenticate identity, whereas digital onboarding increasingly leverages biometric authentication like facial recognition, fingerprint scanning, or voice recognition to ensure secure, seamless user access. Biometric methods provide heightened security and convenience by using unique physiological traits, reducing fraud risks compared to traditional ID checks. Explore the advantages and challenges of biometric authentication in modern digital onboarding processes to optimize security and user experience.

Document Verification

Document verification in in-person verification involves physical inspection of original identification materials by trained personnel to ensure authenticity and reduce fraud. Digital onboarding uses advanced technologies such as Optical Character Recognition (OCR), biometric authentication, and AI-driven validation to swiftly verify documents uploaded electronically. Explore detailed comparisons and best practices to optimize your verification process.

Source and External Links

Verifying your identity in person - ID.me Help Center - In-person verification requires booking an appointment or walk-in online, bringing 2-3 identity documents and a QR code to a retail location, and consenting to biometric data collection for identity confirmation in person.

Verify your identity in person | Login.gov - Login.gov offers in-person identity verification at participating U.S. Post Offices by scanning a barcode and reviewing identity documents with a retail associate to complete identity proofing.

In-Person Verification: Enhancing security and trust - HyperVerge - In-person verification (IPV) is a physical KYC process to verify a person's real identity and documents through physical presence, document checks, and often biometric validation like video calls, mandated by regulatory bodies like SEBI.

dowidth.com

dowidth.com