Personal finance automation simplifies budgeting, bill payments, and savings by using technology to manage day-to-day financial tasks efficiently, reducing errors and saving time. Investment portfolio rebalancing involves periodically adjusting asset allocations to maintain desired risk levels and optimize returns, ensuring alignment with financial goals and market conditions. Discover how these strategies enhance financial health and decision-making by exploring their key benefits.

Why it is important

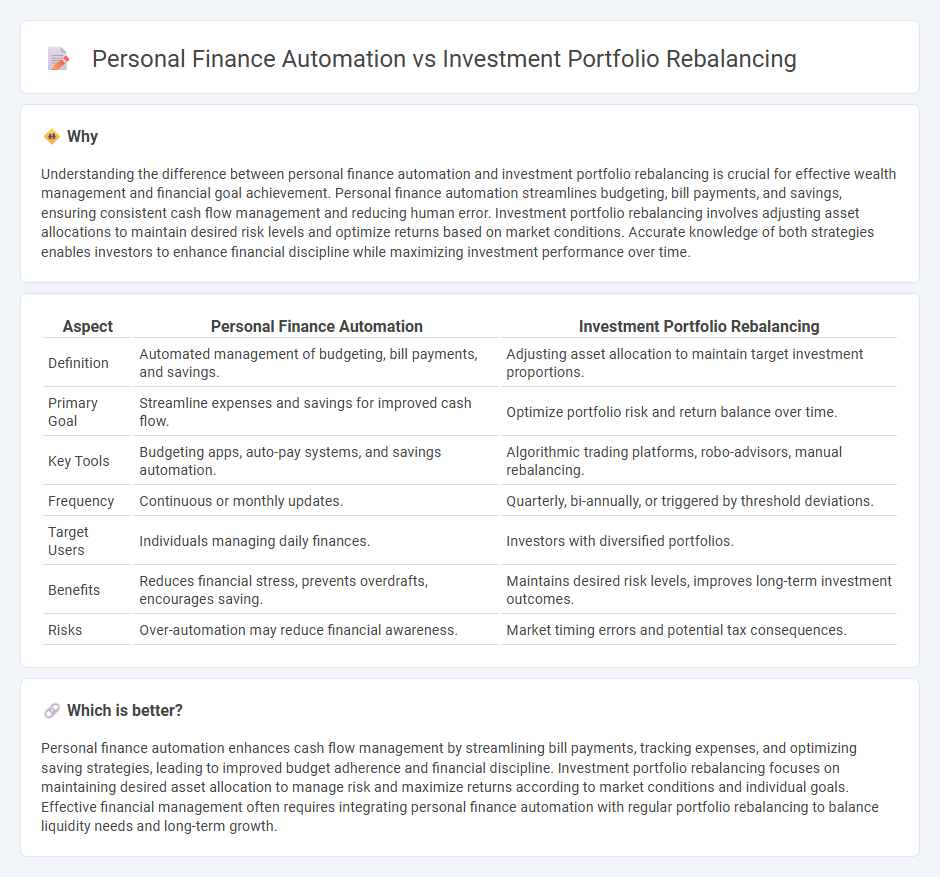

Understanding the difference between personal finance automation and investment portfolio rebalancing is crucial for effective wealth management and financial goal achievement. Personal finance automation streamlines budgeting, bill payments, and savings, ensuring consistent cash flow management and reducing human error. Investment portfolio rebalancing involves adjusting asset allocations to maintain desired risk levels and optimize returns based on market conditions. Accurate knowledge of both strategies enables investors to enhance financial discipline while maximizing investment performance over time.

Comparison Table

| Aspect | Personal Finance Automation | Investment Portfolio Rebalancing |

|---|---|---|

| Definition | Automated management of budgeting, bill payments, and savings. | Adjusting asset allocation to maintain target investment proportions. |

| Primary Goal | Streamline expenses and savings for improved cash flow. | Optimize portfolio risk and return balance over time. |

| Key Tools | Budgeting apps, auto-pay systems, and savings automation. | Algorithmic trading platforms, robo-advisors, manual rebalancing. |

| Frequency | Continuous or monthly updates. | Quarterly, bi-annually, or triggered by threshold deviations. |

| Target Users | Individuals managing daily finances. | Investors with diversified portfolios. |

| Benefits | Reduces financial stress, prevents overdrafts, encourages saving. | Maintains desired risk levels, improves long-term investment outcomes. |

| Risks | Over-automation may reduce financial awareness. | Market timing errors and potential tax consequences. |

Which is better?

Personal finance automation enhances cash flow management by streamlining bill payments, tracking expenses, and optimizing saving strategies, leading to improved budget adherence and financial discipline. Investment portfolio rebalancing focuses on maintaining desired asset allocation to manage risk and maximize returns according to market conditions and individual goals. Effective financial management often requires integrating personal finance automation with regular portfolio rebalancing to balance liquidity needs and long-term growth.

Connection

Personal finance automation streamlines budgeting, savings, and expense tracking, enabling investors to maintain consistent contributions to their investment portfolios. Investment portfolio rebalancing adjusts asset allocations periodically to align with target risk levels, ensuring portfolio performance remains optimized over time. Automated financial tools facilitate timely rebalancing by providing real-time data and triggering trades based on predefined criteria, linking these processes for improved wealth management.

Key Terms

**Investment Portfolio Rebalancing:**

Investment portfolio rebalancing involves regularly adjusting asset allocations to maintain a target risk level and optimize returns, often based on changing market conditions or investment goals. It helps manage risk by realigning investments such as stocks, bonds, and other assets to their intended proportions, preventing overexposure to any one asset class. Discover how strategic rebalancing can enhance your long-term investment performance and risk management.

Asset Allocation

Investment portfolio rebalancing involves adjusting asset allocation to maintain target risk levels and optimize returns by periodically buying or selling assets. Personal finance automation leverages technology to manage savings, bill payments, and investments seamlessly, indirectly supporting asset allocation discipline without manual intervention. Explore how combining these strategies can enhance your financial growth and stability.

Risk Tolerance

Investment portfolio rebalancing involves adjusting asset allocations to maintain desired risk tolerance levels, ensuring alignment with financial goals and market fluctuations. Personal finance automation streamlines managing expenses, savings, and investments, but may lack the nuanced adaptation to changes in risk appetite that manual rebalancing provides. Explore how combining strategic rebalancing with automation can optimize both risk management and financial efficiency.

Source and External Links

Rebalancing your investments - Rebalancing involves adjusting your portfolio by buying and selling assets to realign with your target asset allocation, ensuring your strategy stays on track despite market changes.

What is Portfolio Rebalancing and Why Should You Care? - Portfolio rebalancing means selling assets that have become overrepresented and buying those that are underrepresented to maintain your desired risk level and investment goals as markets shift.

What's The Best Approach for Portfolio Rebalancing? - Rebalancing typically boosts long-term returns and reduces risk by systematically selling outperforming assets and reinvesting in underperforming ones, often using threshold-based triggers for action.

dowidth.com

dowidth.com