Banking as a Service (BaaS) enables non-bank businesses to offer financial products by integrating licensed bank services via APIs, streamlining customer access to payments, loans, and accounts. Banking as a Solution focuses on end-to-end digital banking platforms designed for financial institutions to enhance user experience, improve operational efficiency, and comply with regulations. Explore the distinctions and benefits of BaaS and banking solutions to optimize your financial technology strategy.

Why it is important

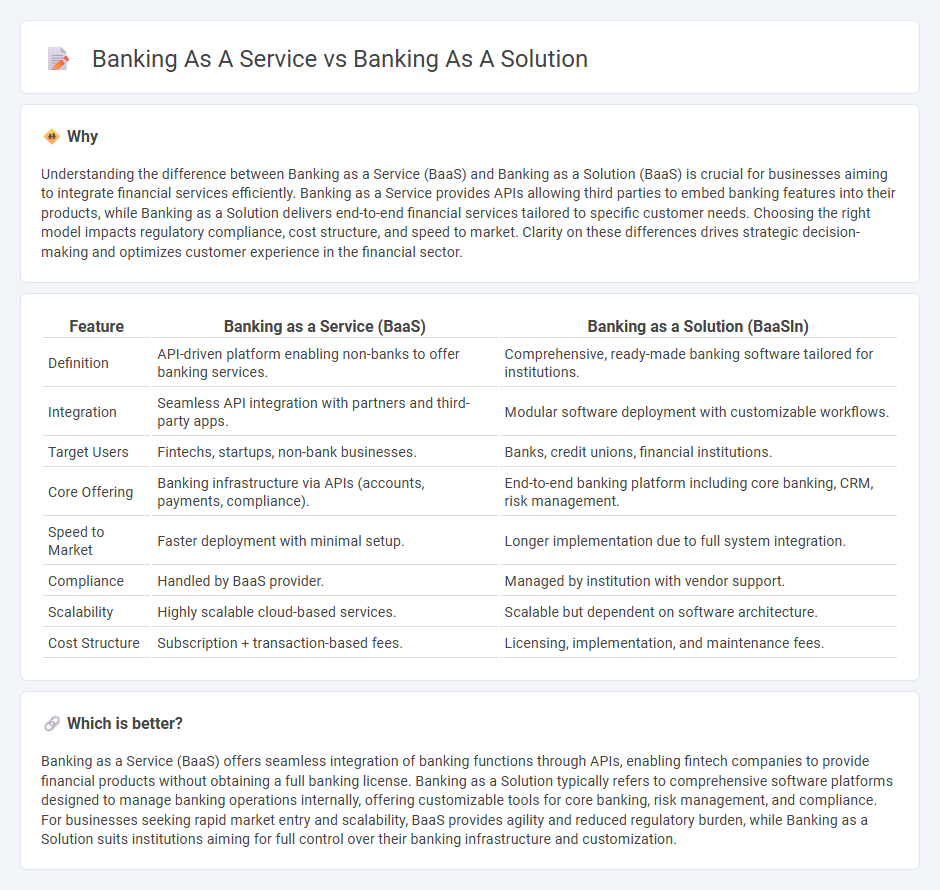

Understanding the difference between Banking as a Service (BaaS) and Banking as a Solution (BaaS) is crucial for businesses aiming to integrate financial services efficiently. Banking as a Service provides APIs allowing third parties to embed banking features into their products, while Banking as a Solution delivers end-to-end financial services tailored to specific customer needs. Choosing the right model impacts regulatory compliance, cost structure, and speed to market. Clarity on these differences drives strategic decision-making and optimizes customer experience in the financial sector.

Comparison Table

| Feature | Banking as a Service (BaaS) | Banking as a Solution (BaaSln) |

|---|---|---|

| Definition | API-driven platform enabling non-banks to offer banking services. | Comprehensive, ready-made banking software tailored for institutions. |

| Integration | Seamless API integration with partners and third-party apps. | Modular software deployment with customizable workflows. |

| Target Users | Fintechs, startups, non-bank businesses. | Banks, credit unions, financial institutions. |

| Core Offering | Banking infrastructure via APIs (accounts, payments, compliance). | End-to-end banking platform including core banking, CRM, risk management. |

| Speed to Market | Faster deployment with minimal setup. | Longer implementation due to full system integration. |

| Compliance | Handled by BaaS provider. | Managed by institution with vendor support. |

| Scalability | Highly scalable cloud-based services. | Scalable but dependent on software architecture. |

| Cost Structure | Subscription + transaction-based fees. | Licensing, implementation, and maintenance fees. |

Which is better?

Banking as a Service (BaaS) offers seamless integration of banking functions through APIs, enabling fintech companies to provide financial products without obtaining a full banking license. Banking as a Solution typically refers to comprehensive software platforms designed to manage banking operations internally, offering customizable tools for core banking, risk management, and compliance. For businesses seeking rapid market entry and scalability, BaaS provides agility and reduced regulatory burden, while Banking as a Solution suits institutions aiming for full control over their banking infrastructure and customization.

Connection

Banking as a Service (BaaS) enables third-party providers to access banking infrastructure via APIs, allowing seamless integration of financial services into non-bank platforms. Banking as a Solution (BaaS) leverages this infrastructure to offer tailored financial products, enhancing user experience and operational efficiency. The connection lies in BaaS providing the technological foundation that banking solutions use to deliver innovative, embedded financial services.

Key Terms

Embedded Finance

Banks offering traditional services provide foundational financial products like accounts and loans, while Banking as a Service (BaaS) enables third-party providers to integrate these services via APIs, promoting seamless Embedded Finance experiences. Embedded Finance incorporates banking functions directly into non-financial platforms, enhancing customer convenience and accelerating digital transformation. Explore how Embedded Finance revolutionizes financial accessibility and drives innovation in the banking sector.

API Banking

Banking as a solution integrates financial services directly within a company's existing platforms, leveraging APIs to streamline transactions and enhance customer experiences. Banking as a service (BaaS) provides infrastructure and compliance frameworks through APIs, enabling third parties to create tailored financial products without building banking systems from scratch. Explore how API banking is revolutionizing financial services for businesses and developers seeking flexible, scalable solutions.

White-Label Banking

White-Label Banking offers financial institutions a tailored solution to provide banking services under their own brand while leveraging the infrastructure of established banks. Unlike traditional banking as a solution, which often requires significant capital and regulatory compliance, White-Label Banking enables faster market entry with reduced operational complexities. Explore more about how White-Label Banking transforms digital financial services and empowers brands to innovate.

Source and External Links

Digital Banking Solutions: Revolutionizing the Financial Industry - Digital banking solutions enable customers to manage accounts, make payments, transfer funds, and apply for loans remotely, transforming traditional banking into a more convenient, efficient, and accessible experience.

Banking Technology Solutions | Virtusa - Banking technology solutions provide financial institutions with pre-built infrastructures and expert services to streamline operations, enhance customer interactions through AI and Open Banking, and ensure regulatory compliance without building systems from scratch.

Digital Banking Solutions | Alogent - Digital banking solutions empower both consumers and businesses with self-service tools, real-time fraud protection, and personalized product promotions, driving efficiency and loyalty for financial institutions.

dowidth.com

dowidth.com