Real-time payments offer immediate fund transfers, enabling businesses and consumers to complete transactions within seconds, unlike ACH payments which typically take one to three business days to settle. Real-time payment systems enhance cash flow efficiency and reduce settlement risk, while ACH remains popular for batch processing of recurring payments due to its cost-effectiveness. Explore how these payment methods impact financial operations and customer satisfaction.

Why it is important

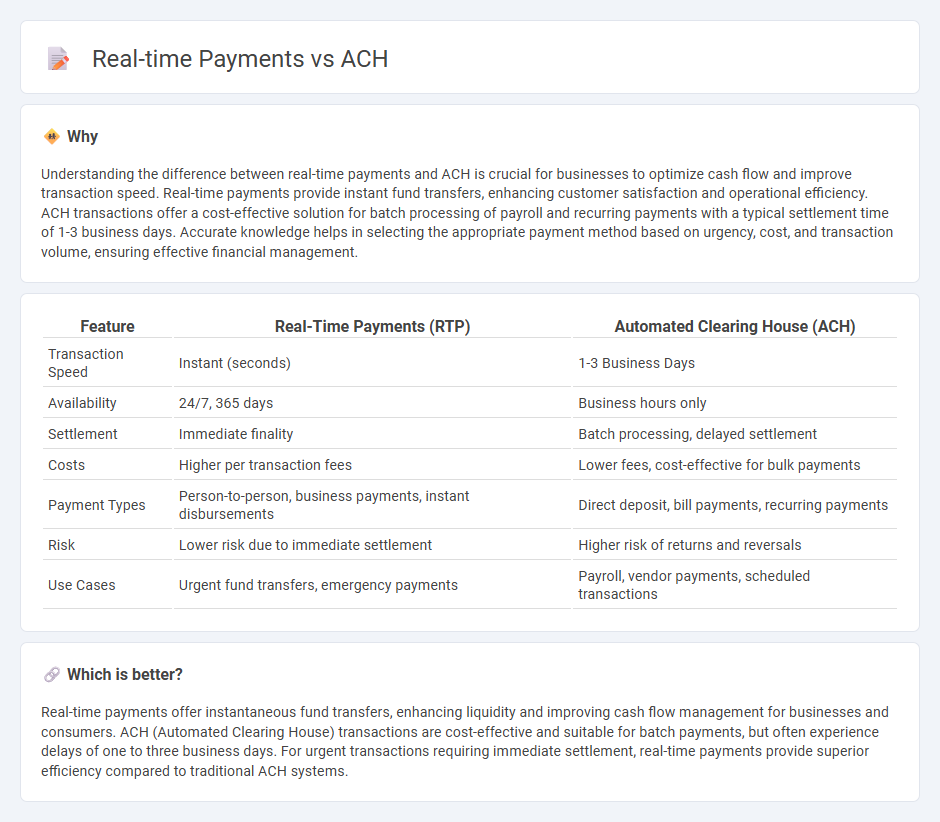

Understanding the difference between real-time payments and ACH is crucial for businesses to optimize cash flow and improve transaction speed. Real-time payments provide instant fund transfers, enhancing customer satisfaction and operational efficiency. ACH transactions offer a cost-effective solution for batch processing of payroll and recurring payments with a typical settlement time of 1-3 business days. Accurate knowledge helps in selecting the appropriate payment method based on urgency, cost, and transaction volume, ensuring effective financial management.

Comparison Table

| Feature | Real-Time Payments (RTP) | Automated Clearing House (ACH) |

|---|---|---|

| Transaction Speed | Instant (seconds) | 1-3 Business Days |

| Availability | 24/7, 365 days | Business hours only |

| Settlement | Immediate finality | Batch processing, delayed settlement |

| Costs | Higher per transaction fees | Lower fees, cost-effective for bulk payments |

| Payment Types | Person-to-person, business payments, instant disbursements | Direct deposit, bill payments, recurring payments |

| Risk | Lower risk due to immediate settlement | Higher risk of returns and reversals |

| Use Cases | Urgent fund transfers, emergency payments | Payroll, vendor payments, scheduled transactions |

Which is better?

Real-time payments offer instantaneous fund transfers, enhancing liquidity and improving cash flow management for businesses and consumers. ACH (Automated Clearing House) transactions are cost-effective and suitable for batch payments, but often experience delays of one to three business days. For urgent transactions requiring immediate settlement, real-time payments provide superior efficiency compared to traditional ACH systems.

Connection

Real-time payments and Automated Clearing House (ACH) systems are both essential components of modern banking with distinct functionalities for transferring funds electronically. Real-time payments enable immediate fund transfers and settlement, providing instant clearing and confirmation, whereas ACH processes batch transactions that settle in one to two business days, primarily for payroll, bill payments, and recurring transfers. Integration between real-time payments and ACH networks enhances financial ecosystem efficiency by offering a spectrum of transaction speeds and settlement options catering to diverse banking needs.

Key Terms

Settlement Time

ACH transfers typically settle within 1-3 business days, making them slower compared to real-time payments that settle instantly, often within seconds. Real-time payment systems, such as RTP or Faster Payments, enhance liquidity and cash flow by providing immediate fund availability. Explore the advantages and limitations of each payment method to determine the best fit for your business needs.

Clearing System

ACH (Automated Clearing House) operates on a batch processing system, clearing transactions typically within one to two business days, making it suitable for payroll and bill payments. Real-time payments utilize instant clearing systems, enabling funds to transfer and settle within seconds, which supports immediate financial transactions like retail purchases and emergency transfers. Explore how each clearing system impacts cash flow management and transaction speed to determine the best fit for your financial needs.

Transaction Cost

ACH transactions typically incur lower fees, averaging between $0.20 to $1.50 per transaction, making them cost-effective for batch payments and payroll. In contrast, real-time payments often involve higher costs due to immediate processing, with fees ranging from $0.50 to $2.00 per transaction but offer instant fund availability and enhanced cash flow management. Explore further to understand which payment method best suits your business needs and cost structures.

Source and External Links

What is an ACH Payment? | HR & Payroll Glossary - Paylocity - The Automated Clearing House (ACH) is an electronic payment network in the U.S. that securely facilitates fund transfers between individuals, businesses, and financial institutions, handling over 31 billion transactions involving $81 trillion in 2023.

What an ACH payment is and how an ACH transfer works - Stripe - ACH payments are electronic transfers between accounts at different financial institutions through the ACH network, which is administered by Nacha and supports same-day, next-day, and two-day settlement options.

What is an ACH transaction? - Consumer Financial Protection Bureau - An ACH transaction is an electronic money transfer between banks and credit unions used for payroll, bill payments, and other transfers, which can clear within the same day but sometimes take several days depending on processing and fraud prevention measures.

dowidth.com

dowidth.com