Credit builder cards focus on helping individuals with limited or poor credit history improve their credit scores through responsible use and timely payments. Student credit cards are designed specifically for college students, offering rewards and lower credit limits to encourage healthy financial habits. Explore the key differences and benefits to find the best option for your credit-building journey.

Why it is important

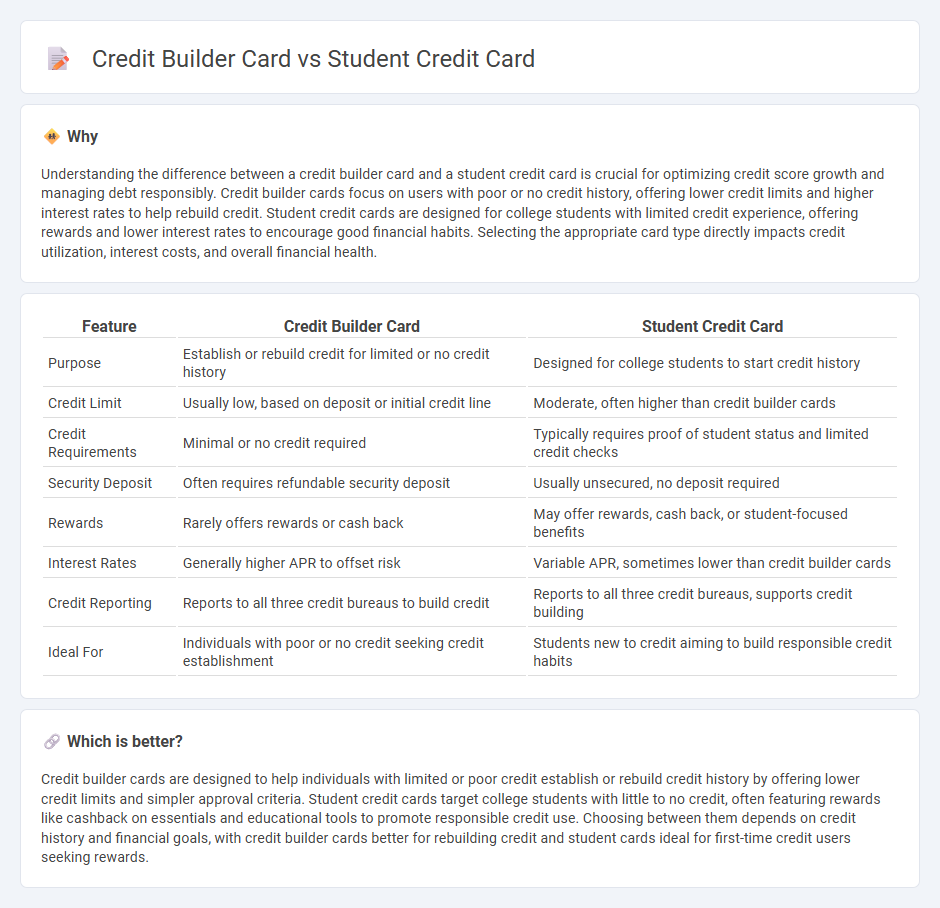

Understanding the difference between a credit builder card and a student credit card is crucial for optimizing credit score growth and managing debt responsibly. Credit builder cards focus on users with poor or no credit history, offering lower credit limits and higher interest rates to help rebuild credit. Student credit cards are designed for college students with limited credit experience, offering rewards and lower interest rates to encourage good financial habits. Selecting the appropriate card type directly impacts credit utilization, interest costs, and overall financial health.

Comparison Table

| Feature | Credit Builder Card | Student Credit Card |

|---|---|---|

| Purpose | Establish or rebuild credit for limited or no credit history | Designed for college students to start credit history |

| Credit Limit | Usually low, based on deposit or initial credit line | Moderate, often higher than credit builder cards |

| Credit Requirements | Minimal or no credit required | Typically requires proof of student status and limited credit checks |

| Security Deposit | Often requires refundable security deposit | Usually unsecured, no deposit required |

| Rewards | Rarely offers rewards or cash back | May offer rewards, cash back, or student-focused benefits |

| Interest Rates | Generally higher APR to offset risk | Variable APR, sometimes lower than credit builder cards |

| Credit Reporting | Reports to all three credit bureaus to build credit | Reports to all three credit bureaus, supports credit building |

| Ideal For | Individuals with poor or no credit seeking credit establishment | Students new to credit aiming to build responsible credit habits |

Which is better?

Credit builder cards are designed to help individuals with limited or poor credit establish or rebuild credit history by offering lower credit limits and simpler approval criteria. Student credit cards target college students with little to no credit, often featuring rewards like cashback on essentials and educational tools to promote responsible credit use. Choosing between them depends on credit history and financial goals, with credit builder cards better for rebuilding credit and student cards ideal for first-time credit users seeking rewards.

Connection

Credit builder cards and student credit cards both serve as financial tools designed to establish or improve credit history by reporting timely payments to credit bureaus. Student credit cards often incorporate features of credit builder cards, providing young adults with limited credit experience a manageable way to build credit while teaching responsible financial habits. Both card types typically have lower credit limits and emphasize affordable terms to reduce the risk for new credit users.

Key Terms

Credit Limit

Student credit cards typically offer a lower credit limit, often ranging from $300 to $1,000, designed to help young adults start building credit responsibly. Credit builder cards usually have adjustable limits that increase with responsible payment history, allowing users to gradually improve their credit score. Explore more about how credit limits impact credit building strategies to choose the right card.

Eligibility Criteria

Student credit cards typically require proof of enrollment in an accredited educational institution and may consider limited or no credit history, making them accessible to young adults with emerging credit profiles. Credit builder cards focus on individuals with bad credit or no credit history and often have more lenient eligibility criteria but require a refundable security deposit to mitigate lender risk. Explore detailed eligibility requirements and compare options to choose the best card tailored to your credit-building needs.

Credit History

Student credit cards are designed for individuals with limited or no credit history, offering low credit limits and rewards tailored to student spending habits, which help establish a credit record gradually. Credit builder cards, on the other hand, specifically target those with poor or no credit by reporting payments to credit bureaus consistently, enabling faster credit score improvement through responsible use. Explore how each card type can strategically impact your credit history and financial future.

Source and External Links

Student Credit Cards: What Are They & How to Get One - Equifax - Student credit cards are designed for students to build credit with typically lower limits and higher interest rates, offering perks tailored to student lifestyles such as rewards for purchases like school supplies and dining, and are easier to qualify for than regular cards.

Credit Cards for College Students | Capital One - Capital One offers student credit cards with no annual or hidden fees, designed for those with little or no credit history, and eligibility requires being enrolled or planning to enroll in an accredited college or university.

Best College Student Credit Cards of August 2025 - NerdWallet - College student credit cards are easier to qualify for than regular cards due to leniency on credit history and often include incentives for responsible use like rewards for timely payments and free credit score monitoring tools.

dowidth.com

dowidth.com