Alternative credit data includes non-traditional financial indicators such as utility payments, rental history, and mobile phone bills, offering a broader perspective on consumer creditworthiness than traditional tax return data. Tax return data primarily reflects reported income and taxable earnings, which may not capture the complete financial behavior of individuals, especially those with irregular or informal income sources. Explore how integrating alternative credit data can enhance credit risk assessment and expand financial inclusion.

Why it is important

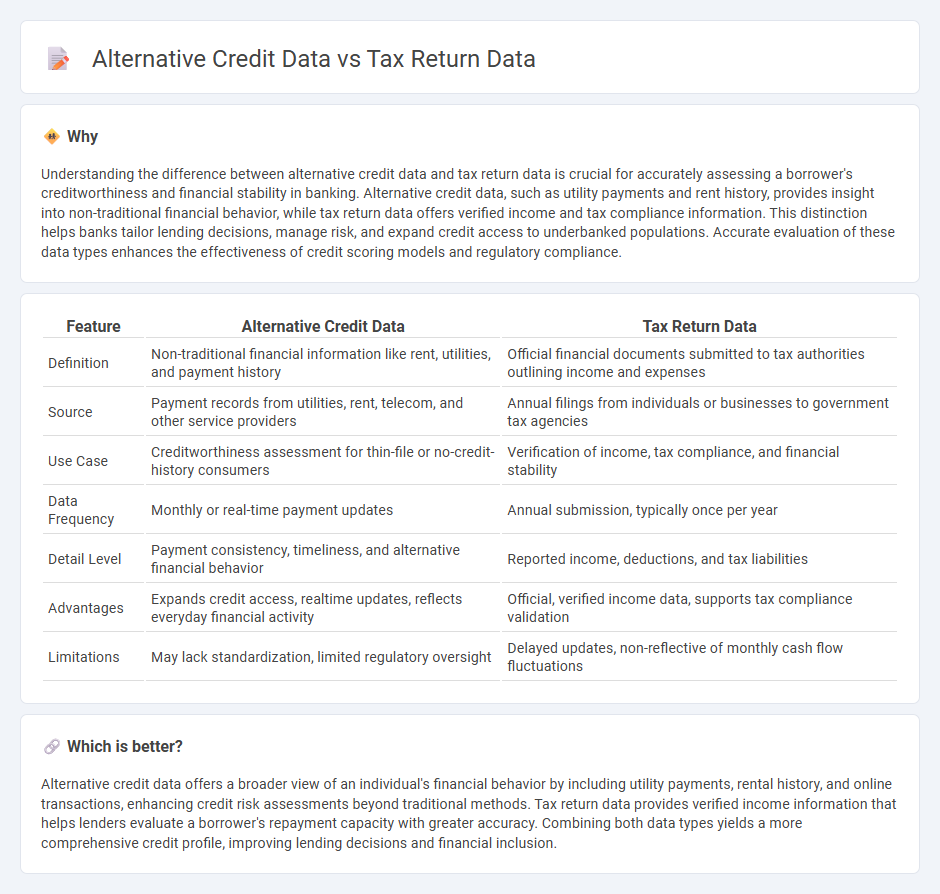

Understanding the difference between alternative credit data and tax return data is crucial for accurately assessing a borrower's creditworthiness and financial stability in banking. Alternative credit data, such as utility payments and rent history, provides insight into non-traditional financial behavior, while tax return data offers verified income and tax compliance information. This distinction helps banks tailor lending decisions, manage risk, and expand credit access to underbanked populations. Accurate evaluation of these data types enhances the effectiveness of credit scoring models and regulatory compliance.

Comparison Table

| Feature | Alternative Credit Data | Tax Return Data |

|---|---|---|

| Definition | Non-traditional financial information like rent, utilities, and payment history | Official financial documents submitted to tax authorities outlining income and expenses |

| Source | Payment records from utilities, rent, telecom, and other service providers | Annual filings from individuals or businesses to government tax agencies |

| Use Case | Creditworthiness assessment for thin-file or no-credit-history consumers | Verification of income, tax compliance, and financial stability |

| Data Frequency | Monthly or real-time payment updates | Annual submission, typically once per year |

| Detail Level | Payment consistency, timeliness, and alternative financial behavior | Reported income, deductions, and tax liabilities |

| Advantages | Expands credit access, realtime updates, reflects everyday financial activity | Official, verified income data, supports tax compliance validation |

| Limitations | May lack standardization, limited regulatory oversight | Delayed updates, non-reflective of monthly cash flow fluctuations |

Which is better?

Alternative credit data offers a broader view of an individual's financial behavior by including utility payments, rental history, and online transactions, enhancing credit risk assessments beyond traditional methods. Tax return data provides verified income information that helps lenders evaluate a borrower's repayment capacity with greater accuracy. Combining both data types yields a more comprehensive credit profile, improving lending decisions and financial inclusion.

Connection

Alternative credit data and tax return data intersect in enhancing credit risk assessment by providing a broader financial profile beyond traditional credit scores. Tax return data offers verified income and employment information, strengthening the evaluation of creditworthiness when combined with alternative data sources like utility payments and rental history. Integrating these datasets supports more accurate lending decisions, especially for individuals with limited or no conventional credit history.

Key Terms

Income Verification

Tax return data provides verified historical income information, offering lenders a reliable basis for assessing creditworthiness through documented earnings and tax compliance. Alternative credit data, such as utility payments and rental history, supplements traditional income verification by capturing real-time cash flow and underreported income sources for individuals with limited tax filing records. Explore more about integrating tax and alternative data for comprehensive income verification and enhanced credit decision-making.

Credit Scoring

Tax return data offers detailed insights into income stability and reported earnings, providing robust indicators for assessing creditworthiness in credit scoring models. Alternative credit data, including utility payments, rental history, and mobile phone bills, can supplement traditional data by capturing financial behaviors of thin-file or unbanked consumers. Explore how combining tax return data with alternative credit data enhances predictive accuracy in credit scoring.

Underwriting

Tax return data offers detailed insights into an individual's verified income, expenses, and financial obligations, enabling precise risk assessment in underwriting. Alternative credit data, such as utility payments, rental history, and social media activity, provides supplemental information that can enhance credit profiles for individuals with limited traditional credit history. Explore how integrating these data sources can improve underwriting accuracy and expand credit access.

Source and External Links

IRS Income Tax Return Form Statistics and Data by Tax Year - Provides annual IRS statistics on total tax returns filed (including the 1040 form), e-filed returns, and the difference between gross and net tax collection by year, with current data through tax year 2023.

Income Tax Return, e-File Statistics - Offers detailed historical data on the number of individual tax returns filed each year, the count and percentage e-filed, and summarizes trends since 2003.

Filing season statistics by year | Internal Revenue Service - Presents weekly and annual IRS filing season statistics, comparing returns filed, processed, and refunds issued each year, with updates for recent and upcoming filing seasons.

dowidth.com

dowidth.com