RegTech leverages advanced technology to enhance regulatory compliance, focusing on automation, real-time monitoring, and data analytics to identify risks and prevent fraud within the banking sector. LegalTech streamlines legal processes through digital tools that improve contract management, case analysis, and document automation, ensuring efficient legal workflows and reduced operational costs. Explore further to understand how these innovations transform banking compliance and legal operations.

Why it is important

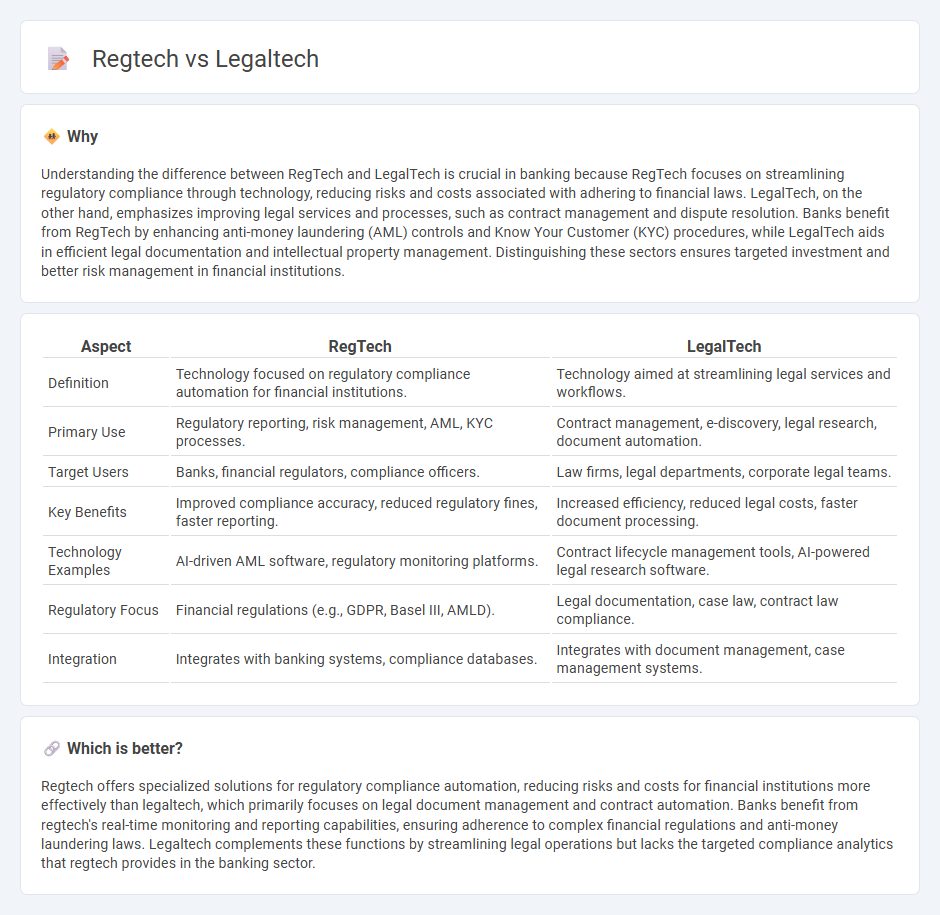

Understanding the difference between RegTech and LegalTech is crucial in banking because RegTech focuses on streamlining regulatory compliance through technology, reducing risks and costs associated with adhering to financial laws. LegalTech, on the other hand, emphasizes improving legal services and processes, such as contract management and dispute resolution. Banks benefit from RegTech by enhancing anti-money laundering (AML) controls and Know Your Customer (KYC) procedures, while LegalTech aids in efficient legal documentation and intellectual property management. Distinguishing these sectors ensures targeted investment and better risk management in financial institutions.

Comparison Table

| Aspect | RegTech | LegalTech |

|---|---|---|

| Definition | Technology focused on regulatory compliance automation for financial institutions. | Technology aimed at streamlining legal services and workflows. |

| Primary Use | Regulatory reporting, risk management, AML, KYC processes. | Contract management, e-discovery, legal research, document automation. |

| Target Users | Banks, financial regulators, compliance officers. | Law firms, legal departments, corporate legal teams. |

| Key Benefits | Improved compliance accuracy, reduced regulatory fines, faster reporting. | Increased efficiency, reduced legal costs, faster document processing. |

| Technology Examples | AI-driven AML software, regulatory monitoring platforms. | Contract lifecycle management tools, AI-powered legal research software. |

| Regulatory Focus | Financial regulations (e.g., GDPR, Basel III, AMLD). | Legal documentation, case law, contract law compliance. |

| Integration | Integrates with banking systems, compliance databases. | Integrates with document management, case management systems. |

Which is better?

Regtech offers specialized solutions for regulatory compliance automation, reducing risks and costs for financial institutions more effectively than legaltech, which primarily focuses on legal document management and contract automation. Banks benefit from regtech's real-time monitoring and reporting capabilities, ensuring adherence to complex financial regulations and anti-money laundering laws. Legaltech complements these functions by streamlining legal operations but lacks the targeted compliance analytics that regtech provides in the banking sector.

Connection

Regtech and legaltech intersect in the banking sector by automating compliance and regulatory processes, reducing risks, and enhancing operational efficiency. Regtech focuses on leveraging technologies like AI and blockchain to monitor financial transactions and ensure adherence to regulations, while legaltech streamlines contract management, due diligence, and legal workflows. Together, they enable banks to navigate complex regulatory environments with greater accuracy and speed, minimizing legal risks and enhancing customer trust.

Key Terms

Compliance

Legaltech streamlines legal service delivery through advanced automation, contract management, and e-discovery tools, enhancing efficiency and reducing manual errors. Regtech specializes in compliance monitoring, risk assessment, and regulatory reporting using AI and big data, ensuring organizations meet evolving regulatory standards. Explore more to understand how integrating legaltech and regtech can optimize your compliance strategy.

Automation

Legaltech automates contract review, document management, and case research to streamline legal workflows and reduce human error, improving overall efficiency in law firms. Regtech emphasizes automated compliance monitoring, risk management, and regulatory reporting to ensure firms adhere to evolving legal standards and avoid penalties. Explore the latest innovations in legaltech and regtech automation to understand their distinct impacts on legal and regulatory processes.

Risk Management

Legaltech and regtech both enhance risk management but target different aspects; legaltech streamlines contract analysis and compliance monitoring through artificial intelligence, reducing legal risks and operational costs. Regtech specializes in regulatory risk by automating regulatory reporting, monitoring compliance with financial laws, and detecting suspicious activities using machine learning algorithms. Explore detailed comparisons to understand how each technology can optimize your organization's risk management strategies.

Source and External Links

Legal technology - Wikipedia - Legal technology (legal tech) refers to the use of technology and software to provide legal services, support the legal industry, and automate or streamline tasks such as contract management, document automation, legal research, e-discovery, and client-lawyer matching.

What is Legal Technology? - Clio - Legal technology typically refers to specialized software that helps law firms and legal professionals manage their daily operations more efficiently--including practice management, e-signatures, legal accounting, appointment scheduling, and document automation--enabling lawyers to access crucial information anytime, anywhere.

Technology in Law Is the New Norm - Thomson Reuters - Legal technology encompasses all devices and techniques that help users interact with and navigate the law, aiming to replace time- and labor-intensive processes with automated, faster, and more accurate solutions for legal organizations.

dowidth.com

dowidth.com