Digital KYC leverages online platforms for customer identity verification, streamlining the onboarding process through secure document uploads and biometric authentication. e-KYC utilizes electronic systems that integrate with government databases, enabling instant validation of identity without physical paperwork. Explore the differences and benefits of digital KYC and e-KYC to enhance your banking experience.

Why it is important

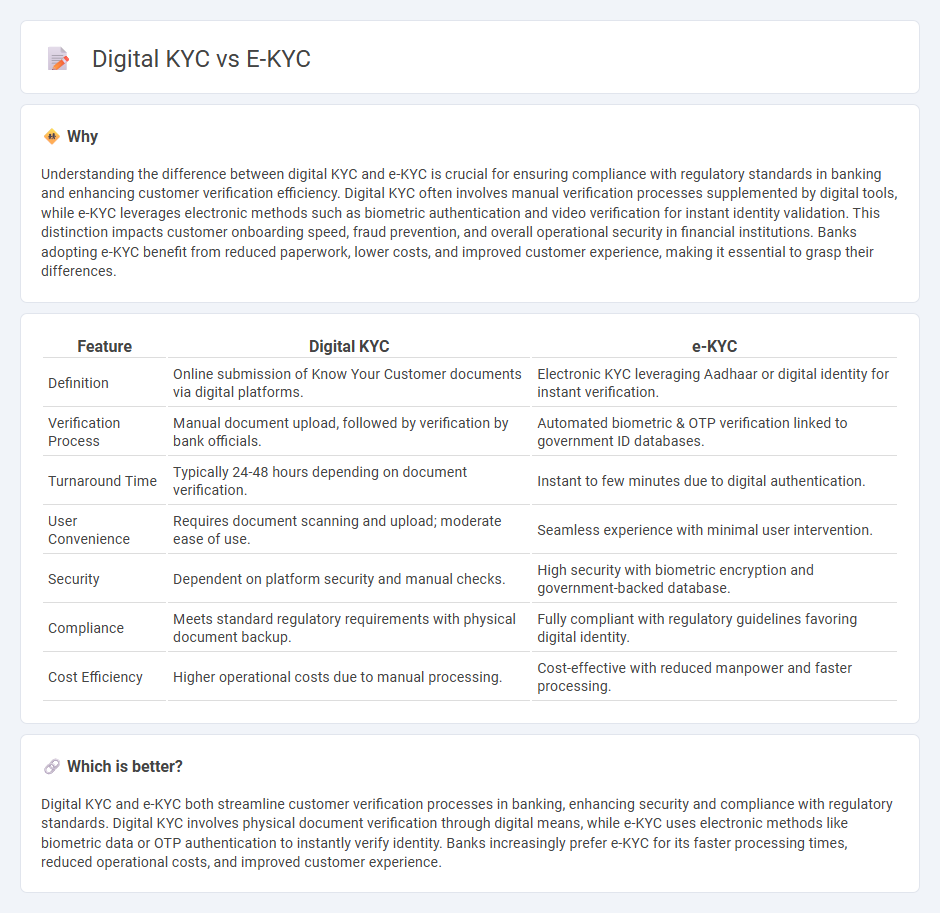

Understanding the difference between digital KYC and e-KYC is crucial for ensuring compliance with regulatory standards in banking and enhancing customer verification efficiency. Digital KYC often involves manual verification processes supplemented by digital tools, while e-KYC leverages electronic methods such as biometric authentication and video verification for instant identity validation. This distinction impacts customer onboarding speed, fraud prevention, and overall operational security in financial institutions. Banks adopting e-KYC benefit from reduced paperwork, lower costs, and improved customer experience, making it essential to grasp their differences.

Comparison Table

| Feature | Digital KYC | e-KYC |

|---|---|---|

| Definition | Online submission of Know Your Customer documents via digital platforms. | Electronic KYC leveraging Aadhaar or digital identity for instant verification. |

| Verification Process | Manual document upload, followed by verification by bank officials. | Automated biometric & OTP verification linked to government ID databases. |

| Turnaround Time | Typically 24-48 hours depending on document verification. | Instant to few minutes due to digital authentication. |

| User Convenience | Requires document scanning and upload; moderate ease of use. | Seamless experience with minimal user intervention. |

| Security | Dependent on platform security and manual checks. | High security with biometric encryption and government-backed database. |

| Compliance | Meets standard regulatory requirements with physical document backup. | Fully compliant with regulatory guidelines favoring digital identity. |

| Cost Efficiency | Higher operational costs due to manual processing. | Cost-effective with reduced manpower and faster processing. |

Which is better?

Digital KYC and e-KYC both streamline customer verification processes in banking, enhancing security and compliance with regulatory standards. Digital KYC involves physical document verification through digital means, while e-KYC uses electronic methods like biometric data or OTP authentication to instantly verify identity. Banks increasingly prefer e-KYC for its faster processing times, reduced operational costs, and improved customer experience.

Connection

Digital KYC and e-KYC are interconnected processes that streamline customer identity verification in banking through electronic methods. Digital KYC utilizes online platforms to collect and validate customer information, while e-KYC leverages electronic databases such as Aadhaar for instant authentication. Both methods enhance security, reduce paperwork, and accelerate account opening and compliance procedures in financial institutions.

Key Terms

Identity Verification

e-KYC (electronic Know Your Customer) utilizes digital platforms for identity verification by capturing biometric data and government-issued ID scans to authenticate users efficiently. Digital KYC encompasses a broader range of online identity verification methods, including document uploads, facial recognition, and database cross-referencing, ensuring compliance with regulatory standards. Explore the advantages and technical details of both e-KYC and digital KYC to understand their impact on secure identity verification.

Customer Onboarding

e-KYC leverages electronic verification methods such as biometric authentication and Aadhaar-based verification to streamline customer onboarding, reducing paperwork and enhancing security. Digital KYC encompasses a broader range of technologies including document upload, facial recognition, and AI-driven risk assessment to provide a faster, more efficient onboarding process tailored to regulatory compliance. Explore how combining e-KYC and digital KYC solutions can transform customer onboarding for financial institutions.

Compliance Regulations

e-KYC and digital KYC both streamline identity verification processes but differ in regulatory nuances and technological approaches. e-KYC typically relies on government databases and biometric authentication to meet stringent compliance mandates, while digital KYC combines broad digital identity verification methods and data encryption to adhere to global privacy laws. Explore deeper distinctions and compliance impacts in e-KYC and digital KYC frameworks.

Source and External Links

eKYC in action - Electronic Know Your Customer (eKYC) offers a powerful solution to identity verification by combining advanced technologies for fast and secure customer onboarding.

What is eKYC? - Electronic Know Your Customer (eKYC) is a fully digital approach to online identity verification, utilizing biometric verification and document verification.

What is eKYC? - eKYC is an automated method to verify customer identities digitally, including ID document verification, biometric authentication, and risk monitoring.

dowidth.com

dowidth.com