Personal financial management tools empower individuals to track expenses, set budgets, and plan for future financial goals by leveraging advanced analytics and real-time data integration. Customer relationship management (CRM) platforms focus on enhancing bank-client interactions, streamlining sales processes, and personalizing marketing strategies through comprehensive customer data analysis. Explore the distinct benefits and functionalities of these solutions to optimize both personal finance and banking relationships.

Why it is important

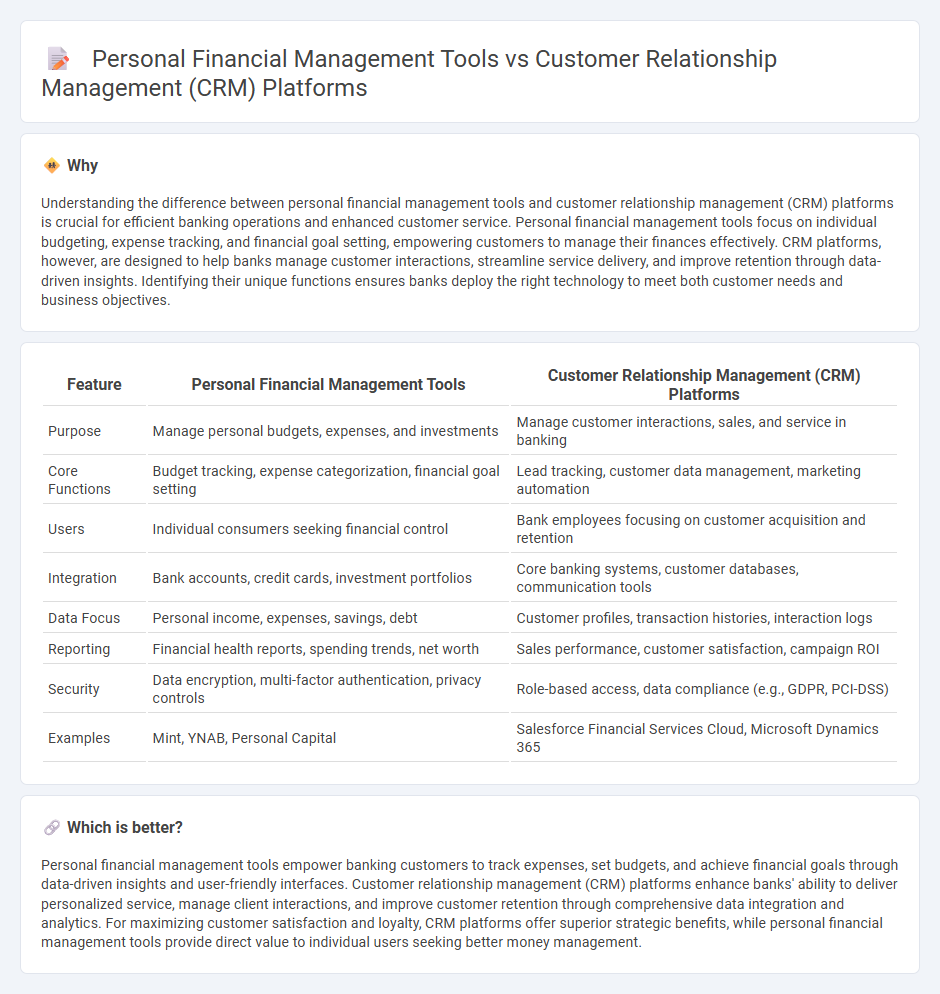

Understanding the difference between personal financial management tools and customer relationship management (CRM) platforms is crucial for efficient banking operations and enhanced customer service. Personal financial management tools focus on individual budgeting, expense tracking, and financial goal setting, empowering customers to manage their finances effectively. CRM platforms, however, are designed to help banks manage customer interactions, streamline service delivery, and improve retention through data-driven insights. Identifying their unique functions ensures banks deploy the right technology to meet both customer needs and business objectives.

Comparison Table

| Feature | Personal Financial Management Tools | Customer Relationship Management (CRM) Platforms |

|---|---|---|

| Purpose | Manage personal budgets, expenses, and investments | Manage customer interactions, sales, and service in banking |

| Core Functions | Budget tracking, expense categorization, financial goal setting | Lead tracking, customer data management, marketing automation |

| Users | Individual consumers seeking financial control | Bank employees focusing on customer acquisition and retention |

| Integration | Bank accounts, credit cards, investment portfolios | Core banking systems, customer databases, communication tools |

| Data Focus | Personal income, expenses, savings, debt | Customer profiles, transaction histories, interaction logs |

| Reporting | Financial health reports, spending trends, net worth | Sales performance, customer satisfaction, campaign ROI |

| Security | Data encryption, multi-factor authentication, privacy controls | Role-based access, data compliance (e.g., GDPR, PCI-DSS) |

| Examples | Mint, YNAB, Personal Capital | Salesforce Financial Services Cloud, Microsoft Dynamics 365 |

Which is better?

Personal financial management tools empower banking customers to track expenses, set budgets, and achieve financial goals through data-driven insights and user-friendly interfaces. Customer relationship management (CRM) platforms enhance banks' ability to deliver personalized service, manage client interactions, and improve customer retention through comprehensive data integration and analytics. For maximizing customer satisfaction and loyalty, CRM platforms offer superior strategic benefits, while personal financial management tools provide direct value to individual users seeking better money management.

Connection

Personal financial management tools integrate with customer relationship management (CRM) platforms to provide banks with comprehensive insights into customer spending habits, saving patterns, and financial goals. This connection enables banks to deliver personalized financial advice, targeted product recommendations, and enhanced customer experiences. Leveraging CRM data alongside financial management tools supports improved customer retention and drives optimized banking strategies.

Key Terms

Customer Data Integration

Customer Relationship Management (CRM) platforms excel in Customer Data Integration by consolidating vast client information from multiple sources into a unified database, enabling businesses to analyze customer behaviors and tailor marketing strategies effectively. Personal Financial Management (PFM) tools primarily focus on aggregating and categorizing individual financial data, facilitating budget tracking and expense monitoring rather than comprehensive customer profiling. Explore the distinct advantages and technological frameworks of CRM and PFM systems to optimize data integration for your specific needs.

Account Aggregation

Customer relationship management (CRM) platforms excel in account aggregation by centralizing customer financial data from multiple sources to enhance business insights and client interactions. Personal financial management tools prioritize account aggregation to provide users with a comprehensive overview of their financial health, enabling informed budgeting and investment decisions. Explore how advanced account aggregation features optimize both CRM platforms and personal financial management tools for superior financial oversight.

Cross-Selling Analytics

CRM platforms utilize cross-selling analytics to identify customer purchase patterns and optimize product recommendations, enhancing revenue growth across multiple channels. Personal financial management tools analyze individual spending habits and financial goals, offering tailored suggestions to improve users' financial health, but generally lack advanced cross-selling capabilities found in CRM systems. Explore the distinct advantages of cross-selling analytics in CRM versus personal finance tools to leverage the best strategies for your business or personal finance needs.

Source and External Links

Top 10: CRM Platforms - Creatio offers a low-code platform with strong AI capabilities for sales management and process automation; HubSpot CRM provides integrated email marketing, sales automation, and customer service tools popular among small to medium businesses.

What is CRM software? 9 best CRM tools of 2025 - Copper is best for Google integration facilitating pipeline and project management, while Zoho CRM excels at sales analytics, workflow automation, and journey orchestration.

CRM for Small Business: Top Free or Low-Cost Options | CO - Affordable CRM options like Pipedrive provide AI-powered insights and visual sales pipelines; Bitrix24 offers free CRM for unlimited users with cloud and on-premises deployment; EngageBay supports multi-pipeline views and predictive lead scoring.

dowidth.com

dowidth.com