Personal finance automation simplifies budgeting and expense tracking by integrating accounts and categorizing transactions in real-time, reducing manual effort for users. Cash flow forecasting systems leverage historical data and predictive analytics to project future income and expenses, enabling proactive financial decision-making. Explore how these banking technologies can transform your financial management strategies.

Why it is important

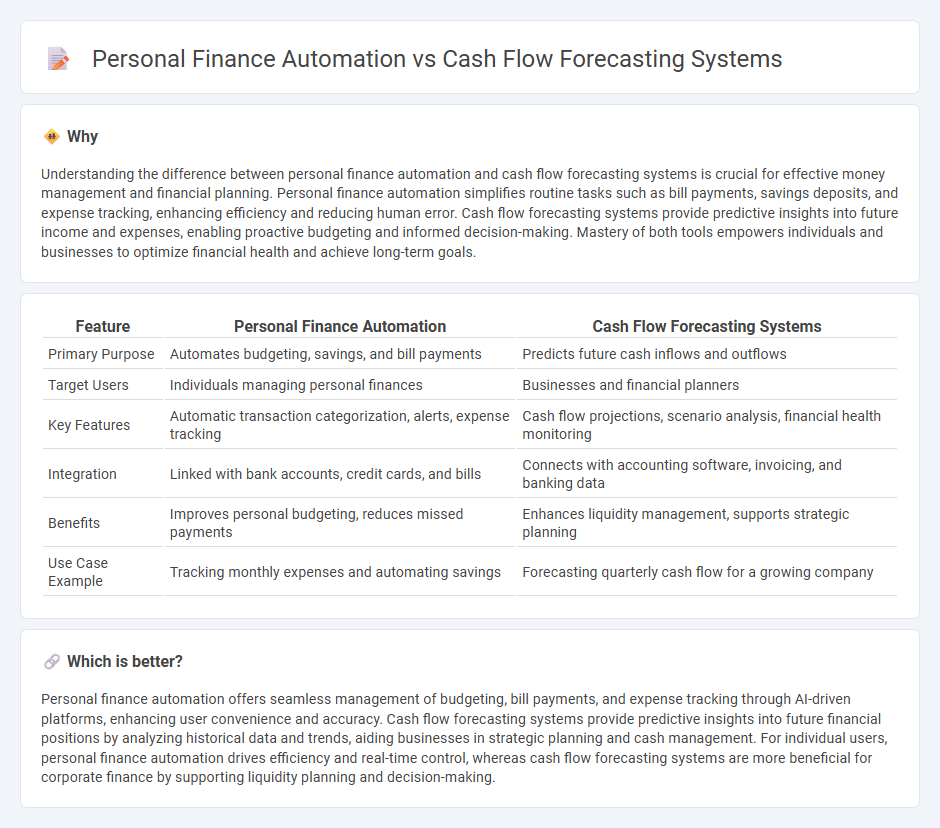

Understanding the difference between personal finance automation and cash flow forecasting systems is crucial for effective money management and financial planning. Personal finance automation simplifies routine tasks such as bill payments, savings deposits, and expense tracking, enhancing efficiency and reducing human error. Cash flow forecasting systems provide predictive insights into future income and expenses, enabling proactive budgeting and informed decision-making. Mastery of both tools empowers individuals and businesses to optimize financial health and achieve long-term goals.

Comparison Table

| Feature | Personal Finance Automation | Cash Flow Forecasting Systems |

|---|---|---|

| Primary Purpose | Automates budgeting, savings, and bill payments | Predicts future cash inflows and outflows |

| Target Users | Individuals managing personal finances | Businesses and financial planners |

| Key Features | Automatic transaction categorization, alerts, expense tracking | Cash flow projections, scenario analysis, financial health monitoring |

| Integration | Linked with bank accounts, credit cards, and bills | Connects with accounting software, invoicing, and banking data |

| Benefits | Improves personal budgeting, reduces missed payments | Enhances liquidity management, supports strategic planning |

| Use Case Example | Tracking monthly expenses and automating savings | Forecasting quarterly cash flow for a growing company |

Which is better?

Personal finance automation offers seamless management of budgeting, bill payments, and expense tracking through AI-driven platforms, enhancing user convenience and accuracy. Cash flow forecasting systems provide predictive insights into future financial positions by analyzing historical data and trends, aiding businesses in strategic planning and cash management. For individual users, personal finance automation drives efficiency and real-time control, whereas cash flow forecasting systems are more beneficial for corporate finance by supporting liquidity planning and decision-making.

Connection

Personal finance automation streamlines the management of incomes, expenses, and savings by integrating transactional data in real time. Cash flow forecasting systems use this automated data to predict future financial positions, enabling more accurate budgeting and risk management. Together, they enhance financial decision-making by providing timely insights into spending patterns and liquidity trends.

Key Terms

**Cash Flow Forecasting Systems:**

Cash flow forecasting systems use historical data and predictive analytics to provide accurate projections of future income and expenses, helping businesses manage liquidity and avoid cash shortages. These systems integrate with accounting software and bank feeds to deliver real-time financial insights and support strategic planning and operational decisions. Explore how cash flow forecasting systems can optimize your financial management and improve business stability.

Liquidity Management

Cash flow forecasting systems enable businesses to predict liquidity needs by analyzing real-time and historical financial data, optimizing cash reserves to meet operational demands and avoid shortfalls. Personal finance automation tools streamline budgeting, bill payments, and savings by integrating bank accounts and credit cards but typically focus less on detailed liquidity projections. Explore more to understand how advanced liquidity management strategies enhance financial stability across both business and personal contexts.

Predictive Analytics

Cash flow forecasting systems leverage predictive analytics to provide accurate financial projections by analyzing historical data and market trends, enabling businesses to optimize liquidity management and strategic planning. Personal finance automation uses predictive models to categorize expenses and forecast spending habits, enhancing budget adherence and financial goal achievement for individuals. Explore more to understand how predictive analytics transforms financial decision-making in both domains.

Source and External Links

Automated Cash Flow Forecasting Software - HighRadius - Offers real-time cash flow visibility, automates forecasting, and optimizes working capital management using advanced AI and ML technologies.

Nomentia Cash Flow Forecasting Software - Provides AI-powered cash flow forecasting by consolidating data from ERP systems, banks, and treasury management systems for accurate financial insights.

GTreasury Cash Flow Forecasting - Streamlines financial planning with AI insights, real-time data integration from ERPs and banks, and customizable cash flow models for enhanced forecasting accuracy.

dowidth.com

dowidth.com